- WeekendInvesting

- Posts

- New Post

New Post

The Good, Bad & Ugly Weekly Review

Edition : 03 May 2024

Markets Overview

Throughout the week, there was a notable sense of optimism in the Nifty, particularly during the first half. However, this sentiment took a sharp turn on Friday, as the market experienced a sudden and significant downturn. Within a mere four hours, all the gains amassed throughout the week were wiped out. This drastic shift was primarily attributed to a rumor circulating on several platforms regarding potential changes to the capital gains tax in the forthcoming budget. Speculation suggested that the government might equalize the capital gains rate across all assets. Yet, this narrative was swiftly challenged when the finance minister took to Twitter late in the day, dismissing the rumor as pure speculation. Now, with uncertainty looming, the market finds itself at a crossroads, grappling with whether to treat the rumor as reality or heed the finance minister’s words. Amidst this ambiguity, the Nifty’s stability appears increasingly precarious.

A potential head and shoulders pattern below the 22,400 mark could prompt a correction toward 22,000, though confidence in the finance minister’s dismissal of such speculation may lead to a swift recovery. With an upcoming event less than a month away, market movement might be anticipated, though a significant decline seems unlikely. Despite personal speculation favoring a sharp market uptick, recent trends haven’t confirmed this outlook. Overall, there’s a sense of stability, highlighted by the Nifty’s impressive 25% gain over the past year, with attention now turning to whether stocks can match this growth with solid results.

Benchmark Indices & WeekendInvesting Strategies Overview

The Nifty Next 50 index stands out significantly in terms of benchmark performances with a solid 2.6% this week and an impressive 8.5% in the FY25. Remarkably, it now closely rivals mid and small-cap indices for the same fiscal year. Despite being classified as a large-cap index, the Nifty Next 50 is demonstrating behavior akin to a small-cap index, which is quite extraordinary. In contrast, other indices like the Nifty 50, CNX 200, and CNX 500 saw more modest increases of 0.3%, 0.6%, and 0.6% respectively.

Mi NNF 10 gained 4.5% this week, reaching a total increase of 11% in FY25. HNI Capital Compounder and Mi India Top 10 saw gains of 2.2% and 2.3% respectively this week outperforming their respective benchmarks. Mi Evergreen also performed well, with a 1.5% increase this week and an 8.7% increase for FY25. However, some strategies experienced losses, with Mi ATH 2, Mi MT Allcap, and Mi ST ATH losing 1%, 1.4%, and 2% respectively.

Sectoral Overview

The PSE sector has emerged as a dominant force in the markets, experiencing a remarkable surge of 12.6% in just over a month. PSU Banks also posted a strong performance this week, gaining 2%. Following suit, Autos, Energy, and Commodity stocks witnessed positive movements. However, the IT sector continues to struggle, recording a loss of 2.3% this week and a cumulative decline of 5.7% over the last month. Despite a slightly weaker week, Real Estate remains in positive territory, with a 6.9% increase in FY25. Similarly, metals also saw gains, up by 12.3% overall in FY25, with a 0.6% increase for the week.

Across all timeframes, autos, metals, PSU banks, and public sector enterprise stocks have maintained their position as the top-performing sectors. However, real estate is currently experiencing a slight decline, while energy stocks have also seen a dip in performance over the past two weeks. Additionally, gold has notably suffered significant losses recently, while infrastructure is also facing downward pressure. Despite these fluctuations, PSU banks, public sector enterprises, and autos continue to lead the market.

Rebalance Update for the week !

Spotlight - How GOLD would’ve saved Japanese Investors

The stock market can be a powerful tool for wealth creation, but history teaches us that even strong markets can experience long periods of stagnation. Look at Japan’s Nikkei 225 index. After a phenomenal 40 years of 14% average annual growth, it took 34 years for the index to even reach its previous peak again. This is a stark reminder that past performance doesn’t guarantee future results.

This is where gold shines. While the Japanese stock market remained flat, gold prices rose steadily. In fact, since the US dollar went off the gold standard in 1971, gold has outperformed Japanese equities, even considering Japan’s impressive earlier equity growth.

Why Gold?

Stability: Unlike stocks, gold has a long history of holding its value during economic downturns. This stability can act as a hedge against volatile markets, protecting your overall portfolio.

Diversification: Owning gold alongside stocks diversifies your holdings. When stocks fall, gold can potentially offset some of those losses.

Inflation Protection: Gold tends to hold its value against inflation, making it a valuable asset when the purchasing power of cash declines.

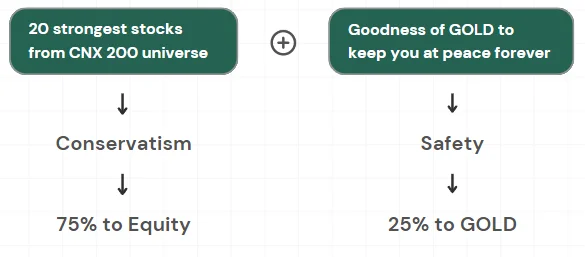

That’s why we created Mi Evergreen, a strategy that combines the power of equity along with the stability of gold.

Mi Evergreen selects 20 of the strongest and most liquid stocks from the CNX 200. We then combine these stocks with a gold ETF, creating a 75/25 portfolio (75% stocks, 25% gold). This portfolio is rebalanced monthly to maintain this allocation.

Use code GOLDRUSH to avail a flat 20% discount on your subscription to Mi EverGreen.

Valid till 07 May 2024 (Tuesday)

The WeekendInvesting App

The Weekendinvesting App is a one stop solution for everything about Weekendinvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, performance metrics, momentum watchlists, discounts and many other exciting things. This app acts as a medium for us to provide direct support and resolve your queries.

Please write to [email protected] if you have any questions.

Reply