- WeekendInvesting

- Posts

- Is Your "Quality" Stock a Bubble?

Is Your "Quality" Stock a Bubble?

A Reality Check for Your Portfolio

Wednesday, 17 Sep 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

Tonight is an important evening as we will come to know what the US Federal Reserve decides to do and what it signals for the future. At the same time, there is news of collaboration between the US and India teams, with President Trump congratulating Prime Minister Modi on his birthday.

This positive sentiment seems to have given some relief to the markets, which are slowly inching back toward their previous highs after a period of worry.

Over the past twelve sessions, the market has moved from 24,400 to 25,330, showing strength despite distractions such as tariff news. The move clearly indicates that the market is in no mood to stop, even when faced with roadblocks.

Nifty rose 0.36% for the day.

Nifty Junior also showed a steady upward trend of 0.21% in the last eight to nine sessions, moving close to its resistance near 69,000.

Midcaps gained 1.18% & Small caps were up 0.5%.

Bank Nifty moved up 0.63%. Though still lagging behind, Bank Nifty has gained nearly 700 points over the last two days.

Gold, however, seems to be taking a pause, waiting for the Fed’s decision to determine its next big move.

Other Market Triggers

SBI shined with a 3% gain in a single day. Other gainers included Bharat Electronics, Tata Consumers, Maruti, and Kotak Bank.

In the Nifty Next 50, PSU banks like Bank of Baroda, Canara Bank, and PNB showed strong momentum along with companies like BPCL, HAL, and IOC.

Tata Consumers was the top mover of the day, up 4.05%, thanks to its focus on premiumization in the tea business.

What to watch next ?

The expectation is for a quarter percent rate cut. If the Fed announces half a percent cut, gold may not fall and could even rise if further cuts are hinted at.

On the other hand, a quarter percent cut might push prices down somewhat.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

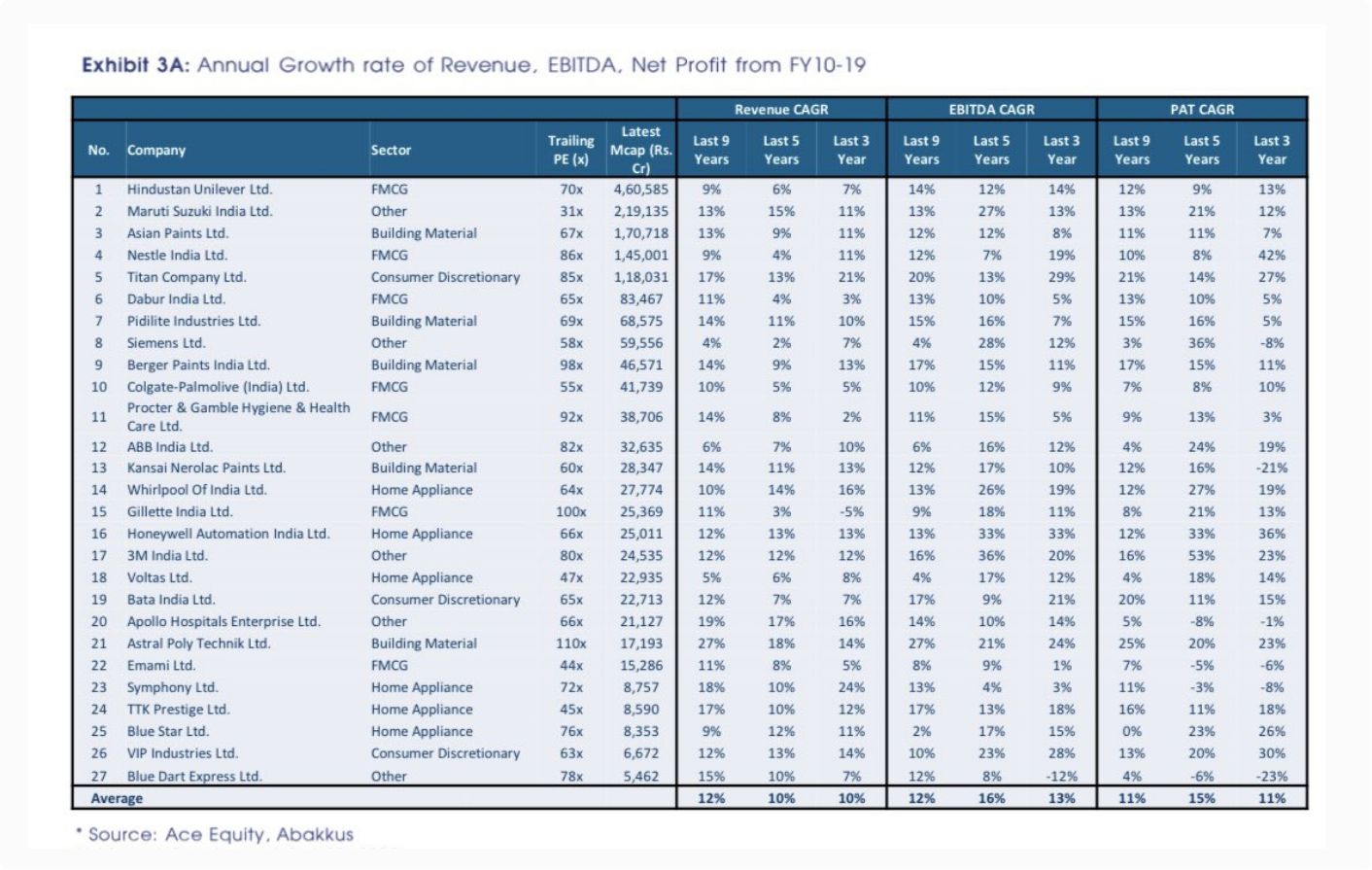

A Reality Check for Investors: Is the "Quality" Stock Bubble Bursting?

In a surprising and rare move, fundamental investors have sounded the alarm on a potential bubble in "quality" stocks. A recent tweet from Safir Anand highlighted a bold call by Abakkus, led by Mr. Sunil Singhania, who expressed concern that many of these highly-regarded companies may offer no returns for the next few years.

This is a significant departure from the common "buy at any price" mentality that often dominates market sentiment.

The "No-Returns" List

Abakkus has identified 27 specific companies they believe are at risk of a period of stagnant returns.

The list includes several household names, which might come as a shock to many investors:

Consumer Goods: Hindustan Unilever, Nestle, Titan, Dabur, Berger Paints, Colgate-Palmolive, Whirlpool, Gillette, Bata, VIP, Emami

Paints & Chemicals: Asian Paints, Pidilite, Kansai Nerolac

Engineering & Manufacturing: Siemens, ABB, Honeywell, 3M, Voltas, Blue Star

Construction & Home Improvement: Astral Poly, TTK Prestige

Automotive: Maruti Suzuki

Logistics: Blue Dart Express

Healthcare: Apollo Hospitals

Miscellaneous: Symphony

The Valuation Conundrum

The core of Abacus's argument lies in the disconnect between these companies' valuations and their underlying growth metrics. The listed companies are trading at trailing price-to-earnings (P/E) ratios of 50x to 100x. However, their revenue and earnings growth often tell a different story:

Revenue CAGR: Single-digit or low double-digit growth.

EBITDA & PAT CAGR: While some are decent, the growth rates are not high enough to justify the steep multiples.

This imbalance suggests that while the companies themselves are fundamentally sound, their current stock prices have already priced in an extraordinary amount of future growth that may not materialize. The high P/E ratios create a significant risk, as any slowdown in growth or market correction could lead to a steep decline in stock prices.

Key Takeaways

Price Matters: Even the best companies can be a poor investment if purchased at an exorbitant price. Valuations, specifically the P/E ratio relative to growth, are a critical component of a sound investment thesis.

A Complete Strategy: A robust investment framework should address four key principles, not just one:

What to Buy: Identifying high-quality businesses.

When to Buy: Determining the right entry point based on valuation and market conditions.

How Much to Buy: Position sizing and risk management.

When to Sell: Establishing clear exit criteria to protect profits or cut losses.

In conclusion, while "quality" stocks are often considered a safe haven, this rare and important warning suggests that even the best businesses are not immune to overvaluation. Investors should be cautious and remember that a "buy at any price" strategy is often an incomplete one, leaving them vulnerable to market fluctuations.

Meme Of The Day

Based on the recent warning about a potential bubble in "quality" stocks, what is your primary approach to investing in these types of companies? |

|

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply