- WeekendInvesting

- Posts

- Precious Metals Under Pressure

Precious Metals Under Pressure

The Gold-Porsche Paradox

Tuesday, 28 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

Today was the expiry day on NSE, and the markets stayed very range-bound throughout the day. There wasn’t much movement on the external front either. The news that Trump and Xi are going to meet soon has created a bit of risk-off sentiment, with precious metals coming down.

The big announcement today was that the government plans to allow FDI into PSU banks.

Looking at the Nifty chart, it was an absolute Doji day. A Doji is when the open and close prices for the day are almost the same.

Nifty Junior was down half a percent and hasn’t moved much in the last eight sessions. Midcaps were flat at -0.01%, small caps up 0.09%.

Nifty Bank managed a small gain of 0.17%.

Gold continued to slide, now at ₹57,400 for 10 grams, which seems like a reasonable level to start nibbling if you believe in the long-term story.

Silver also dropped by 1.93%, now at ₹73,800 by calculated value, but still not available below ₹160 in the physical markets.

Other Market Triggers

Tata Steel, JSW Steel, State Bank of India, Kotak Bank, and SBI Life were slightly positive. Among PSU banks, PNB, Bank of Baroda, and Canara Bank did quite well.

Naukri and ICICI General Insurance were also among the gainers.

On the losing side were Adani Enterprises, Hindustan Zinc, TVS Motors, and Siemens.

The mover of the day was TTK Prestige, which surprised everyone with strong Q2 results. The stock jumped 10.7% and hit a new high.

U.S. Market Update

Globally, US markets were remarkable again. Nasdaq rose 1.8% in the previous session and is up 5% in the last month, and a massive 27% over the last year. These are stunning gains considering how many experts have been predicting a fall for months. But the market continues to stay strong.

S&P 500 and Dow Jones are also doing well. Qualcomm gained 11% in a single day, Tesla rose 4%, and Alphabet was up around 3.6%.

What to watch next ?

Many people are seeing the upcoming meeting between Trump and Xi, as the start of a new tariff equation, but I think it’s best to wait and see how it unfolds. It’s one day at a time on that front.

Today, in Nifty, we opened at 25,939 and closed at 25,936. This means there was no real body on the candlestick, which is called a Doji candle. It usually shows that the market is indecisive—it doesn’t know whether to go up or down. This could indicate a consolidation phase, a range-bound movement, or possibly the end of the current uptrend. We’ll know more in the coming days about what this Doji really means.

Central banks are playing an active role in buying gold, and that won’t stop anytime soon. Every time gold dips, they come in as big buyers. So don’t get trapped into thinking gold is finished for good. It might just be resting before another move up.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

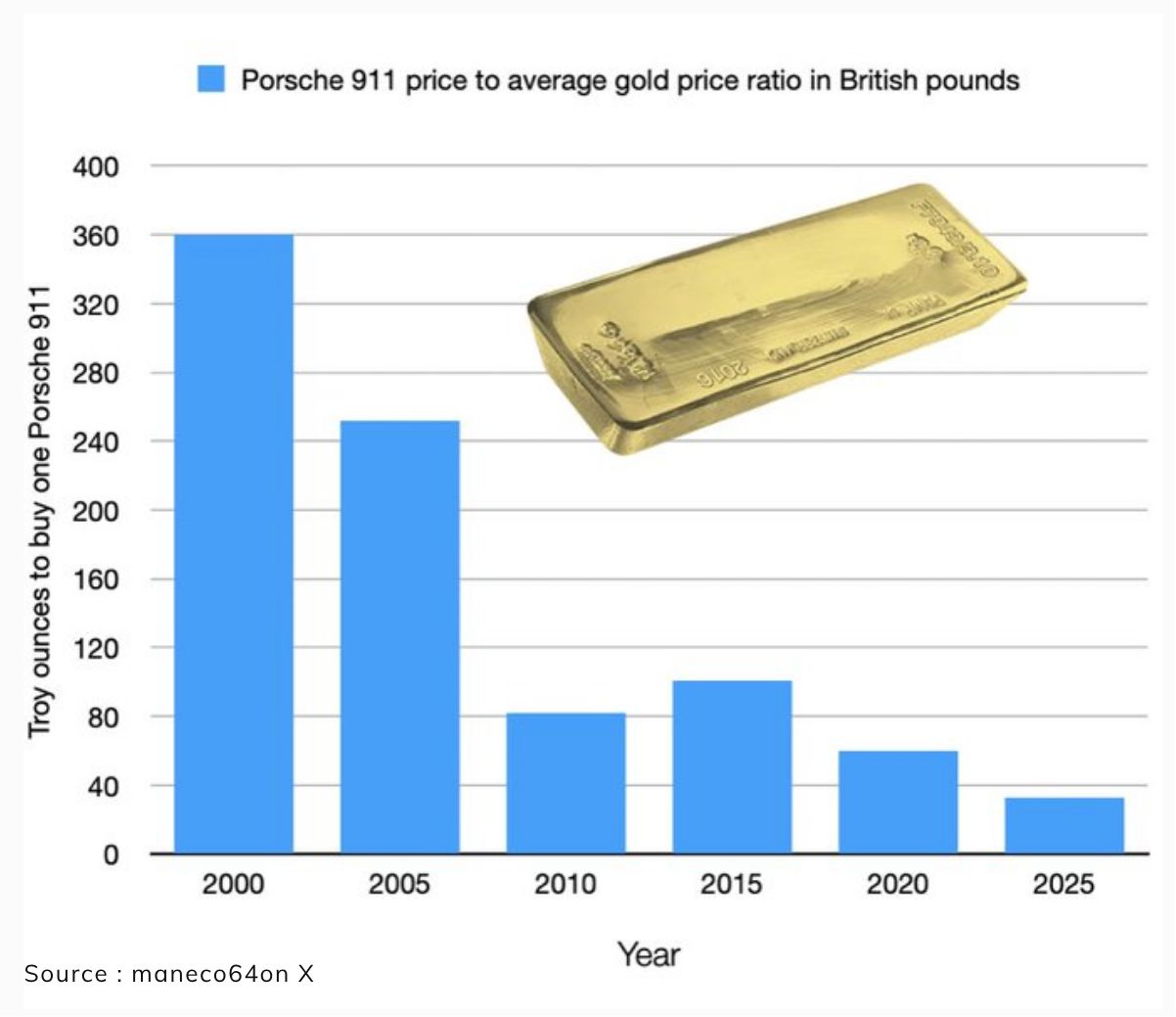

The Gold-Porsche Paradox: A Clear Case for Wealth Preservation

This analysis, sourced from Monaco 64 on X, presents a compelling illustration of gold's role as a supreme store of value over the past quarter-century. By comparing the cost of a luxury consumption item—the iconic Porsche 911—against the price of physical gold (in pounds), the data reveals a profound shift in purchasing power that investors should heed.

The Astonishing 25-Year Ratio Shift

The core data shows a dramatic reduction in the amount of gold required to purchase one of the world's most desired sports cars. This is not simply about fluctuating prices; it is a stunning demonstration of a scarcity asset consistently outperforming a high-end manufactured good.

Year 2000: It took 360 troy ounces of gold to purchase one Porsche 911.

Year 2005: The cost fell to 250 troy ounces.

Year 2025 (Projected/Current): The requirement is reduced to less than 40 troy ounces of gold to acquire the same vehicle.

Pointers:

This represents an almost 9-fold increase in the purchasing power of gold relative to the Porsche 911.

The speaker notes that 40 ounces of gold held in the year 2000 (which was only one-ninth the price of the car then) can now buy the entire car.

Driving Forces Behind the Divergence

Why has this ratio shifted so drastically? The answer lies in the contrasting economics of production and scarcity. The narrative highlights two primary drivers:

Technological Advances & Industrial Efficiency (The Porsche Side): Due to innovation and improvements in manufacturing, the real-term cost of the Porsche 911 has been contained. The asset inflation for complex consumption items has not kept pace with overall monetary inflation, making the car relatively cheaper over time.

Scarcity and Recognition (The Gold Side): Gold's price has soared, far outpacing reported inflation. Its value is driven by its scarcity and, crucially, its global recognition as a store of value.

The Crisis Hedge: Why Gold is Different

The speaker emphasizes that gold acts as a fundamental hedge against monetary instability. In periods where governments engage in expansive fiscal policy—such as printing money and expanding balance sheets—investors naturally return to assets that cannot be created out of thin air.

The Fiat Money Dilemma: Any asset that "can be printed out of thin air will never hold value."

The Gold Advantage: Because the metal is scarce, its value preserves its purchasing power in turbulent times. It offers a refuge from inflation and currency debasement.

A Focus on Preservation: The 50+ Mandate

The final takeaway is directed toward a specific demographic: those approximately 50 and older. At this stage, the investment focus often shifts from aggressive growth (taking higher and higher risk) to prudent preservation of accumulated wealth.

Meme Of The Day

Which factor do you believe is the primary reason for gold’s massive outperformance against a consumption asset like the Porsche 911 since the year 2000? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

1

Reply