- WeekendInvesting

- Posts

- Have We Found A Contrarian Signal For The Next Big Rally?

Have We Found A Contrarian Signal For The Next Big Rally?

The Rupee’s Resistance

Market Update - Thursday, 18 Dec

The market remained relatively dull and flat today with no major moves. Although the day started on a weak note with the market dropping almost half a percent, it recovered significantly afterward to end the day on a very flat note.

Last night, rumors circulated that the US President might make a major announcement during an address to the nation. While the address was not as earth-shattering as some expected, it did repeat cues that the Federal Reserve chairman will be changed soon.

Additionally, announcements were made regarding dole-out checks for ex-military and armed forces. This sends a message that stimulus and direct checks are being provided to support the economy, especially as Christmas approaches and the US economy struggles.

Back home in India, there has been no news regarding the US-India tariff front, and the market is waiting for a specific trigger. Since it is the second half of December, the period is typically dull as many foreign investors go on holiday.

The Nifty was absolutely flat today, closing at minus 0.01 percent.

The Nifty Junior was mildly down by 0.36 percent but recovered significantly from its daily low.

Mid-caps rose by 0.2 percent, also recovering from the bottom, while small-caps ended at minus 0.11 percent. Charts for these segments showed long tails, which suggests that the market is willing to support these price levels for now. If this pattern continues for a few days, it often indicates an upward bias.

The Nifty Bank was also flat at minus 0.02 percent. In commodities, gold was down 0.46 percent at 13,296 per gram, and silver fell 0.6 percent to 202788.

Despite the slight dip, silver has gained significantly since the start of the month. If it closes green, it will mark eight straight months of gains—a first in history. This historical record suggests something fundamental may be changing in the system.

Other Market Triggers

The Nifty heat map showed some movement in IT stocks, while most other stocks were only slightly in the red or green.

Larger drops were seen in IOC and Enrin, as well as MotherSon.

On the positive side, commodities like Hindustan Zinc and Vedanta continued to show strength, and pharma stocks like Divi's Lab were up. Financials and PSU banks took a breather today.

The mover of the day was HDFC AMC, which jumped 7.15 percent after SEBI revised the maximum cap AMCs pay to brokerages. This change is expected to lower operating costs and improve margins for AMCs, even if expense ratios for customers remain the same.

U.S. Market Update

In contrast to the domestic recovery, US markets were in tatters yesterday. The NASDAQ lost 1.8 percent, the S&P fell 1.1 percent, and the Dow Jones was down 0.47 percent.

Major stocks saw significant losses, with Palantir dropping 5.5 percent and Oracle falling 5 percent. Oracle has now lost nearly 50 percent from its recent top, moving from 350 dollars down to near 170 dollars. AMD lost 5 percent, and Tesla fell 4.6 percent despite having just hit a new high. Caterpillar also dropped 4.59 percent.

It appears a "Santa rally" is not currently materializing in the US. Some of these stocks may be part of Weekend Investing strategies, but these mentions are strictly for information and are not recommendations.

What to watch next ?

Trading activity normally picks up again in the first week of January, so the market may remain in this state for a couple of weeks.

Interestingly, the volatility index in the Indian market is at a historic low. This can be interpreted either as a sign of inactivity or as the calm before a storm if a significant event is on the horizon.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The Rupee’s Resistance: A Contrarian Signal for the Next Big Rally?

The Historical Blueprint

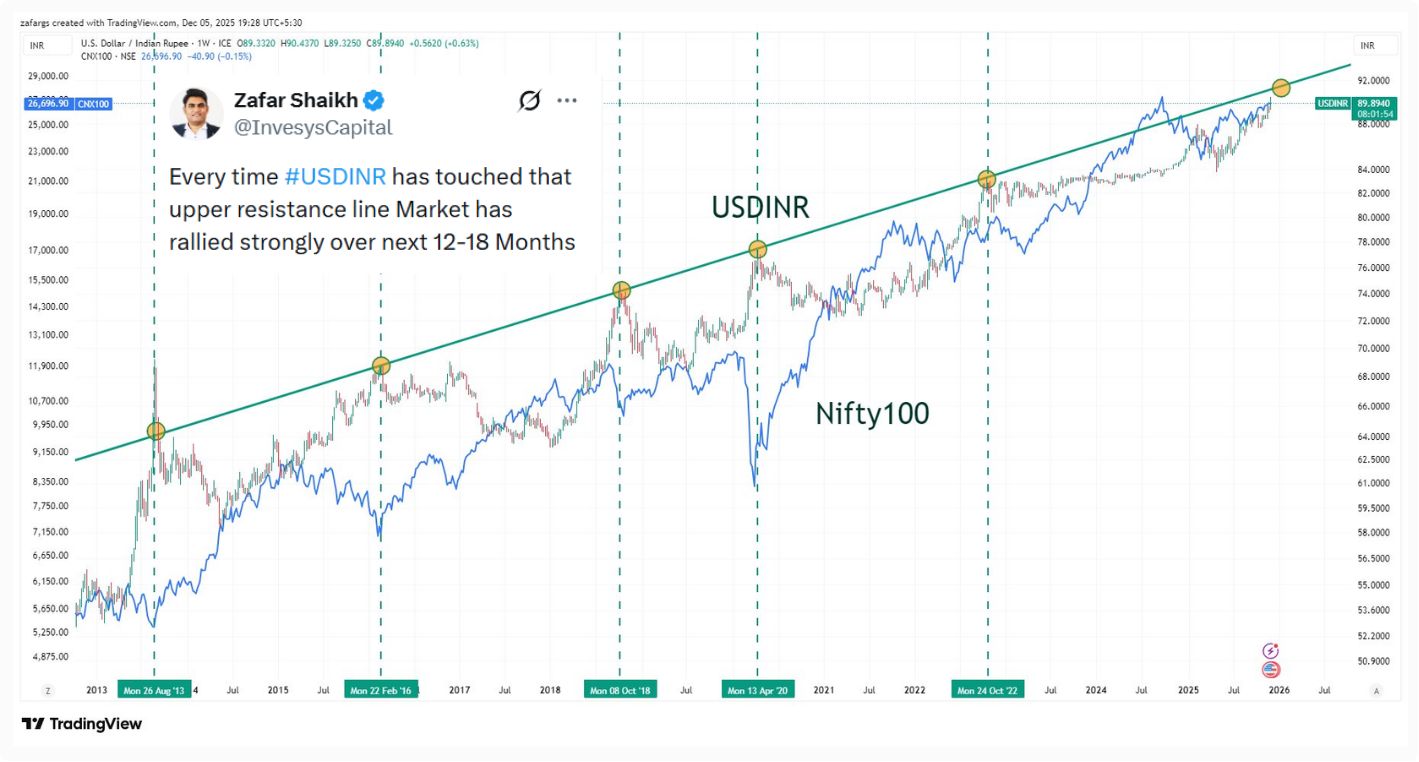

Data presented by market analyst Zafar Shaikh (known as Invesys Capital on X) suggests a compelling correlation between the USD/INR exchange rate and Indian equity bull runs. Historically, whenever the USD/INR pair hits its upper resistance line—meaning the Rupee reaches a point of significant weakness—it acts as a precursor to a massive market rally over the following 12 to 18 months.

Source : Zafar Shaikh on X

Tracking the Pattern (2013–2022)

The analysis highlights five distinct instances where the Rupee’s "pain point" became the Stock Market’s "gain point":

2013: USD/INR hit a major high; a massive equity rally followed.

2016: The resistance was tested again, followed by a strong market upmove.

2018: A peak in the currency pair led to a moderate rally.

2020: The pandemic-induced spike in USD/INR preceded one of the fastest bull runs in history.

2022: Another resistance touchpoint resulted in yet another strong market performance.

The "New Normal": Why This Time is Different

While the pattern is historically consistent, there is a unique twist in the current cycle. In all previous instances, the stock market usually experienced a significant correction or "crash" before the USD/INR hit its resistance line.

Currently, the USD/INR is approximately 1-2% away from that critical resistance level. However, unlike previous cycles, the Indian equity market has remained relatively resilient and hasn't seen a deep drawdown yet. This raises a crucial question: Will the market fall as the Rupee edges closer to that 1-2% gap, or will the rally trigger from these elevated levels?

Meme Of The Day

With the USD/INR now just 1–2% away from that line—and the market still sitting at high levels—what do you think happens next? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply