- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 31 May 2024

Good, Bad & Ugly Weekly Review : 31 May 2024

Edition : 31 May 2024

Hello, Investor !

Markets Overview

Nifty saw cautious trading this week following a strong two-week rally from 21,800 to around 23,000. On Monday, a new high of 23,100 was reached, but profit-taking ensued, leading to a pullback in the subsequent sessions. This cautious behavior is primarily due to the anticipation of important exit polls on Saturday and the resulting market reactions on Monday and Tuesday, with actual election results expected by Tuesday.

The market sentiment suggests confidence in the continuation of the current government. However, a surprise outcome could lead to significant market volatility. Despite the pullback, the market remains fundamentally strong, as it hasn’t broken recent support levels of 21,600 or 21,000. A breach of these levels might indicate weakness, potentially leading to further declines towards 18,800 or 17,600 if political uncertainty prevails.

Overall, the market appears overcautious, and while media and social media amplify this nervousness, the underlying market strength suggests there is no immediate reason for alarm.

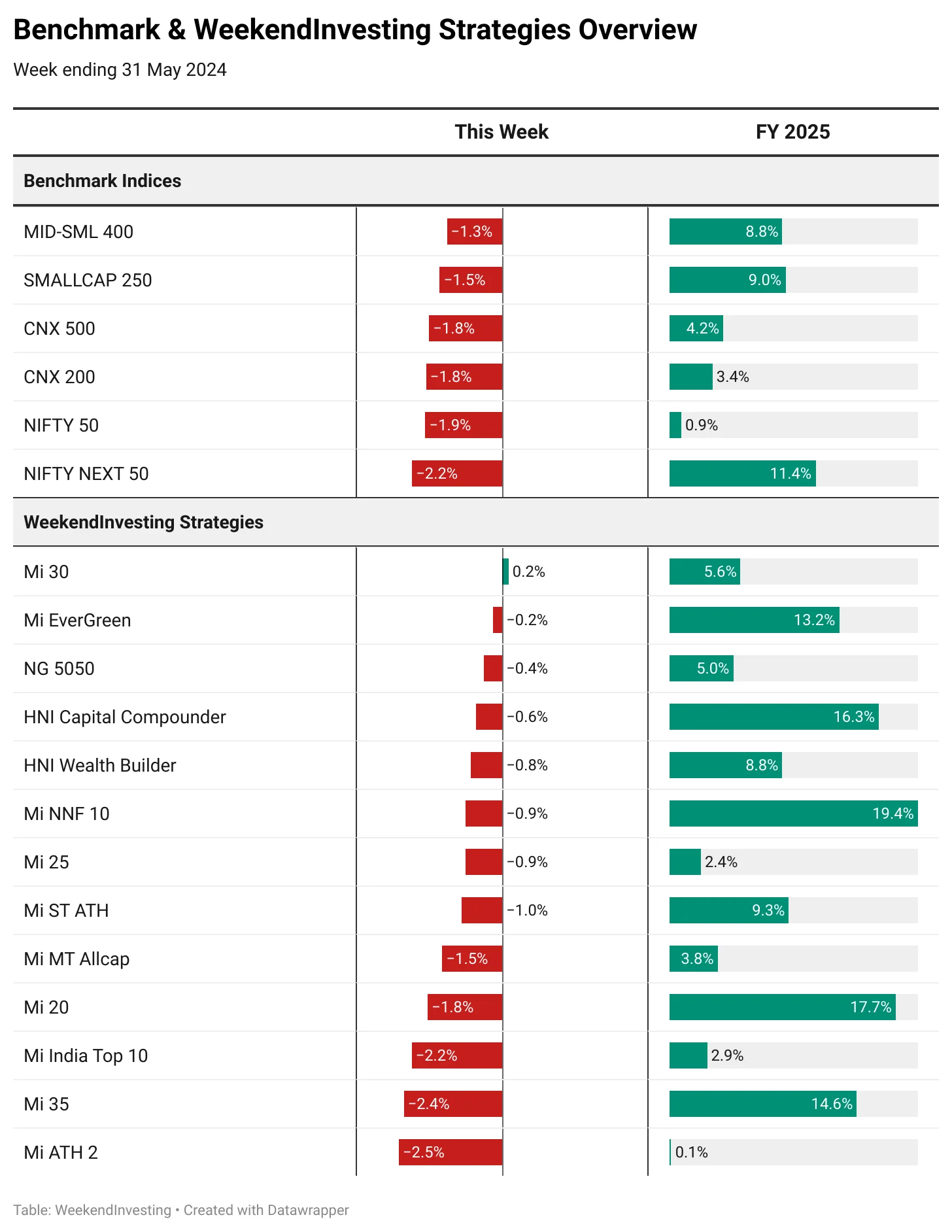

Benchmark Indices & WeekendInvesting Strategies Overview

This week, benchmark indices saw a decline, with the Nifty 50 dropping 1.9% and the Nifty Next 50 falling 2.2%. Other indices also decreased by 1.5% to 2%. Weekend investing strategies followed suit, with losses up to 2.5%. However, Mi Evergreen experienced the smallest loss at 0.2%, and Mi 30 actually ended in the green. HNI Capital Compounder and HNI Wealth Builder also outperformed the indices, losing less than the broader market. Mi 35 and Mi ATH 2 faced slightly higher losses compared to the market.

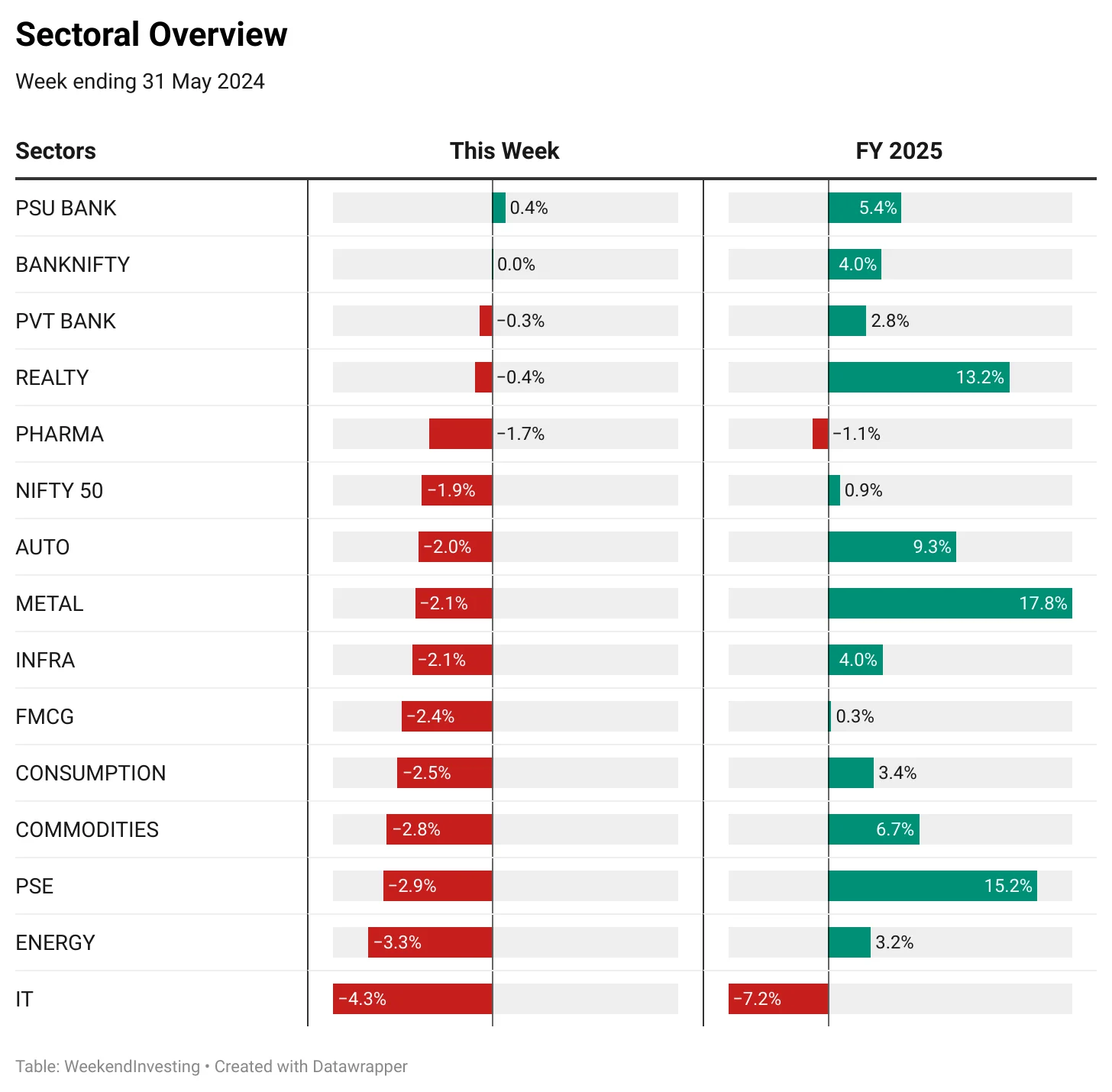

Sectoral Overview

This week saw minimal gains for PSU banks and small losses for private banks, keeping the banking sector stable. This stability in banking is a positive sign for the market, as it often follows the banking sector’s lead. Real estate remained flat, maintaining its 13% gain for FY 25. Other sectors experienced losses between 2% and 4%, with the IT sector being the hardest hit, down 7.2% for FY 25. Energy and public sector enterprises lost 3.3% and 2.9%, respectively. Despite these losses, public sector enterprises and metals have shown significant gains of 17.8% for FY 25, making the recent 2% loss for metals relatively insignificant. Overall, the market is experiencing mixed performance across different sectors.

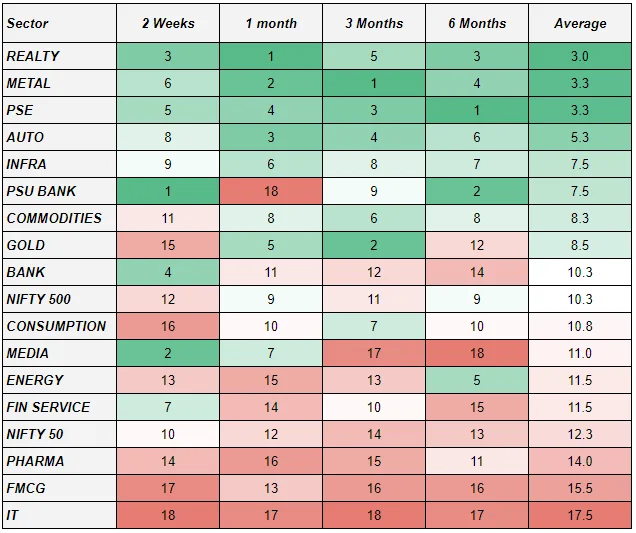

Sectoral momentum shows that public sector enterprises, metals, real estate, and autos are top performers across various time frames. GOLD has lost some steam in the recent few weeks after a strong run. MEDIA has also done quite well to recover from the recent weakness to occupy the 5th spot in the fortnightly ranking.

Discretionary investors can focus on opportunities within these strong sectors. Real estate, metals, public sector enterprises, and autos have consistently held top positions in sectoral momentum over various time frames (two weeks, one month, three months, and six months). If you are a discretionary trader, these sectors are likely to lead the market, so it would be interesting to look for stocks within these sectors for potential leadership and investment opportunities.

Spotlight

The art of Extracting Alpha from a Rangebound Stock – Bank of Baroda case study

today let us see how to momentum investing extracts alpha from range-bound stocks, using Bank of Baroda as an example. Over ten years, the stock fell from ₹200 to ₹35, a drop of more than 80%.

This significant decline illustrates the emotional challenges investors face when holding a stock over a long period with no system in place. Investors might prematurely exit positions due to loss of confidence, even when the stock starts to recover.

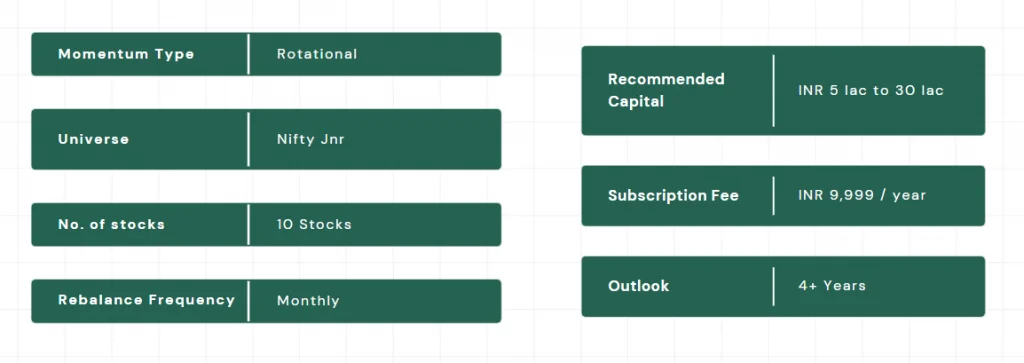

By employing a system-based approach like Mi NNF 10, investors can avoid going through emotional roller coaster & ambiguous situations. For instance, Mi NNF 10 bought Bank of Baroda at ₹107 and exited at ₹214, achieving a 98% gain without having to ponder over the decade-long drawdown on the stock.

This systematic strategy helps manage risks and capitalize on market opportunities without getting emotionally entangled.

The Mi NNF 10 strategy has demonstrated impressive performance, achieving 98% returns in one year and 212% since its inception in 2020, showcasing the benefits of structured investing and risk management over long-term, emotional decision-making.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply