- WeekendInvesting

- Posts

- ITC Hits 27 Year Low !!

ITC Hits 27 Year Low !!

Is Your Money Building Businesses ?

Market Update - Friday, 23 Jan

This marks the end of what can only be described as a disastrous week for the markets. The Nifty continued its downward journey today, notably breaking below its 200-day Daily Moving Average (DMA). The 200 DMA is a critical psychological mark; when the market falls below this level, it often signifies that the underlying strength of the market has been broken.

In this update, the focus is on the movement of real assets like real estate, gold, and silver compared to financial assets. While financial assets are also real assets, their ease of buying and selling, combined with low transaction costs, leads to much higher volatility. This often results in investors selling during moments of despair.

The ITC price chart denominated in gold, rather than fiat currency, reveals a striking reality regarding long-term purchasing power.

Turning to the current market performance, the last 14 sessions have seen a dramatic drop from 26400 to a close of 25048. Being below the 200 DMA after a failed attempt to resist this level two days ago suggests the market is looking into an abyss with the potential to go lower. Momentum trends are down across the board, painting a dismal picture.

The Nifty Junior fell 1.97%, erasing the gains of a recent "dead cat bounce," while Mid caps were unable to cross their own 200 DMA and dropped 1.72%.

Small caps followed suit with a 1.95% decline.

Meanwhile, the Nifty Bank was smashed down 1.23%, showing that no pocket of the market was spared.

In contrast, gold and silver are rising. Gold stands at 15414, and silver surged 2.66% to 307781, with both showing positive trends.

Other Market Triggers

Specific stocks took significant hits. Zomato fell 6% following the notification that Deepinder Goyal is leaving the CEO position. Cipla dropped 4% and Adani Ports fell 7%.

Other heavyweights like State Bank of India, Axis Bank, and Jio Finance were also down.

Some IT stocks remained stagnant rather than falling, aided by a crash in the rupee as the USD/INR reached almost 92, providing comfort to exporters.

Hindustan Zinc rose 4.5% on the back of silver's movement, but Adani stocks—including Green, Enterprise, and Power—were badly battered, along with Ambuja Cement which fell 5%.

Tanla showed a significant uptick, gaining 7.29%. While this might look like a dead cat bounce, the positive momentum (after the latest financial result) is a welcome move, after its recent decline.

U.S. Market Updates

In the US, markets showed a different story with indices up between 0.5% and 0.8%.

Meta rose 5.6%, and others like Tesla and Salesforce saw gains of 3% to 5%. While some of these are part of the Weekend Investing US strategy, they are mentioned for context and not as recommendations.

Interestingly, even in the US, consumption-related stocks like Walmart, Costco, and Netflix saw declines.

What to watch next ?

There is extreme pessimism in the air, especially with the budget only five days away. There is currently no "whisper" or positive expectation regarding the budget; it is possible the market anticipates news that will not be favorable. We will find out the reality on February 1st.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📉 The Great IPO Flip: Is Your Money Building Businesses or Just Buying Out Founders?

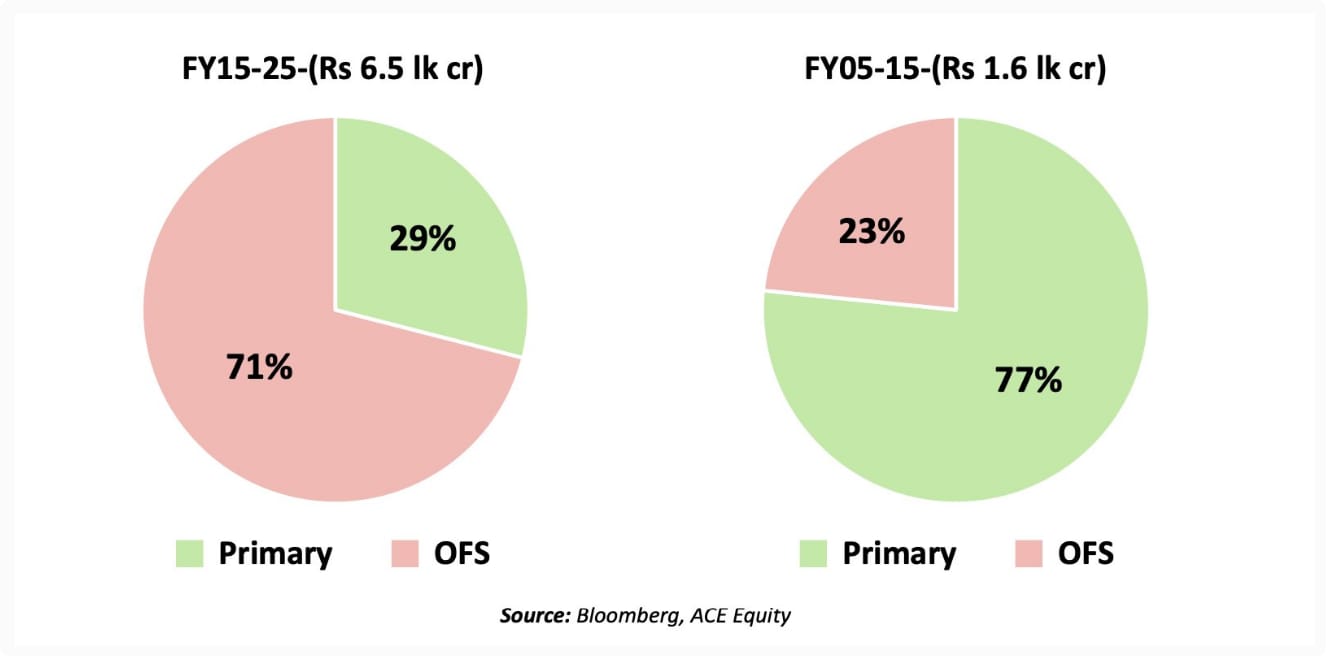

The Indian IPO market is booming, with record-breaking listings and a flood of retail capital. However, a deeper look at the data—recently highlighted by financial analysts and Bloomberg—reveals a startling trend. Over the last 20 years, the fundamental purpose of an IPO has undergone a complete 180-degree turn.

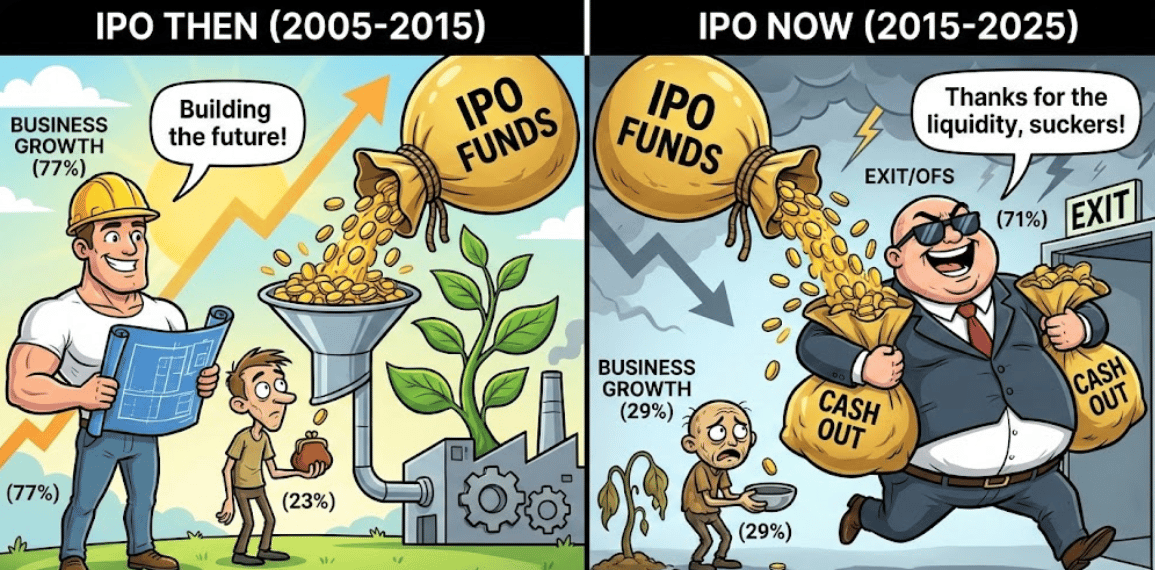

The Era of Expansion (2005–2015)

A decade ago, when a company went public, it was usually because they needed "Fresh Capital." They wanted to build new factories, expand into new territories, or develop new products.

Between 2005 and 2015, Indian companies raised approximately ₹1.6 Lakh Crore through IPOs. The breakdown of that capital was healthy:

77% for Business Growth: The lion's share went directly into the company’s coffers to fund expansion.

23% for Offer for Sale (OFS): Only a small fraction was used by early investors or promoters to sell their existing shares.

The Decade of the "Exit" (2015–2025)

Fast forward to the last ten years, and while the scale of the market has exploded, the intent has shifted. Between 2015 and 2025, the total amount raised surged to ₹6.5 Lakh Crore. However, the utilization of these funds tells a different story:

71% for Offer for Sale (OFS): The majority of the money is now simply "changing hands." It goes to the private equity firms, VCs, or promoters who are cashing out.

29% for Business Growth: Less than a third of the capital raised is actually staying within the company to drive future operations.

What Does This Mean for the Market?

This shift suggests that the IPO market has transitioned from a Capital Formation Hub (where businesses are built) to a Liquidity Event Hub (where early investors exit).

When you see a "flood of public money" entering the market today, it often isn't funding the next industrial revolution; it is providing an exit door for those who invested years ago. While exits are a healthy part of the ecosystem, the extreme tilt toward OFS means that new shareholders are buying into the past success of a company rather than funding its future potential.

Meme Of The Day

Knowing that 71% of IPO money now goes to exiting investors (OFS) rather than business growth, how does this change your investment strategy? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply