- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 31 Oct 2024

Good, Bad & Ugly Weekly Review : 31 Oct 2024

Recovery on Cards ?

Edition : 31 Oct 2024

Hello, Investor !

Markets Overview

The markets have been on a downswing, as you all know. However, things seem to be slowing down now. The pace of the fall has certainly been arrested, though it may be just a pause before another fall—such possibilities always exist. As we edge closer to the U.S. elections, the market seems to be waiting for the outcome. Either way, I don't believe India will be impacted badly. India is an important trade partner for the U.S., so any president, whether Trump or otherwise, is unlikely to have issues with India. However, if Trump wins, a pro-America manufacturing agenda might emerge, which could weaken China's currency and impact India. But we’ll cross that bridge when we get there.

The last two weeks trended downward. This week, we saw a flattish consolidation, which may indicate either a pause before another fall or the start of a build-up. The level of 24,500 will be the first cue—if that level is crossed, we might see a leg up. Conversely, a drop below 24,100 could signal further weakness. After four weeks of a downtrend, we finally got a week of consolidation. Though no uptrend is in sight yet, the formation of a doji candle suggests a potential end to the downtrend. However, it’s important to note that this isn’t guaranteed.

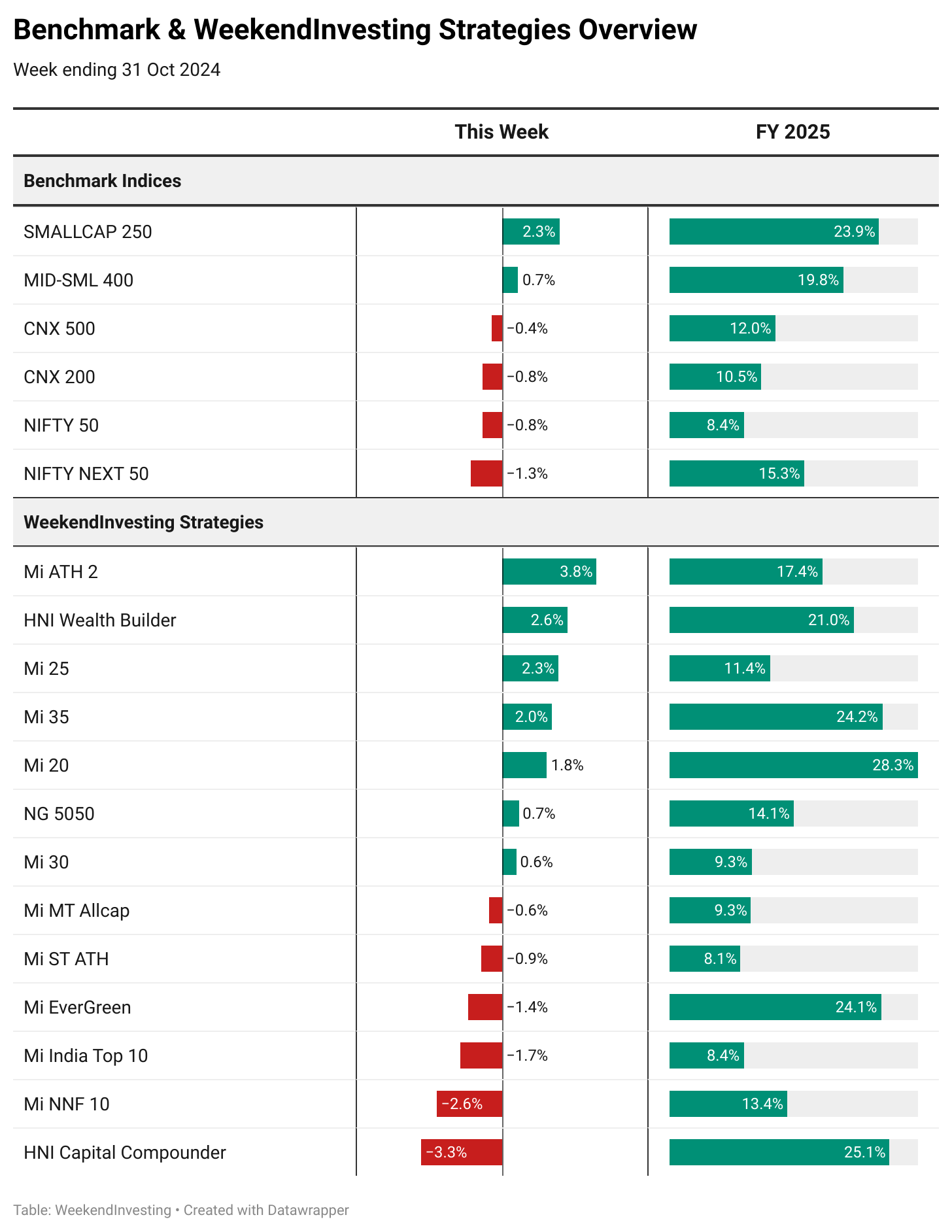

Benchmark Indices & WeekendInvesting Strategies Overview

Looking at the benchmarks, small caps stood out this week, performing well with a gain of 2.3%. In contrast, large-cap indices and multicap indices like CNX500 fell by 0.4%, while Nifty Next 50 collapsed by 1.3%.

Among Weekend Investing strategies, Mi ATH 2 was the top performer, up 3.8%, followed by HNI Wealth Builder at 2.6%, Mi 25 at 2.3%, and Mi 35 at 2%, all benefiting from a small-cap strategy. Meanwhile, strategies focused on larger caps, such as Mi EverGreen, Mi India Top 10, and HNI Capital Compounder lost ground this week.

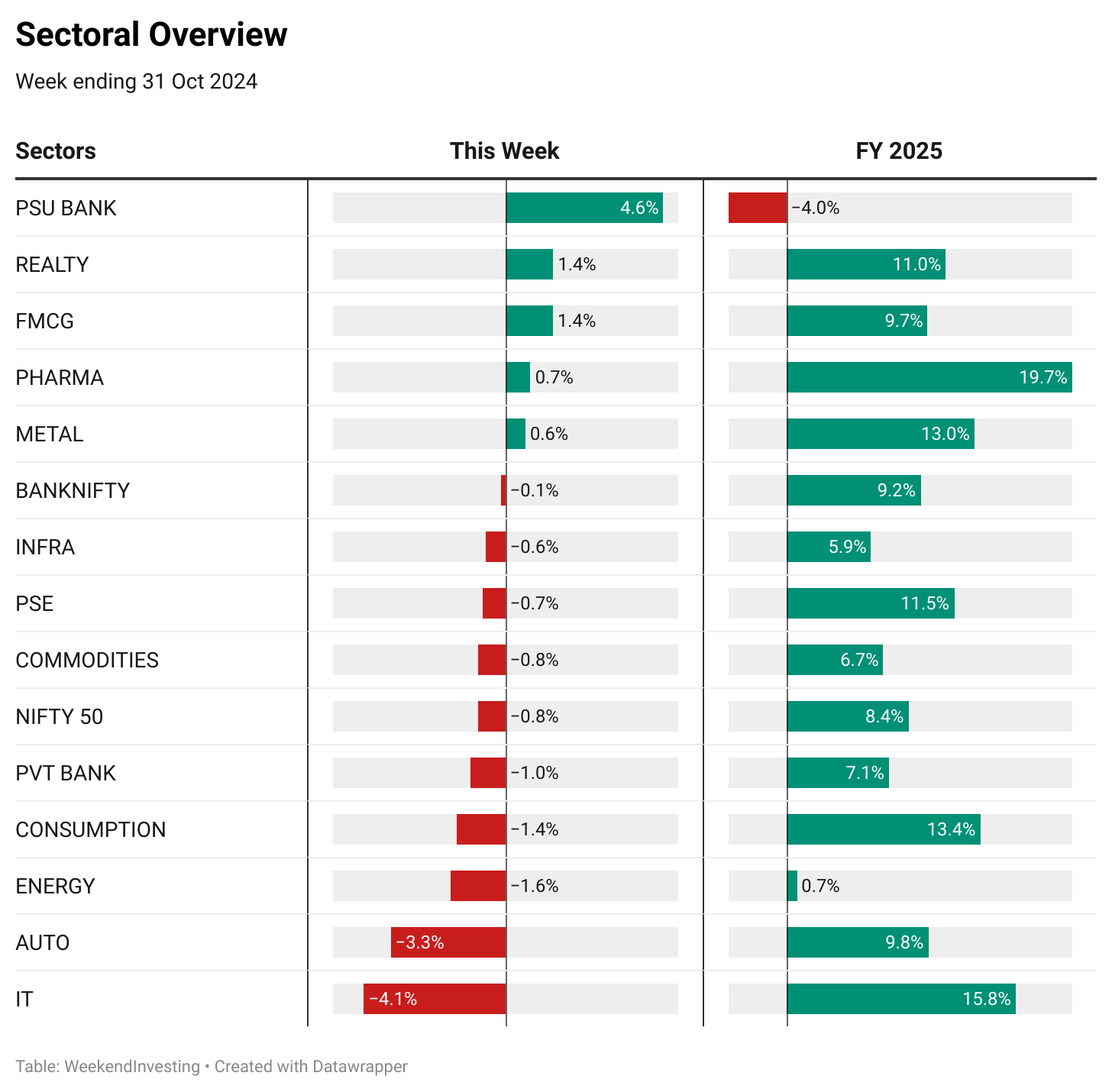

Sectoral Overview

In terms of sector performance, three sectors stood out. Autos and IT were on the downside, while PSU banks were on the upside. Other sectors fluctuated within a range of plus or minus 1.5%. The auto sector faced challenges due to rising inventory, though reports suggest October has been reasonably good, which could slow down the inventory buildup. IT stocks fell due to Microsoft's caution regarding the next year, despite good results. Meanwhile, PSU banks delivered solid results, finding some support to halt their decline.

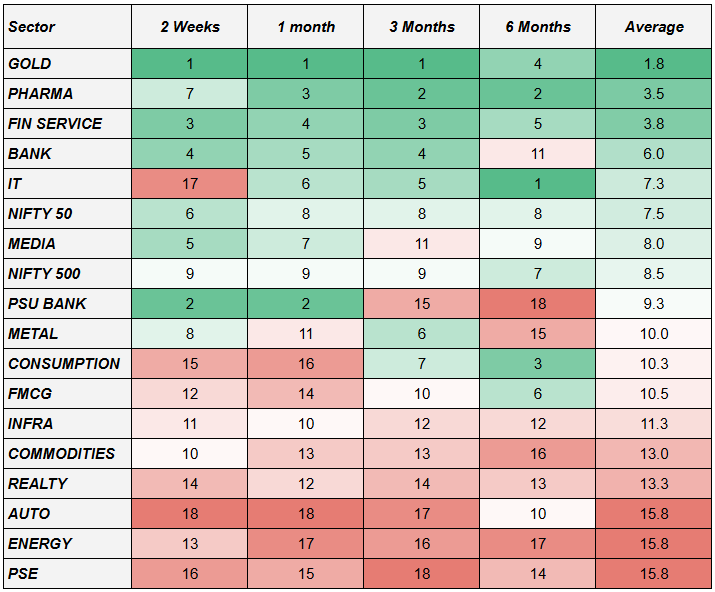

In sectoral momentum rankings, gold took the top spot, followed by pharma, financial services, banks, and IT. IT stocks have stumbled in the short term but remain strong on a longer average. PSU banks also rose in the short-term rankings, with the financial services and banking sectors generally holding up. However, pharma, which previously ranked high, has slipped to seventh place in recent weeks. This shift signals that money is moving toward safer assets like gold, reflecting growing market concerns. Eventually, though, this trend will reverse, restoring the balance.

Spotlight - Mi EverGreen

In the Weekend Investing strategy spotlight, we reflect on the agony of waiting through market lows. For instance, PFC (Power Finance Corporation) went nowhere for 13 years after its listing. Each time it dropped to around Rs. 50, people would buy, and at Rs. 100, they would sell.

But then, in one instance, PFC shot up from Rs. 100 to Rs. 500. Many investors, stuck in the yo-yo of buying and selling, likely didn’t last until the breakout. After years of seeing the same stock revert to a certain level, most investors lose patience and exit, only to miss out when it finally surges. This is normal, but if you follow a non-discretionary strategy, you won’t get bogged down by these emotional cycles.

Momentum investing, for example, might result in more small losses than wins, but the few big wins more than make up for the losses. Out of 100 transactions, about 50 to 60 might go right, and the other 40 to 50 might go wrong. But the gains from the winners are generally much larger than the losses from the losers. A common mistake is avoiding a stock after experiencing a loss with it. However, a stock might give you small losses several times before it becomes a multi-bagger. So, it’s important to remain unbiased and treat each trade as a fresh opportunity.

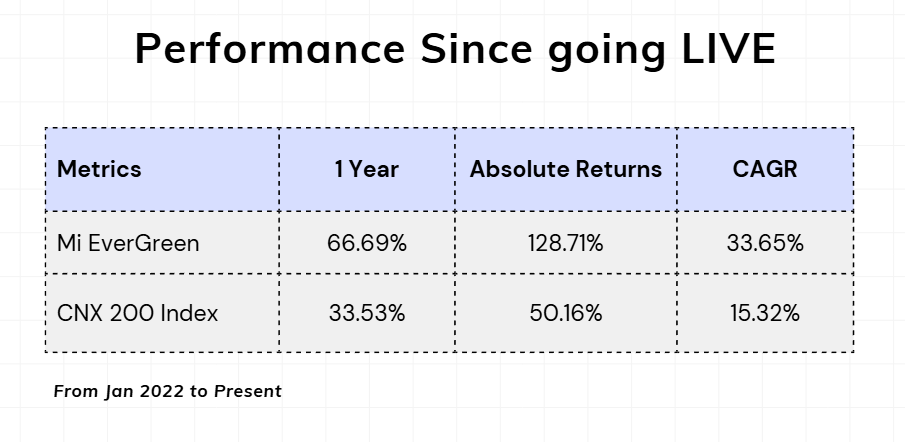

Take the example of Mi Evergreen, a conservative strategy that invests in 20 top 200 stocks and allocates 25% to gold, rebalancing monthly. Since going live in January 2021, it has steadily b

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply