- WeekendInvesting

- Posts

- Market Cycles : Gold vs. US Equities

Market Cycles : Gold vs. US Equities

Is a New Multi-Year Cycle Beginning?

Market Update - Monday, 15 Dec

The financial narrative is currently dominated by precious metals, which are on fire. Both gold and silver have reached new all-time highs in rupee terms, and they are very near their all-time highs even in dollar terms.

The exchange rate for the USD INR continues its ascent, hovering around 90.67 to 90.72. Despite this, stock markets, after opening soft this morning, managed to recover most of the lost ground by the end of the day.

The chart of the USD INR is revealing, showing a rapid upward pace since late October. Having been near 83 at that time, the exchange rate is now above 90, representing a loss of almost 10% in just under two months.

What is compounding the situation is that the dollar price of gold is also rising. The world is increasingly recognizing that the US dollar is not the strong currency it once was, burdened by a 130% debt-to-GDP ratio. Historically, whenever a leading reserve currency country's debt-to-GDP ratio crosses a certain threshold, it signals the end of that regime, although no one can predict if this transition will take five, ten, or twenty years.

Indices recovered from their morning lows to close very near yesterday’s levels, registering a minor loss of only minus 0.08%. The Nifty remains within a stone's throw of new highs.

The Nifty Junior chart gained 0.16%, marking the third consecutive day of gains.

Mid caps were also very flat, down minus 0.07%, quickly recovering their morning losses.

Small caps gained 0.36%, marking the first time they have recorded gains three days in a row since September. This is seen as a positive sign that the current phase of weakness may be concluding.

Nifty Bank was also up 0.12%, having recovered from its morning lows.

Gold is up 1.18%, now priced at 13,423 per gram or 1,34,230 per 10 grams. It has clearly broken out of the previous high set in October and looks set to go higher.

Silver is showing even more dramatic moves, surging 3.2% in a single day, effectively nullifying the sharp move observed on Friday.

Other Market Triggers

The Nifty heatmap looked decent, with gains in Hindustan Unilever, IndiGo, Trent, Shriram Finance, TCS, Infosys, and HCL Tech. Some banking, auto, and energy stocks were down, but the overall picture was reasonably decent.

The Nifty Next 50 saw good runs in commodity stocks and cement, with some FMCG and PSU banks also moving up.

Rumors about foreign holding limits in PSU banking are back on the agenda, with expectations that clarification might come only in the budget.

In the Mover of the Day segment, WPIL Limited was up 8.2% after securing an order worth 1,300 crores.

U.S. Market Update

The US markets all closed down on Friday: S&P 500 down 1%, NASDAQ down 1.69%, and Russell down 1.5%. A 1% to 1.5% drop in the US market is significant, given that it accounts for 60% to 70% of the world's market capitalization.

Specific stocks showing heavy losses included Broadcom, which fell 11.43% after being a spectacular multi-fold performer in the last couple of years, AMD losing 4.8%, Oracle down 4.4%, and both Caterpillar and Intel also declining. Some of these stocks may be part of a US stock strategy, but they are not recommendations.

What to watch next ?

A significant point of discussion is the purported export of 600 tons of silver directly from China to India, bypassing the London Bullion Market Association (LBMA). This, along with other data, strongly suggests that India's demand for silver has exploded.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📰 Market Cycles : Gold vs. US Equities

📈 The "Temporary Phenomenon" Myth in Gold Performance

The recent strong performance of Gold over the past 1-1.5 years has led many investors to believe it is merely a temporary phenomenon or a statistical anomaly—a stroke of luck that won't last in the long term.

This ananysis explores a counter-argument presented by Mr. Costa, an analyst at Crisis Capital, who suggests that the current shift is part of a much larger, recurring, multi-year cycle.

📊 The 80-Year Gold vs. S&P 500 Cycle Study

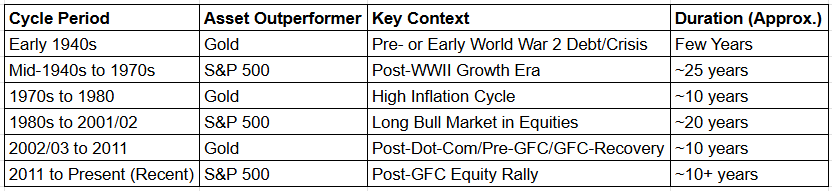

Mr. Costa's analysis studies the cycles of the past 80 years using a crucial metric: the Gold vs. S&P 500 Ratio Chart on a 10-year rolling return basis.

Above the Zero Line: Indicates that Gold has outperformed the S&P 500 over the preceding 10 years.

Below the Zero Line: Indicates that the S&P 500 has outperformed Gold over the preceding 10 years.

The historical data reveals distinct cycles:

The current movement suggests that this cycle is once again turning upwards, favoring Gold.

Source : @TaviCosta on X

🔄 Is a New Multi-Year Cycle Beginning?

The recent outperformance of Gold, currently seen only over a single year, could potentially extend for the next 10 years if it develops into a decisive cycle, similar to those seen historically. While there have been instances of whipsaws (brief moves up then down, or vice versa), a decisive shift typically leads to a long-term trend.

The need to allocate to Gold is emphasized, not just in comparison to the S&P 500, but also considering the performance of the Indian market, as these long-term cycles impact global assets.

🌍 Confluence of Historical Catalysts

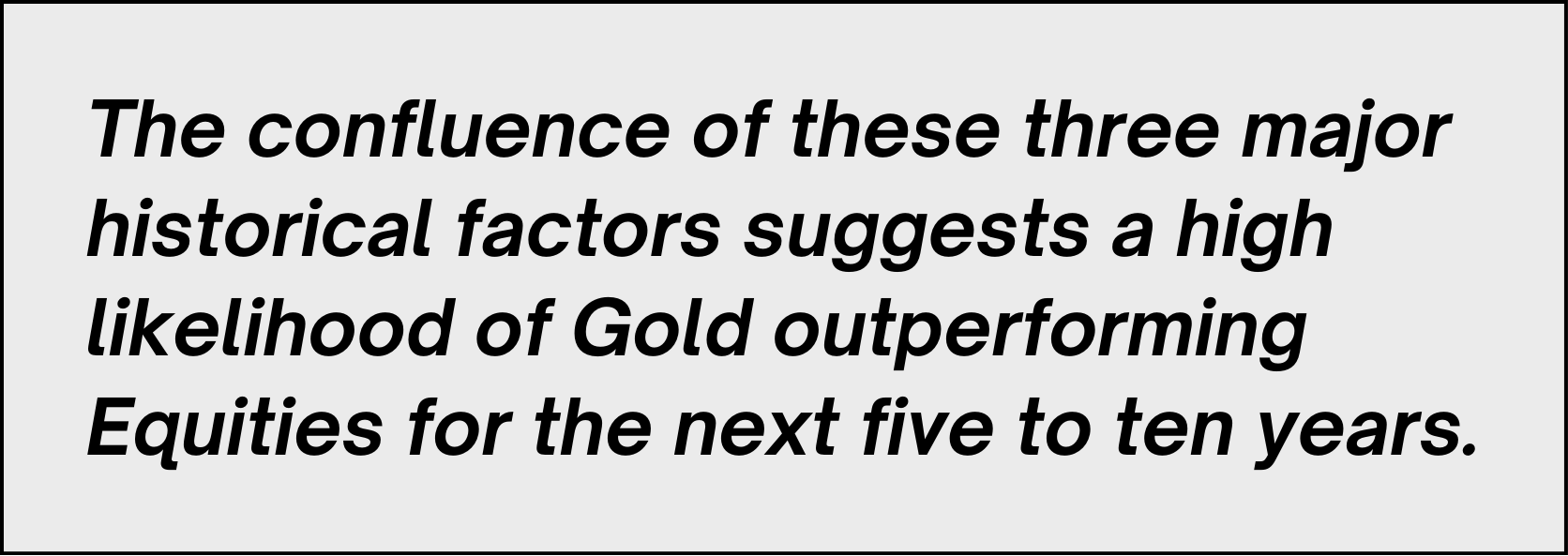

What makes the current situation potentially ripe for a prolonged Gold outperformance cycle? The speaker notes that the current environment combines the key features of the previous Gold-outperforming cycles:

Debt Problems (1940s): The high global debt issues of the 1940s have surfaced again.

Inflation Issues (1970s): The inflation concerns reminiscent of the 1970s are currently a global challenge.

Asset Valuation Imbalance: Assets are trading at high valuations, creating an imbalance similar to pre-cycle shifts.

Meme Of The Day

Based on the historical market cycle analysis (10-year rolling returns), which asset do you believe will deliver the superior returns over the next 5-10 years? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply