- WeekendInvesting

- Posts

- Our Domestic Investors Are Changing the Market Story

Our Domestic Investors Are Changing the Market Story

Its The Decadal Shift

Market Update - Thursday, 05 Feb

Two days after the so-called US-India deal, it has been announced that there is still work happening on the deal. It is likely that some parts of it will get closed in the next four or five days. So nothing is certain, no fine print is known, and the market also was not so happy on this news. The jump that the market did two days back has almost been half given away.

On a more wider basis, India is looking to close deals with many countries, and that is a good thing to have FTAs with more countries and have a proper runway for exporters and importers to do their business.

A tweet from Bull Theory highlights an absolute bloodbath in the markets in the last 24 hours. Gold dumped 5.5% wiping 1.9 trillion dollars, while silver dumped 19% wiping almost a trillion dollars. The S&P 500 dumped a percent with 580 billion gone, the NASDAQ saw 2.51 trillion gone, and the Russell 2000 was down 2% with 65 billion gone. Bitcoin dumped 8% for a loss of 120 billion, and total other crypto lost 184 billion. About 5 trillion dollars have been wiped out in the last 24 hours.

On the charts, the market shows an inside candle, which occurs when the top and bottom of the current range stays within the range of the previous session. This indicates an undecided or indecisive day where there is no clear direction. Overall, the short term and long term remain positive.

Nifty and Nifty Junior both lost half a percent, but trends remain positive there.

Mid caps lost 0.3% and small caps lost 1%, but none of these charts came down to fill the gap, which suggests strength in the market as it looks for more cues to go up.

Nifty Bank stayed at -0.29%.

Gold dumped 2% today and silver was down 11.2%. Comparing the two, silver is already at the lows of the pre-first day's crash, whereas gold is much higher.

A divergence is happening where silver has had many speculators get onto the bandwagon and needs consolidation, while gold has deep buyers available to ensure a shallow fall.

Other Market Triggers

The heat map is predominantly red. The Next 50 heat map showed big falls in metal stocks like Zinc and Vedanta, and PSU stocks like HAL and Gas Authority Limited. Bank of India is not yet falling off, so many oil stocks are gradually inching up.

The mover of the day was Westlife, up 12.2%, as QSR stocks like Westlife, Jubilant, Devyani, and Sapphire have all been in demand and rallying.

Sectoral trends were mixed, with minor gains in tourism and PSU banks, but bigger losses in defense, which was down 2%. Capital markets fell 1.3% and metals were down 1%.

U.S. Market Updates

In the US markets, there were big falls in AMD at 17%, Palantir at 11.6%, and Oracle at 5%. Lockheed and Broadcom were down about 4% and the Nasdaq was down 1.6%.

Over the last 12 months, the Nasdaq is still up 14.3%, with the recent fall being only 3% over the last month. Some of these stocks could be part of the Weekend Investing U.S. stock strategy, though these are not recommendations.

The US heat map is red, with semiconductor and chip stocks giving up gains. Even with fantastic results, Google was down 2%, Tesla fell 4%, and Meta and Amazon were also down.

What to watch next ?

There is a common thought lately asking if the gold rally is done and if investors should exit after gold went from 2,000 to 5,000. If gold was taken as a trade, a 150% gain in a couple of years is welcome, but gold should be looked at as insurance for a portfolio rather than just a trade.

Even if there are zero returns in gold for the next two years, an allocation should remain in each portfolio. If a 1% scenario plays out where the world becomes even wilder, this hedge and insurance will really come into play.

Do not look at gold for returns; look at it for safety. Gold is an allocation, not just a trade. If an allocation has shifted—for example, from 80% equity and 20% gold to 65/35 because gold doubled—it can be rebalanced back to 80/20, but one should not get out of it entirely.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

For more details about Category 3 AIFs, fill in the interest form below

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📈 The Great Flip: Domestic Might vs. Foreign Flight

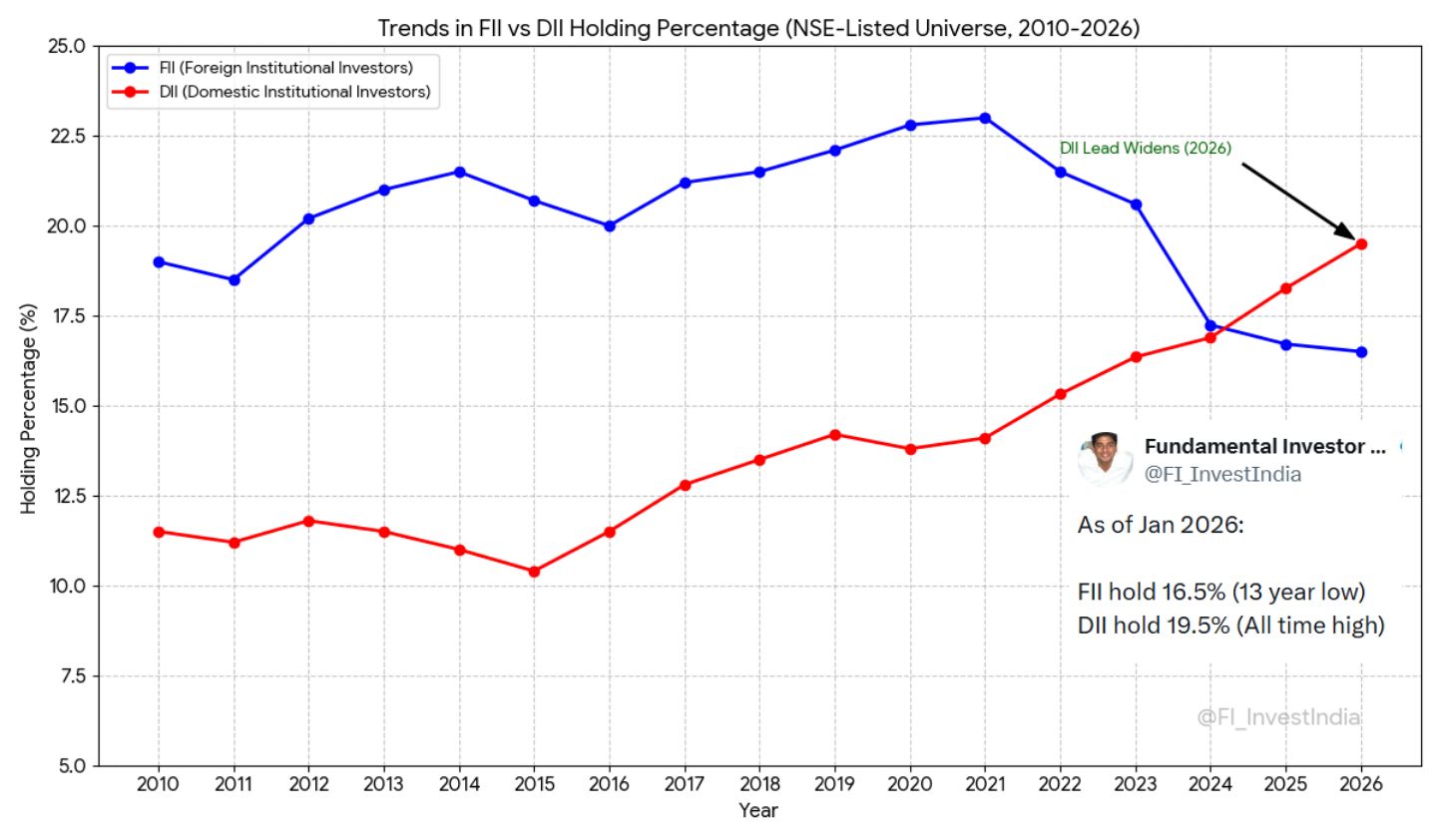

For decades, the Indian stock market danced to the tunes of Foreign Institutional Investors (FIIs). If they pulled out, the market tumbled. But as of January 2026, the script has officially flipped. Data presented by Fundamental Investor reveals a dramatic structural shift in who really owns the Indian market.

