- WeekendInvesting

- Posts

- Market Fell Due to A.I. Bubble Fear?

Market Fell Due to A.I. Bubble Fear?

Your Cost Of Timing The Market

Tuesday, 4 Nov 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

It was certainly not a day to remember for the markets. There was fierce selling across the board, with almost all benchmark indices losing more than half a percent. Every sector ended deep in the red, as fear-based selling hit tech and auto stocks the hardest.

The Nifty, which had been holding an important support for some time, finally broke below it — a crucial point that could define its next move.

Before diving deeper, let’s take a quick look at the global backdrop. The discussions around a possible AI-driven stock market bubble continue to grow louder. Just like the dot-com bubble of 2000, some patterns seem to be repeating.

Coming to the markets, the Nifty closed down 0.64%, breaking below the crucial 25,700 support and even dipping under 25,600.

The Nifty Next 50 fell 0.45%, Midcaps were down 0.36%, and Small caps dropped 0.6%, holding close to their support at 17,300.

Other Market Triggers

The advance-decline ratio was weak with 366 declines versus just 134 advances, and the heatmap was mostly a sea of red.

Tech stocks like Infosys, TCS, and Wipro led the decline, while a few names like SBI and M&M managed to stay green.

In sectoral action, every index closed in red except MNCs and PSU banks, which remained relatively flat.

U.S. Market Update

Globally, US markets also remained weak, with the S&P 500 and NASDAQ posting mild losses as smaller stocks underperformed.

What to watch next ?

Back home, the sentiment has turned clearly negative. The headwinds are stronger than the tailwinds, and the lack of any positive news — especially around the trade war — is keeping the mood sluggish.

FIIs continued their selling spree for the fourth straight session, breaking away from the brief flat phase seen earlier.

On the positive side, NSE made an important announcement about introducing a pre-open session for the F&O segment from December 8. This move aims to improve price discovery and reduce early-session volatility, which has been a pain point for years.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

📰 The Cost of Timing the Market: A Critical Lesson in Investing 📈

🎯 The Illusion of Control: What is Market Timing?

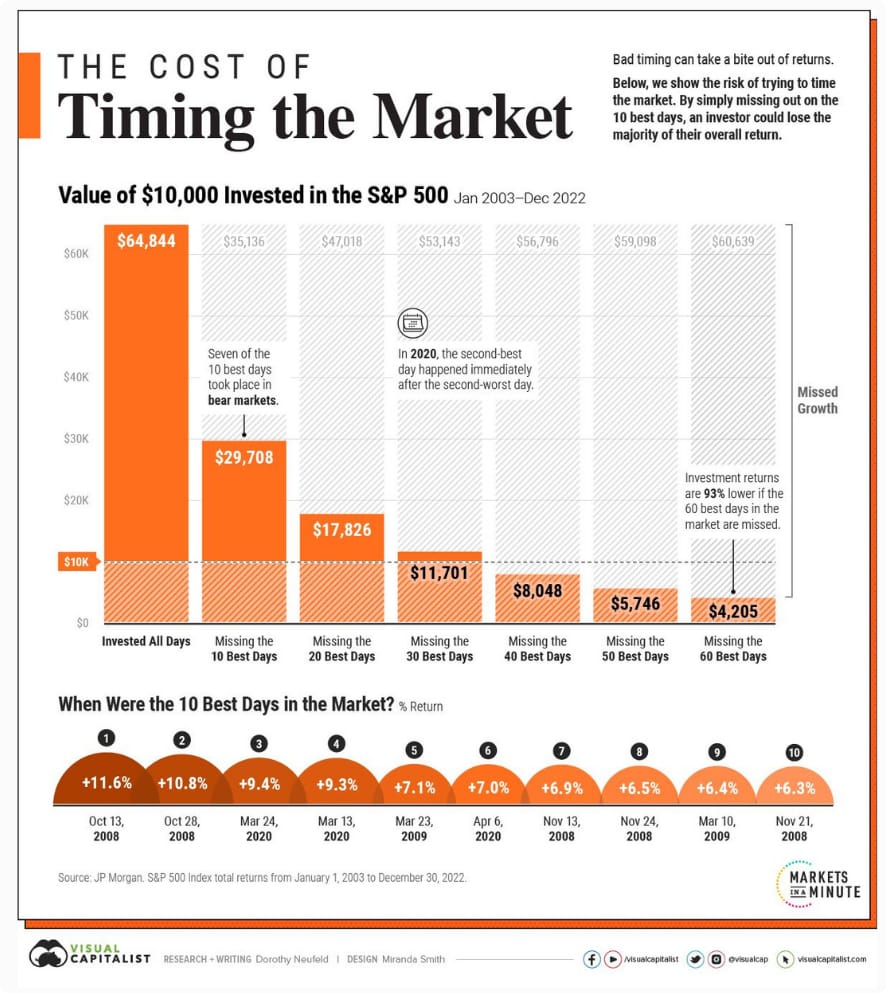

The core discussion revolves around the "Cost of Timing the Market." Market timing is the strategy of trying to predict future market price movements—attempting to "buy low" just before a rally and "sell high" just before a crash. While this sounds appealing, the data highlights a critical study that illustrates the severe financial penalty for attempting this strategy. The data, sourced from a visual graphic by "Visual Capitalist," focuses on the S&P 500 over a 20-year period (January 2003 to December 2022).

Source : Visual Capitalist on X

Key takeaway: Missing even a small number of the best performing days can erase a significant portion—or even all—of your potential gains. Missing the top 60 days resulted in the investment value being 93% lower than the fully invested benchmark.

💡 The Paradox: Best Days Follow the Worst Days

Why is it so easy to miss the best days? The transcript explains a crucial, often overlooked, phenomenon: The market's best performance days tend to occur immediately after its biggest crashes and periods of turmoil.

2008 Financial Crisis: Days with gains of $11\%$, $10.8\%$, $6.5\%$, and $6.3\%$ occurred around the sharpest market declines. An investor who sold at the bottom out of fear and stayed out for six months would have missed this crucial recovery.

COVID-19 Pandemic (March/April 2020): Significant single-day gains of $7\%$, $9\%$, $9.4\%$, and $7\%$ occurred within a three-week window following the initial crash.

An investor attempting to time the market—getting out when things look bad—is virtually guaranteed to miss the initial powerful leg of the recovery, thereby forfeiting much of the overall long-term return.

🛑 Dispelling the Myth: 'Sit on the Sidelines'

The speaker strongly criticizes the common advice often heard from media personalities: "Sit on the sideline until there is clarity."

The Problem: By the time the market offers "clarity" (i.e., certainty that the worst is over), the market has usually already rebounded significantly.

The Reality: Market clarity never truly exists. Investing involves uncertainty. If buyers and sellers had perfect clarity on future prices, the market would cease to function efficiently.

Time IN the Market Trumps Timing the Market: The most damaging action an investor can take is pulling their money out during a crash. The fear-driven exit causes a realized loss and almost guarantees the investor will miss the explosive recovery days that often follow, decimating the long-term compounding effect.

Meme Of The Day

Based on the discussion about the "Cost of Timing the Market" and missing the best recovery days, which investment approach do you primarily follow? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

1

Reply