- WeekendInvesting

- Posts

- New Post

New Post

Edition : 29 Nov 2024

Hello, Investor !

Markets Overview

This week, Nifty started with a strong performance, opening with a significant gap-up and maintaining that level for three days, boosted by the political strength that emerged from the Maharashtra elections. However, on the expiry day, market dynamics changed as some games were being played, and the market dipped, closing the gap. By Friday, there was a pullback towards 24,123, resulting in an overall 0.9% gain for the week, indicating no major losses.

The market has been consolidating for the past month, remaining mostly stable from the start to the end of November. Despite a sharp decline from late September to mid-November that even breached the 200 DMA, the market rebounded following the election results. Currently, the market is in a middle ground—while not entirely out of risk, the situation has improved. A significant reduction in downside risk would occur if the market crosses 24,500. For now, as long as the market stays above the 200 DMA and recent lows, it remains in a range, which is a better position compared to last week.

On a weekly basis, most of the last 8-10 weeks have seen downward trends, with only a few weeks of upward movement, including the gap-up week. It remains uncertain whether the market will now move towards its highs or consolidate in its current range. The next major support levels are the recent bottom and the election day low, which serve as reference points for worst-case scenarios. On the upside, the best-case scenario would be reaching a new all-time high in the coming months.

S&P 500 Overview

Globally, markets are performing well, with the S&P 500 hitting a new all-time high of over 6,000. There are high expectations surrounding the new US president, particularly regarding fiscal deficit management and efforts to boost domestic manufacturing through tariffs on other countries. However, if tariffs are imposed aggressively and the US dollar strengthens further, it could negatively impact global markets.

GOLD Overview

Gold has been relatively stable this week, with a 2.2% decline. After peaking at around 8,000 INR and dropping to 7,300, gold bounced back to 7,800 and now sits at 7,600. The chart doesn't appear weak, and gold may be consolidating before another upward move. The good news for emerging markets and precious metals is that the dollar index has started to weaken after strengthening since September, which coincided with Nifty's decline. Now, as the dollar loses strength, Nifty is finding some stability.

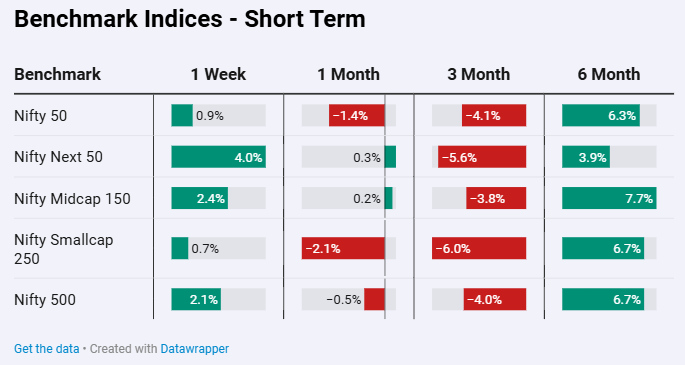

Benchmark Indices Overview

In terms of benchmark indices, Nifty was up 0.9% for the week, with Nifty Next 50 surging 4%, largely due to Adani stocks. The Nifty Midcap index rose by 2.4%, showing healthy growth, while Smallcaps remained subdued at 0.7%, and Nifty 500 increased by 2.1%. Over the past month, Nifty Next 50 and Nifty Midcap have performed well, but other indices are still down. In the last three months, all indices are down, with Nifty falling by 4% and Nifty Next 50 down by 5.6%. However, over six months, all indices are comfortably in the green, highlighting a three-month period of decline.

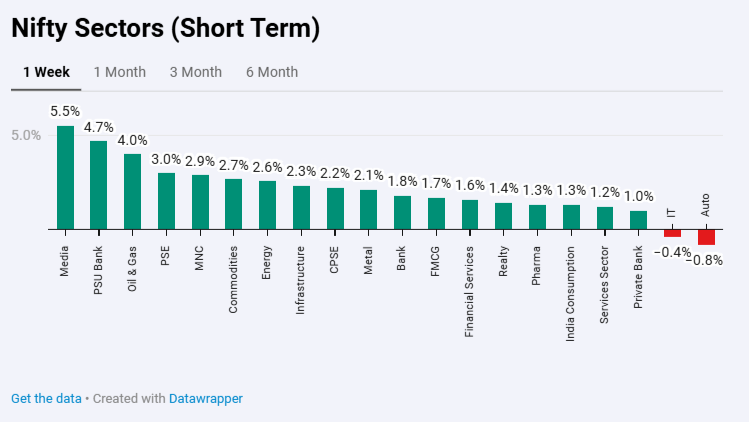

Sectoral Overview

In terms of sector performance this week, media stocks rose sharply, and PSU banks were up 4.7%. Oil and gas stocks climbed 4%, and public sector enterprise stocks performed well. Commodities gained 2.7%, while energy was up 2.6%. However, IT and auto stocks were the laggards, losing ground this week, and private banks showed only modest growth at 1%.

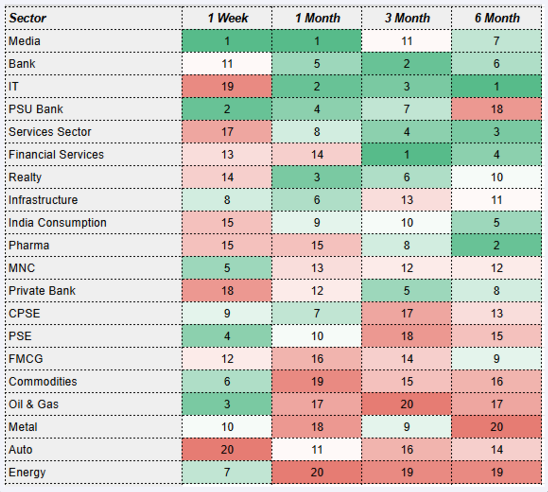

Over the past month, energy, commodities, metals, and oil and gas sectors have lost significant ground, while media, IT, and real estate sectors have done well. PSU banks managed a modest 0.8% gain. In the last quarter, financial services, banks, and IT sectors are in the green, while oil and gas, energy, and public sector stocks have experienced significant losses. Over six months, most sectors have seen positive performance, with metals, energy, and PSU banks underperforming. However, the overall declines have been less than 10%, while some sectors have made impressive gains.

In terms of short-term momentum, media, banks, IT, and PSU banks remain at the top, although IT stocks suffered a significant loss this week. It's unclear if this will lead to a more sustained downtrend. Over the past six, three, and one-month periods, IT has performed well. Autos, energy, and metals are currently at the bottom of the pack but are attempting to make a comeback. Public sector enterprises are also showing signs of recovery, indicating that these sectors may gradually move up in the longer term.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply