- WeekendInvesting

- Posts

- Markets crushed ahead of Budget. Any hope of recovery.

Markets crushed ahead of Budget. Any hope of recovery.

Good, Bad & Ugly Weekly Review

Hello, Investor !

Markets Overview

The markets were completely down and out this week, and what makes this particularly striking is the timing — we are barely four trading sessions away from the Union Budget on 1st February. Sentiment remained deeply negative throughout the week, driven largely by uncertainty around geopolitics and trade narratives. Then, almost ironically, breaking news emerged on Saturday that the US Treasury Secretary has called for a potential removal of the 25% tariff on India.

As has been evident for several weeks now, markets seem to be dancing to narratives emerging from the White House, and this is yet another headline in that series. Whether this proposal actually translates into policy is uncertain, but it does give markets something to latch onto. If nothing else, it offers a possible reason for relief or a bounce when markets reopen on the 27th of January.

From a technical standpoint, the Nifty daily chart looks deeply oversold and heavily beaten down. The index lost about 2.5% over the week and has been stuck in a continuous downtrend ever since it became clear that the US trade deal was not happening in the near term.

Latest Daily Byte

This marks the end of what can only be described as a disastrous week for the markets. The Nifty continued its downward journey today, notably breaking below its 200-day Daily Moving Average (DMA). The 200 DMA is a critical psychological mark; when the market falls below this level, it often signifies that the underlying strength of the market has been broken.

In this update, the focus is on the movement of real assets like real estate, gold, and silver compared to financial assets. While financial assets are also real assets, their ease of buying and selling, combined with low transaction costs, leads to much higher volatility. This often results in investors selling during moments of despair. Taking ITC as an example—not to criticize the company, but to illustrate a point—a look at its chart in gold terms reveals a striking reality.

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

You May Also Like

How IPO Money Use Has Changed Over Time | Why Most Active Funds Fail to Beat the Market |

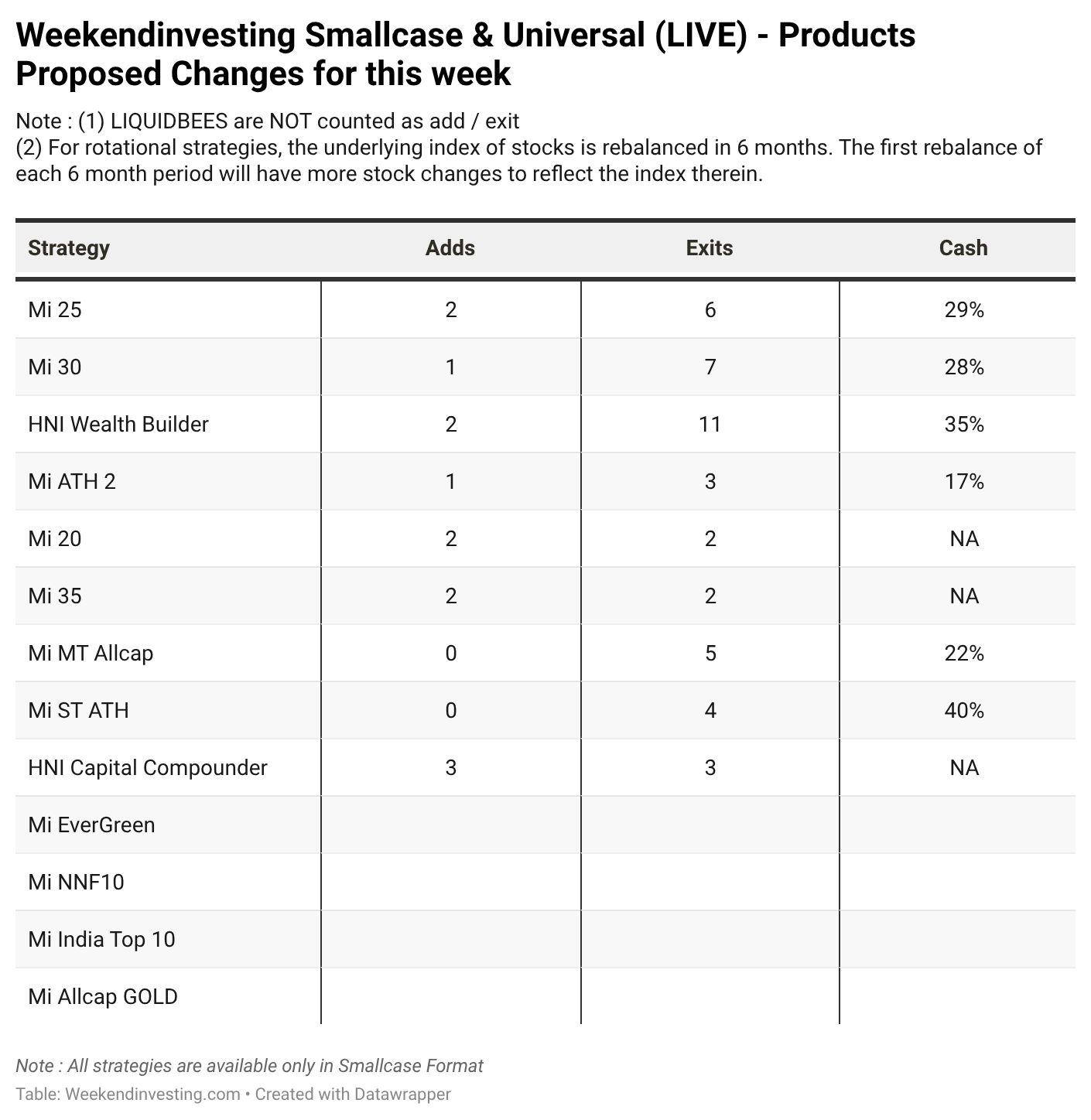

Rebalance Update for the week

Please write to [email protected] if you have any questions.

Reply