- WeekendInvesting

- Posts

- Is India’s Underperformance a Hidden Opportunity?

Is India’s Underperformance a Hidden Opportunity?

Global Market Wrap-Up

Market Update - Friday, 2 Jan

It is a fantastic way to kickstart the new year as the first weekly candle close of 2026 has reached a new all-time high mark. This weekly performance of approximately 1% is the best the market has seen since mid-November. This surge comes after a consolidation period of about 15 to 16 months.

This traction is primarily driven by strong expectations surrounding the upcoming Q3 earnings season and optimism regarding the budget due in February.

Since the COVID bottom, markets have rallied exceptionally hard. Large caps have grown 3x while mid caps and small caps have grown 5x over a period of 5 to 6 years. This period also saw an explosion in the number of demat accounts as strong rallies prompted many new investors to enter the market. However, with the Nifty at an all-time high, investors should ask themselves if their own portfolios are also at record highs and if their expectations are aligned with current market realities.

Nifty 50 rose 0.7% and is trending positively above its 50 and 200-day moving averages.

Nifty Next 50 gained 1.06% and is very close to crossing key resistance levels after four consecutive green sessions.

The Nifty Mid Cap Index established a new all-time high at 22,579. The Small Cap index rose 0.7%, crossing its 50-day moving average for the first time since mid-November.

Bank Nifty gained 0.74%, while Gold rose 2% and Silver jumped 4.2% despite previous selling pressure.

Other Market Triggers

The Nifty heatmap showed Coal India as a top performer with a 7% gain, followed by NTPC at 4.7%.

On the losing side, ITC dropped 3.7% and Nestle fell 1.18%.

IDBI Bank was the mover of the day, rising 10.5% on the back of disinvestment progress.

US Market Updates

Global markets had a muted start to the year. With January 1st being a holiday, the weekly performance for US markets showed small caps losing 2.07%, with the Nasdaq and S&P 500 also facing pressure.

Tesla lost 7% and Palantir dropped 8% over the week. Despite this, the Dow Jones remains up 1.2% on a one-month basis.

Even though the end of the year usually brings quiet trading, some negative performance was noted across major US indices.

What to watch next ?

Nifty has been hovering near its all-time high for the last two or three months, and every time selling pressure emerged, a strong buying force neutralized it. Momentum has now shifted in favor of the bulls.

Only time will tell if this will be a long-term rally similar to those seen after consolidations in 2021-22 and 2023-24. While the post-Covid era saw significant rallies following consolidation, it remains to be seen if 2026 is starting the next major leg of growth.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

For more details about Category 3 AIFs, fill in the interest form below

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

Global Market Wrap-Up: Is India’s Underperformance a Hidden Opportunity?

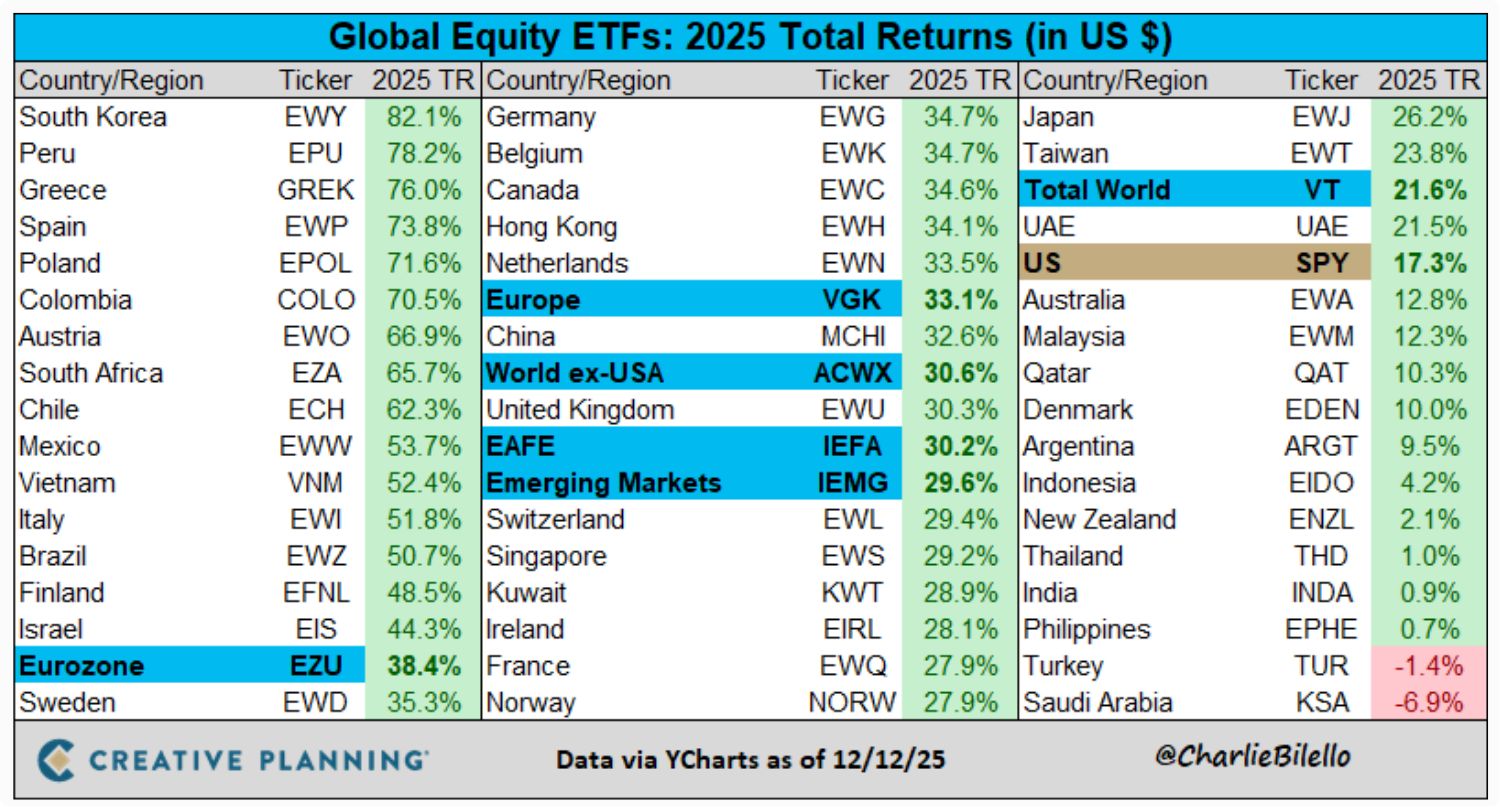

The 2025 calendar year data is in, and it’s quite a wake-up call for those tracking global markets. Based on data shared by Charlie Bilello, the performance of various country ETFs in US Dollar (USD) terms reveals a stark contrast between India and the rest of the world.

Source : Creative Planning on X

While the numbers might seem discouraging at first glance, they tell a deeper story about market cycles and where the "smart money" might look next.

The 2025 Scorecard: India vs. The World

For a global investor looking at returns in dollars, India’s performance was nearly flat. The INDY ETF (the India ETF traded in the US) delivered a meager 0.9% return for the entire year.

To put that in perspective, India only managed to outperform three countries in this specific data set: the Philippines, Turkey, and Saudi Arabia. Meanwhile, the rest of the world seemed to be in a massive bull run.

A Global Perspective: Why the "Flow" Shifted

If you are a global investor sitting anywhere in the world, would India have looked attractive in 2025? Probably not. Capital tends to follow momentum. As long as countries like South Korea or even smaller markets like Kuwait, Switzerland, and Qatar were delivering high double-digit returns, the global "flow" of money naturally moved toward them.

Even countries often considered "frontier" or smaller economies—like Vietnam at 52%—thrashed India's performance this year. This explains why the Indian market felt heavy; it simply wasn't the favorite destination for dollar-denominated capital in 2025.

The Silver Lining: The Power of Mean Reversion

Markets do not move in a straight line; they move in cycles. This is often referred to as Sector or Country Rotation. After a year and a half of "taking a beating" relative to global peers, the probability of India outperforming in the near future has actually increased.

Think of it as a rubber band being stretched. India’s long-term average return in dollar terms is approximately 9% to 10%. Because we have had a period of near-zero returns, the principle of Mean Reversion suggests that we are likely to see "lumpy" returns ahead—meaning some years could see a massive catch-up growth of 20% to 30% to bring the average back to its trend line.

Looking Ahead: The "Top Third" Ambition

The stage is set for a potential comeback. As markets rotate away from the overheated performers of 2025, India stands a strong chance of moving from the bottom of the list to at least the middle or even the top one-third of global performers.

“Investors who stayed patient during this period of underperformance may soon reap the rewards of this cyclical shift.”

Meme Of The Day

Where do you think the "Dollar Term" returns for India are headed? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply