- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 30 Aug 2024

Good, Bad & Ugly Weekly Review : 30 Aug 2024

Edition : 30 Aug 2024

Hello, Investor !

Markets Overview

Another month has passed, and August 2024 has been quite a topsy-turvy period. We experienced a significant fall at the beginning of the month, primarily due to the yen carry trade fiasco. However, the recovery from that bottom has been quite spectacular. Overall, it has been a good month, ending on a positive note.

Looking at the Nifty this week, the chart shows a steady rise. Last week, we closed at 24,800, and now we’ve closed at 25,247, gaining over 400 points. This marks a strong week, especially considering that at the beginning of August, we were much lower, even below 24,000. The entire month has seen continuous upward movement, with four consecutive weeks of gains. Typically, after a sharp dip, you might expect continuous gains, as we’ve seen here. Although the recovery wasn’t as sharp as before, there have been multiple upward candles, suggesting the possibility of further gains before any consolidation. However, we are nearing the upper band of an imaginary trajectory, perhaps with a couple of hundred points more to go. Some consolidation in September might be due, as September and October are typically weaker months seasonally. If consolidation occurs, it could be a healthy development, though continued upward movement would also be welcome.

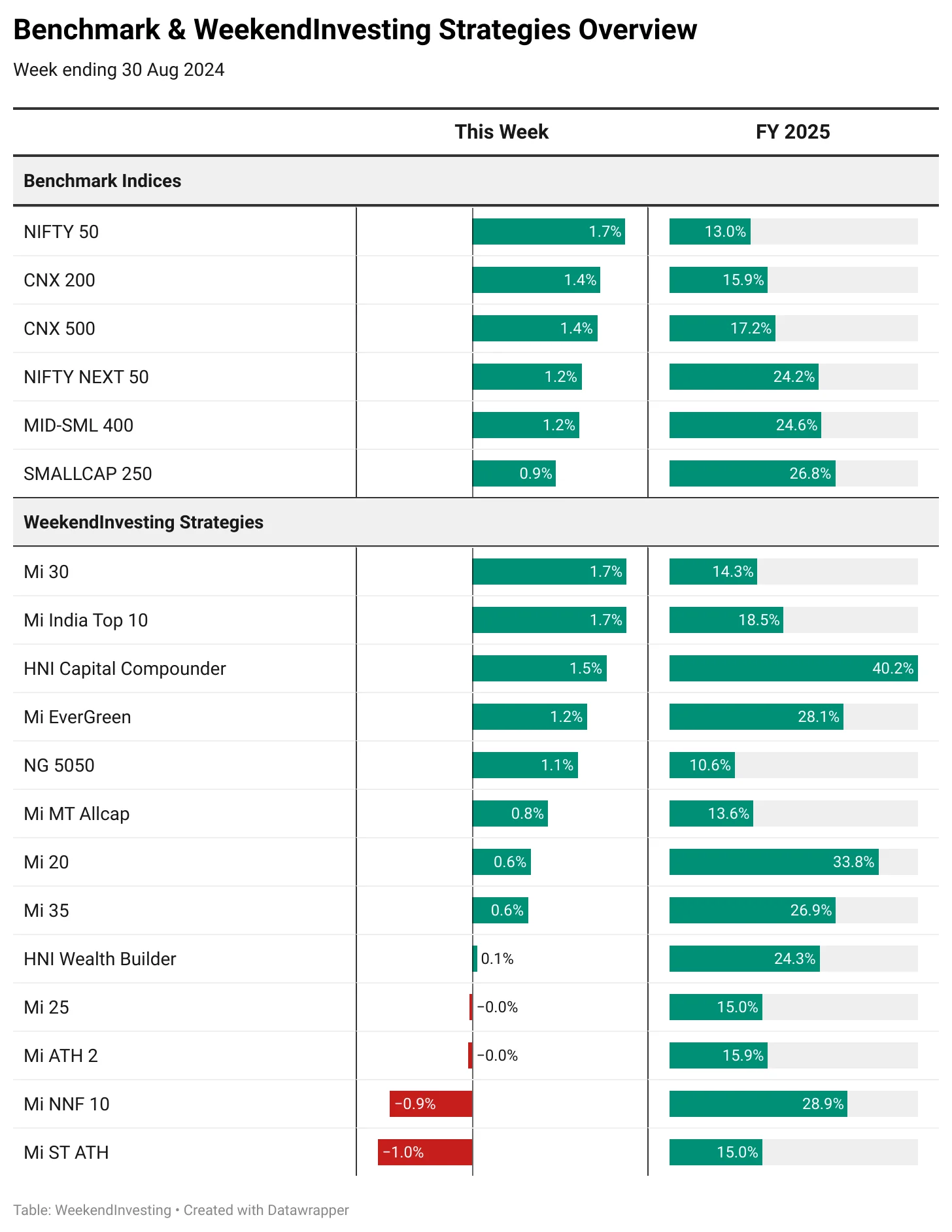

Benchmark Indices & WeekendInvesting Strategies Overview

Nifty 50 is up 1.7% this week, with CNX 200, CNX 500, Nifty Next 50, and Mid and Small Cap 400 all gaining between 1.2% to 1.4%. The Small Cap 250 is up only 0.9%.

Within the Weekend Investing strategies, Mi India Top 10 and Mi 30 both rose by 1.7% this week. The HNI Capital Compounder is the leading strategy for FY 25, having already crossed 40%, which is quite phenomenal. For this week, Mi Evergreen is up 1.2%, Mi MT Allcap gained 0.8%, and Mi 20 remained muted at 0.6%, though it’s still up 33% for FY 25. Mi 35 also gained 0.6%, while HNI Wealth Builder, Mi 25, Mi ATH 2, and Mi ST ATH were either flat or lost some ground. Mi NNF 10 is up 28.9% for FY 25, slightly ahead but not by much.

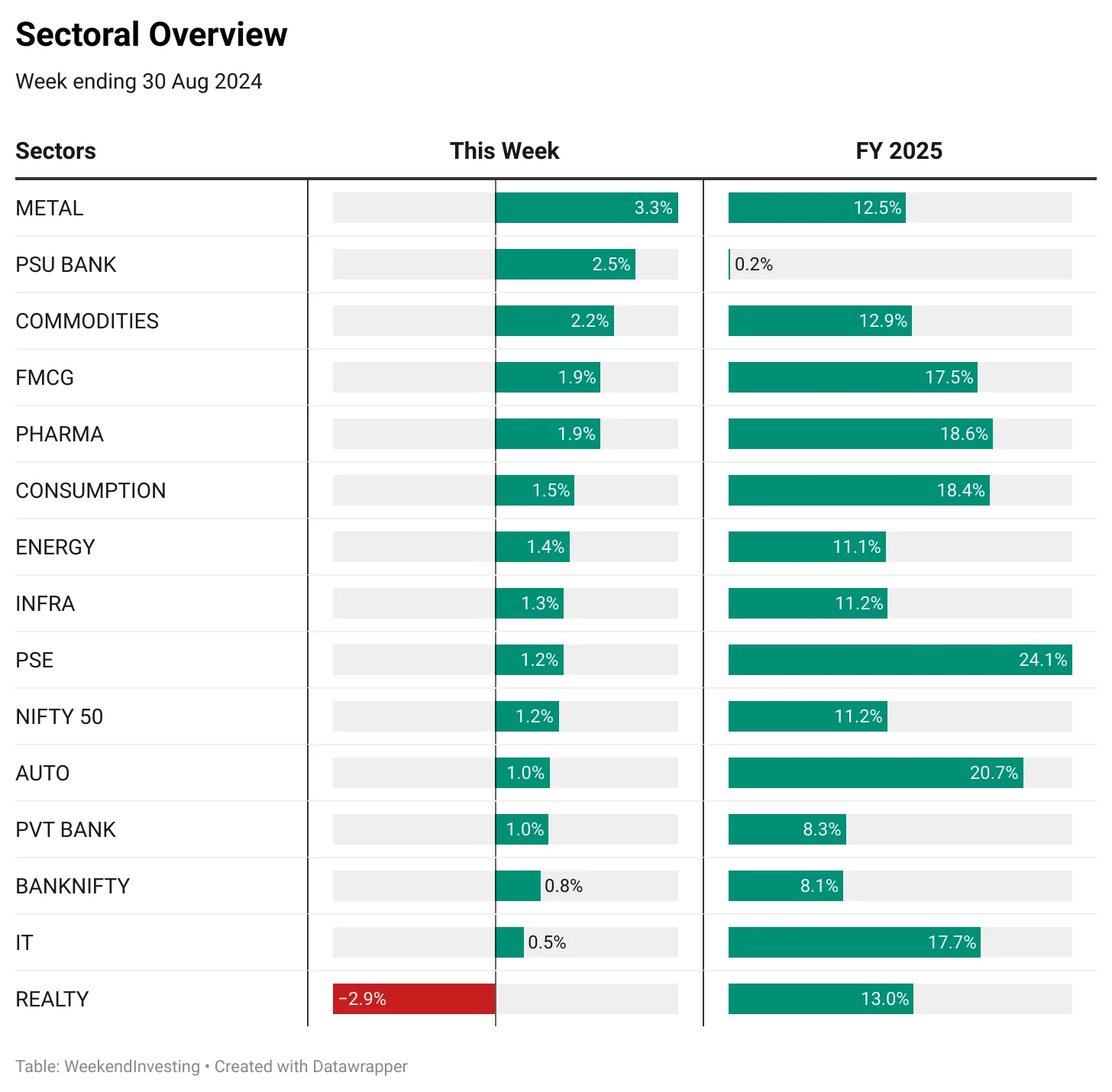

Sectoral Overview

In terms of sectors, real estate took a hit this week, down 2.9%, although there was some recovery on Friday. Metals led the way with a 3.3% gain, and PSU banks also made a comeback, rising 2.5% this week. Other sectors were up between 1% to 2%. For FY 25, Public Sector Enterprise stocks are still leading with a 24% gain, Autos are up 20%, and Pharma has done quite well, up 18.6%. Pharma, in particular, has performed strongly in FY 25, reaching nearly 18%.

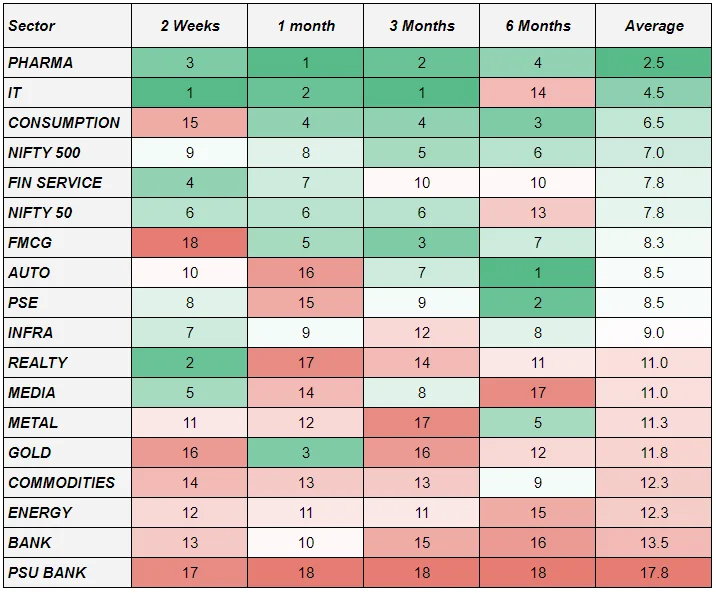

Pharma & Consumption are doing well, which is why they are at the top, along with IT. Financial services, FMCG, and others are following. However, banks have been pushed down to the lower ranks, with Commodities, Energy, and Banks at the bottom in the very short term. Real estate has seen a pullback, but overall rankings remain low. Autos, which were leading six months ago, have now slipped to the 6th or 7th position. Despite this, the overall market index is at number four, indicating that the overall market is still performing well in terms of momentum ranking.

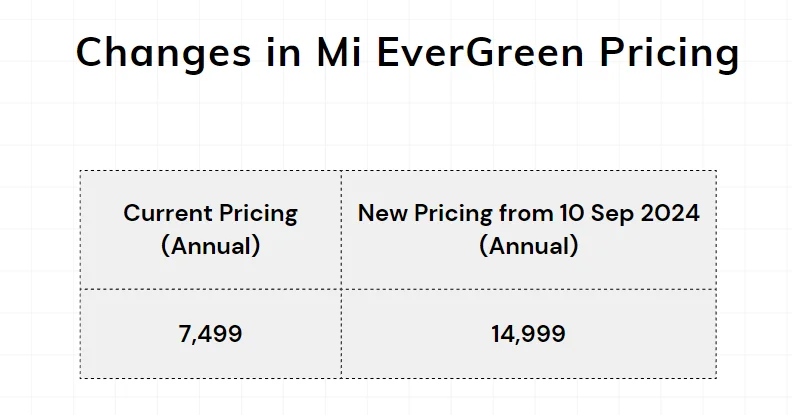

Spotlight - Mi EverGreen’s Price Revision

The subscription fee for Mi Evergreen will increase starting from 10 September. The inaugural fee is being normalized, but this change does not impact existing Mi Evergreen users or anyone who subscribes by 10 September 2024. Current users will continue their renewals at the old rates, but it’s important to ensure that the auto-renew option is not discontinued. If it is, renewing the strategy later will be at the new price. For those interested in Mi Evergreen, it’s advisable to subscribe before 10 September to lock in the current rate.

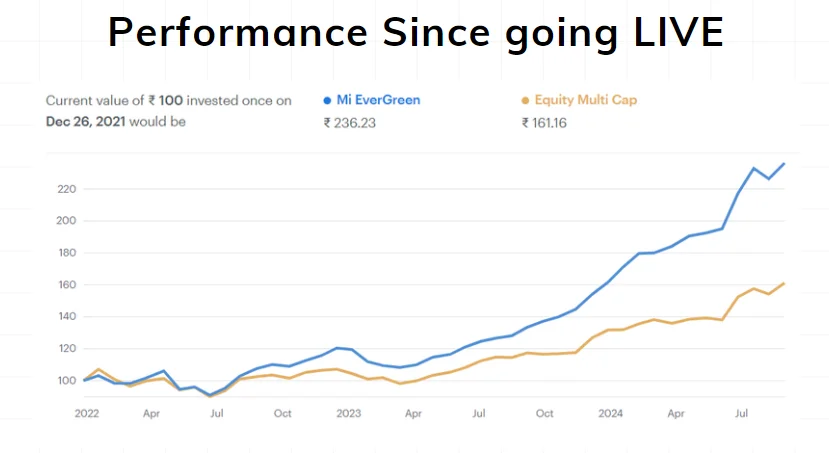

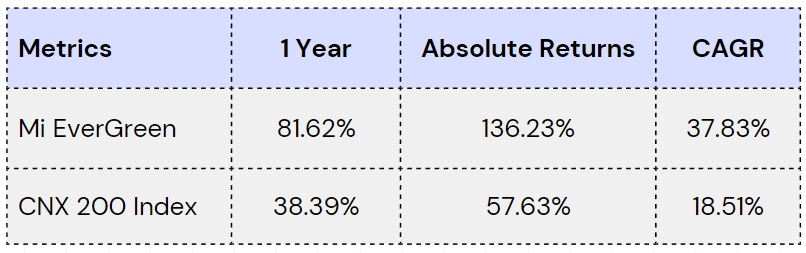

The performance of Mi Evergreen has been quite strong since its launch. An investment of ₹100 would have grown to ₹236 by now, compared to ₹161 in the equity multi-cap index. As you may know, Evergreen has a 25% allocation to gold, which helps as a hedge when markets decline. Over the last year, the performance has been impressive, with an 81% gain compared to 38% in the underlying CNX 200 index. Absolute returns and CAGR have also been strong.

The strategy is rotational, investing in 20 equally-weighted stocks, with 25% allocated to gold ETFs. The strategy is reviewed and rebalanced monthly, with a few stock changes possible. The recommended capital is ₹5 to ₹30 lakhs, with a suggested investment horizon of four to five years.

The reason for recommending a four to five-year view is that market trends or rallies might not occur immediately. If you’re fortunate, you may catch an uptrend early on, but if not, you may have to wait a few years. The last four years have been unusual, especially since COVID-19, with many new investors thinking that quick gains are the norm. However, this is not sustainable in the long run. Natural market cycles usually have at least one large uptrend within an eight-year period, and the goal is to capture this when recommending a five-year investment window for this strategy.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply