- WeekendInvesting

- Posts

- Is it Time to Pivot Your Portfolio?

Is it Time to Pivot Your Portfolio?

The Golden Shine

Market Update - Monday, 5 Jan

The week began with a significant amount of anxiety and pessimism following the United States' attack on Venezuela and the abduction of their president. Despite these geopolitical tensions, global markets reacted with surprising resilience.

Japan’s Nikkei 225 and South Korea’s Kospi index both rose by 3 percent, while China gained more than 1 percent. European indices were also trading in the green as the Indian markets closed for the day.

The Indian markets held up relatively well despite the global uncertainty. While large-cap indices saw some profit booking, particularly among heavyweight stocks in the Nifty Next 50 and Mid Cap indices ahead of the earnings season, the Nifty managed to reach a new all-time high.

A particularly positive note was the continued momentum in smaller and micro-cap indices. This consistent performance in lower-cap stocks suggests a healthy trend as the year 2026 progresses.

The Nifty was down 0.3 percent but maintained a positive outlook across short, medium, and long-term parameters.

Other indices showed mixed results, with the Nifty Junior index finishing flat after a strong four-session streak.

The Mid Cap index was also flattish with a minor decline of 0.1 percent, while the Small Cap index rose 0.28 percent and finally managed to move past its 50-day moving average to end at 16,843.

The Nifty Bank index saw a slight decline of 0.18 percent.

Today has been a significant day for precious metals, with gold performing exceedingly well. This upward movement is primarily driven by the prevailing global uncertainty and recent news involving the United States and Venezuela.

As a result of these developments, gold has seen a notable increase of 2.73%.

Following this trend, silver is also experiencing a major surge, exploding with a gain of 5.03% today.

Other Market Triggers

The market heat map showed profit booking across IT counters, with TCS down 1.06 percent, Infosys down 2 percent, and HCL Tech down 1.9 percent.

Zomato and Wipro also saw significant losses. In the banking sector, HDFC Bank fell 2.4 percent, which significantly impacted the Nifty.

While some stocks like Axis Bank, ICICI Bank, and Maruti gained, the Nifty Junior index was a mixed bag.

LIC lost 1.7 percent and certain Adani stocks also declined.

On the positive side, Solar gained 3.2 percent and Pidilite Industries rose 1.8 percent.

In the mover of the day segment, CSB Bank performed exceptionally well, rising 15.38 percent on the news of improved loan books in their Q3 results.

Jtekt, an auto components manufacturer within the Toyota group, rose 7.8 percent.

US Market Updates

In the US markets, the Russell 2000 Small Cap index rose 1.06 percent as of January 2, while the broader NASDAQ 100 heat map showed gains for Nvidia and Google, but losses for Microsoft, Meta, Netflix, and Palantir.

What to watch next ?

In the context of the situation in Venezuela, it is important to note that the country holds about 18 percent of global oil reserves, totaling more than 304 billion barrels.

There is a developing narrative that oil supplies might actually improve, though it remains to be seen if the United States will gain a strategic advantage or how shale oil prices will ultimately define the outcome.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

For more details about Category 3 AIFs, fill in the interest form below

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The Golden Shine: Is it Time to Pivot Your Portfolio?

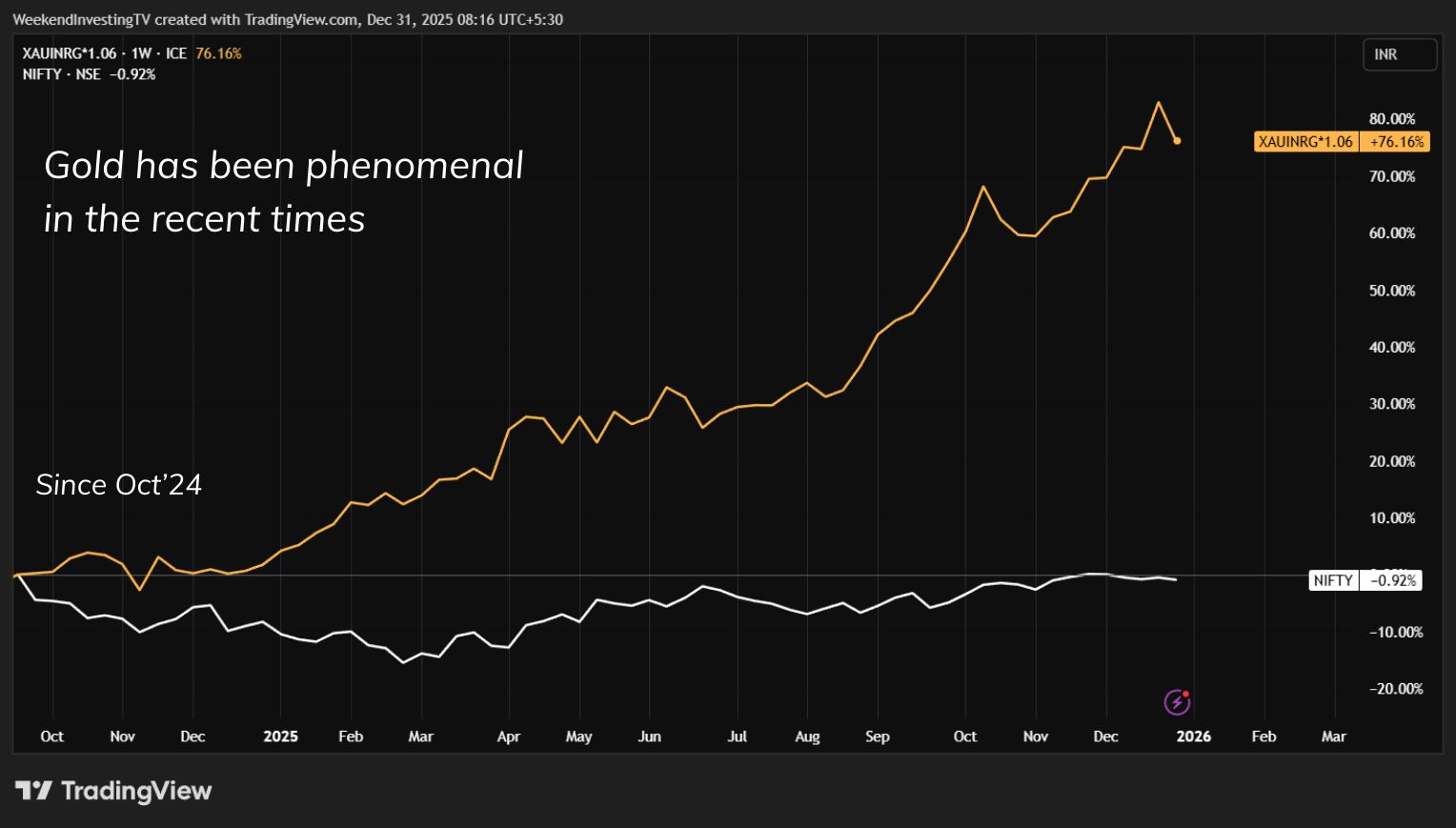

Gold has been the talk of the town lately, outshining almost every other asset class. In the last 15 months, gold has delivered a staggering 76% growth, while the Nifty has remained largely flat.

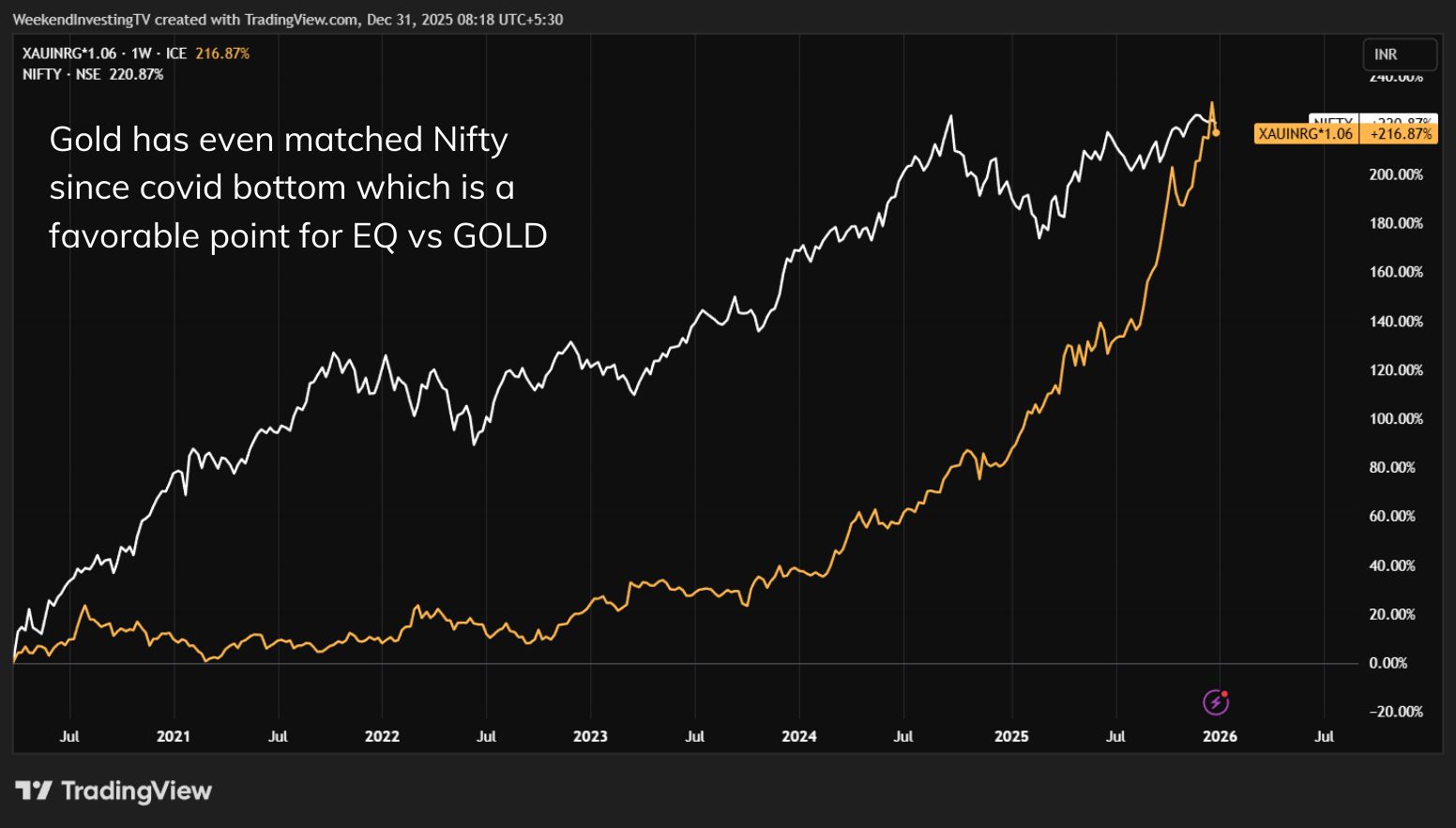

Even if we look back to the COVID-19 market bottoms, the returns from Gold and Nifty have leveled out—Nifty took the lead initially, but Gold has since caught up with a vengeance.

However, before you consider moving all your capital into the yellow metal, let’s look at the bigger picture.

The Trap of "Lumpy" Returns

Gold is famous for what we call "lumpy returns." It tends to stay dormant for years, followed by a massive, sudden surge. History shows us that Gold goes through long cycles of stagnation:

The takeaway? Just because Gold has performed exceptionally well over the last 3 to 5 years does not mean it will continue this trajectory indefinitely.

Avoid the "Performance Chasing" Mistake

When one asset class outperforms others in a short duration, many investors feel the urge to "go all in." This is a classic psychological trap. Switching entirely from Equity to Gold right now—after a 76% run—could mean entering at a peak and missing the next leg of growth in the stock market.

The Power of a Balanced Portfolio

The goal isn't to pick a "winner" between Gold and Nifty; it’s to have both working for you. A balanced approach ensures that when Equity is flat, Gold protects your wealth, and vice versa.

Meme Of The Day

Which of these best describes your current investment strategy? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply