- WeekendInvesting

- Posts

- Rally or Consolidation Ahead for Markets

Rally or Consolidation Ahead for Markets

Good, Bad & Ugly Weekly Review : Week ending 31 Oct 2025

Edition : 31 Oct 2025

Hello, Investor !

Markets Overview

The market logged a mildly negative week, with the Nifty 50 slipping by roughly a quarter percent. The encouraging bit was beneath the headline index: breadth improved. Nifty Next 50, Midcap, and Smallcap gauges all managed gains of half a percent or more, suggesting participation broadened beyond the usual mega-caps. That’s healthier market anatomy than what we’ve seen in the U.S., where a handful of giants have been steering index-level returns even as broader breadth has lagged. Several cross-currents shaped sentiment: steady chatter that Indo–US trade negotiations are progressing, a fresh Fed cut paired with guidance of no further cuts in 2025, a firmer dollar, buzz around Bank Nifty’s reweighting cap and potential additions, and noisy rumors about changing the F&O expiry cadence. Add mixed earnings and the still-watchful stance on FII flows and you have a market that’s constructive under the hood but cautious at the surface.

On balance, the Indo–US deal talk is a near-term tailwind if it turns into anything concrete. The caveat is durability—global trade truces have a habit of being short, jagged, and conditional. Staying nimble and aligned with relative strength remains the right operating principle. The Fed’s latest move adds another wrinkle: a cut now, but no more through 2025, effectively guides to a shallow easing path. Pair that with a strengthening dollar and the message to risk assets is “supportive, not exuberant.” Meanwhile, the Bank Nifty reweighting headline—20% cap per stock, top three capped at 45%, plus likely inclusions—could trigger passive flows, trimming some heavyweights and seeding others, and that rotation noise will show up in index funds and ETF adjustments. The expiry-rumor burst and subsequent clarification whipsawed capital-market stocks midweek. Through it all, DIIs have remained constructive while FIIs, after a sharp one-day buy of ~₹10k crore late last month, have mostly flattened their 30-day trend. If FII flows flip even modestly positive alongside DII support, the index is close enough to its highs that momentum could reassert quickly.

On the daily Nifty chart, the index eased 0.28%, but the key development is tactical: the old ceiling near 25,700 has been retested as a floor. Friday’s 0.6% dip keeps the level in play, yet price holds above the 20-DMA and 100-DMA, with the shorter average convincingly above the longer—clean, bullish alignment. If the macro cues cooperate—trade headlines leaning positive, steadier earnings, less index-rule noise—the setup favors another push higher in the short term.

Latest Daily Byte

Markets have been nervous lately. After the recent fall, they seem to be looking for support. Whether the current level will hold or we go back to previous highs or averages, we’ll know next week. A few days ago, it seemed like the India-US deal was close, but that narrative quickly faded. The Fed’s statement that there will likely be no rate cuts in December also disappointed investors.

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

You May Also Like

Central Banks Are Quietly Building a Golden Future | India’s Rising Smartphone Exports to the US: A Silent Revolution |

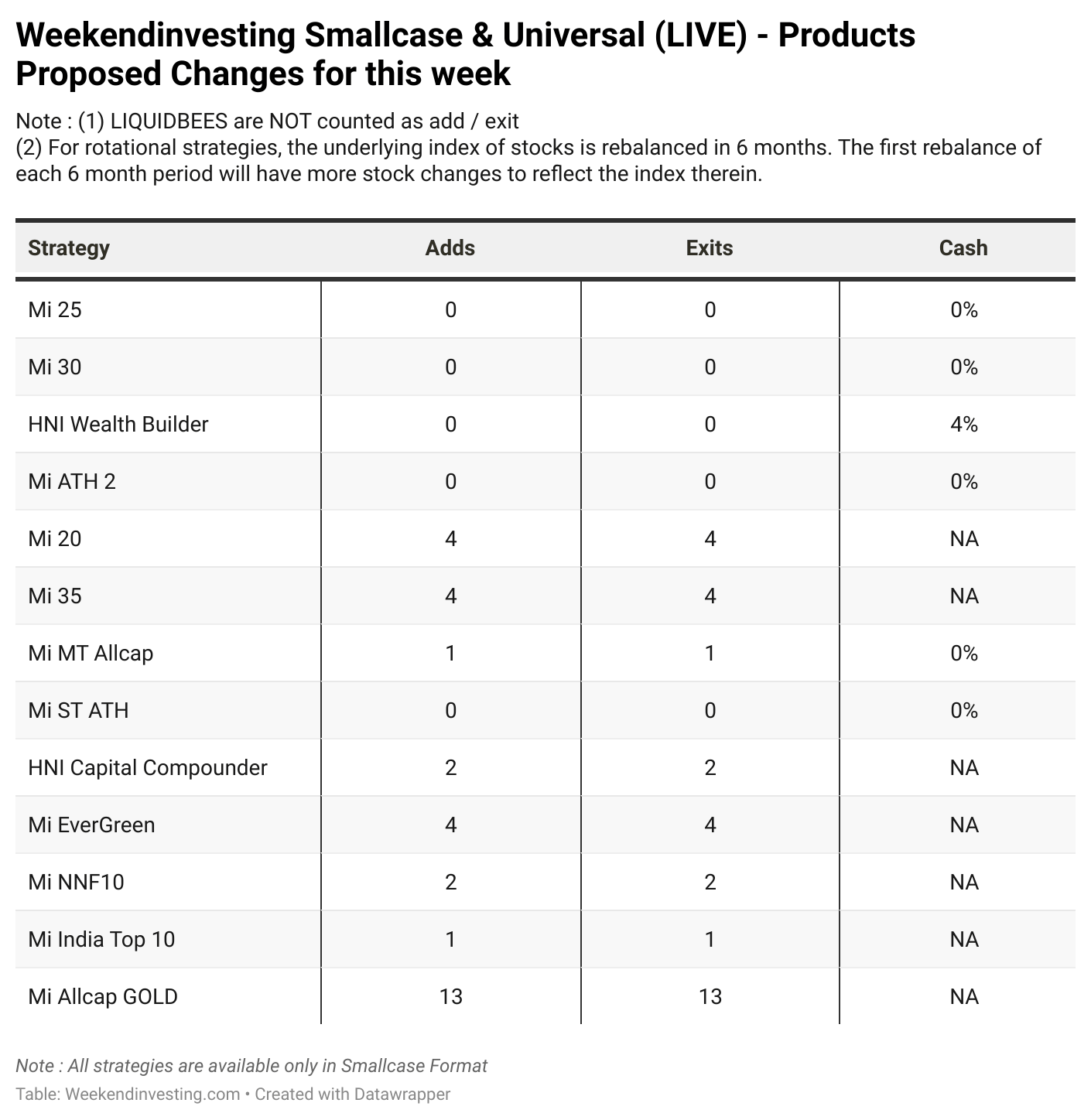

Rebalance Update for the week

Please write to [email protected] if you have any questions.

Reply