Source : FI_InvestIndia on X

The Decadal Shift

In the previous decade, FIIs were the undisputed heavyweights, consistently holding 20–21% of the market share. Meanwhile, Domestic Institutional Investors (DIIs) hovered quietly in the 11–12% range.

That gap has now closed—and reversed. Post-2021, the trend shifted aggressively:

FII Holding: Slipped from 21% down to 16.5%.

DII Holding: Surged from 15% to a dominant 19.5%.

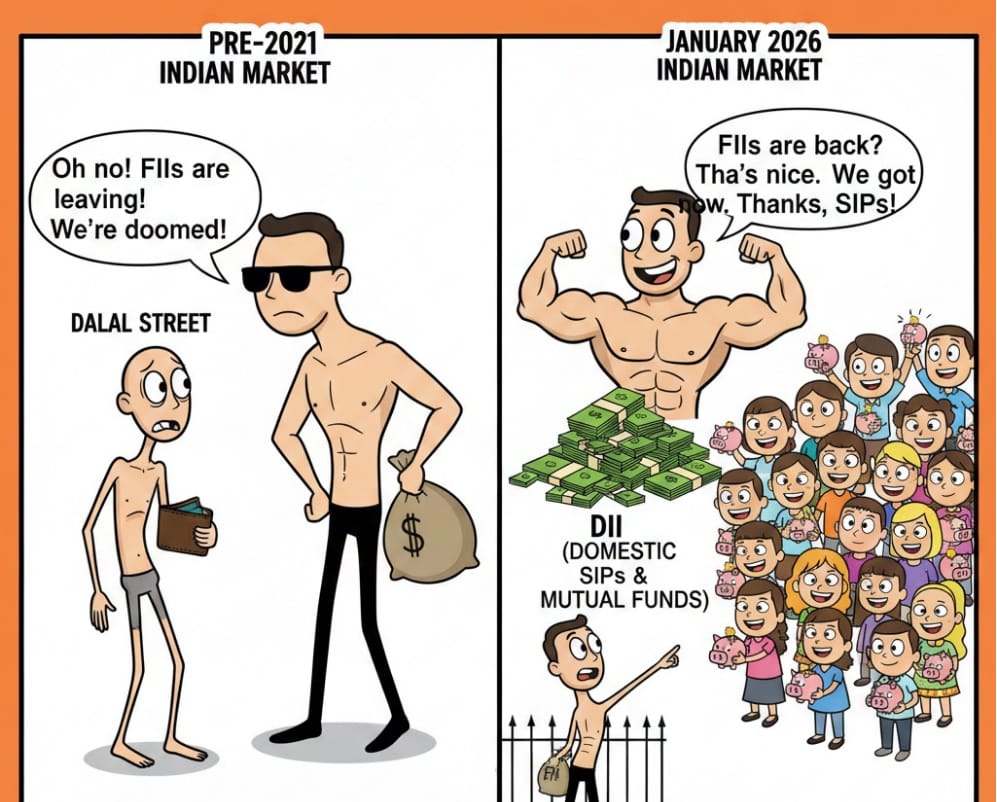

The "SIP Shield"

Why is this happening? The answer lies in the unstoppable momentum of domestic equity flows. The habit of disciplined investing through Systematic Investment Plans (SIPs) has created a "floor" for the market. Even when global sentiments turn sour and foreign funds exit, the steady stream of domestic capital acts as a cushion, preventing the free-falls we used to see a decade ago.

The "Double Engine" Bull Case

The most exciting part isn't just that domestic investors are leading; it’s what happens next. If the US Dollar weakens or global allocation toward emerging markets increases, FIIs will eventually have to come back in a big way to catch up.

When that happens, we won't just have one engine running. We will have:

Engine 1: The relentless, non-stop flow of Domestic SIPs.

Engine 2: The massive re-entry of Foreign Capital.

This "Double Engine" effect has the potential to ignite one of the most powerful bull markets we’ve ever witnessed.

Meme Of The Day

What do you think will be the biggest driver for the next major Bull Run? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply