- WeekendInvesting

- Posts

- Record High - India's Market Cap to GDP

Record High - India's Market Cap to GDP

What it Means For You

Monday, 06 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The week started on a very strong note with all Asian markets showing good momentum, led by Japan. Japan is in the spotlight as it sees a new lady Prime Minister taking charge, who has very bold and radical ideas compared to the previous government. She plans to follow a dovish and expansionary fiscal policy.

Because of this, Japanese markets are rallying, and the yen is weakening against the dollar. This sudden change seems to be having a positive effect across Asia. There is a growing belief that Japanese investments may rise in the region, and India could be one of the major beneficiaries.

The Nifty closed at 25,077, up 0.74%, showing a very healthy short-term trend.

The Nifty Junior index was up 0.34%, while midcaps rose by 0.7%, showing good strength. Small caps, however, stayed flat at just 0.09% up. So today’s rally was mainly led by large and midcap stocks.

Bank Nifty also broke a key resistance level and moved higher, forming an inverted head and shoulders pattern on the charts, suggesting the possibility of another 2,000-point upside from here.

Gold continues to remain in a strong bullish grip, now at ₹11,923 per gram, rising from ₹9,900 in just over five weeks. It’s been a relentless run, though such sharp moves could also signal a possible short-term top forming around $4,000 on the international gold chart.

Other Market Triggers

Banking and finance stocks rebounded strongly.

Reliance was up nearly 1%, though FMCG stocks saw some profit booking. Among notable movers, Adani Power, IOC, LTIM, Naukri, Solar, TVS Motors, and Chola Finance performed well, while Dmart and Siemens Energy saw some weakness after results.

Chola Finance rose 4%, becoming one of the top gainers, while Fortis Healthcare jumped 7.5% as the government raised CGHS treatment rates for central government employees, which could significantly boost hospital revenues.

In the Nifty Next 50 space, Nykaa rose 6.5% after a strong Q2 update, hitting a record high.

U.S. Market Update

In the U.S., markets stayed mostly flat overnight. The S&P 500 was unchanged, Dow Jones gained 0.5%, and NASDAQ 100 fell 0.28%. Despite this, over the past 12 months, the S&P 500 is up 17%, and NASDAQ has gained 25.6%, showing how strong the American markets have been.

Stocks like Charter Communications, Thermo Fisher, Eli Lilly, Nextera, and Medtronic were among the top performers. For investors interested in the U.S. market, Weekend Investing also runs a portfolio on the Vested platform.

What to watch next ?

The yen carry trade, which was almost fading away, seems to have found new life again. If Japan continues to keep its yields low, this carry trade could further prosper.

Japanese equity markets and gold-dollar markets were shooting up early in the morning, and there doesn’t seem to be any other reason behind this sudden surge.

Back home, the Indian markets are once again above 25,000 on the Nifty.

The charts suggest that the index might be breaking out of a base pattern, indicating a possible continuation of the rally. For the third day in a row, the market has seen a strong pullback.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

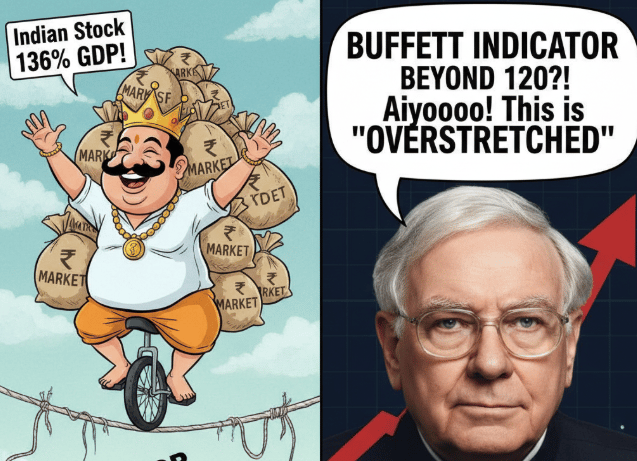

📈 The Buffett Indicator Flashes Red: Analyzing India's All-Time High Market Cap to GDP Ratio

New data from Old Bridge Asset Management highlights a significant development in the Indian market: the Market Cap to GDP percentage is at an all-time high of 136%.

Source : @datta_arvind on X

This means the total market capitalization of all listed stocks in India is 136% of the country's Gross Domestic Product.

The Benchmark: This ratio is often referred to as the Buffett Indicator, a widely-watched valuation tool. Historically, a figure below 100% is considered comfortable.

The Overstretch: The general consensus is that a ratio beyond 120% to 130% signals that markets are becoming severely overstretched or significantly overvalued.

Global Context: While India is high, other major economies are even more elevated. The United States, for example, reportedly stands at an astonishing 210%.

Debt: The Engine Driving Asset Inflation

The primary force behind this divergence—market cap rising while GDP does not keep pace—is the global phenomenon of unlimited debt. The increasing debt load injects liquidity and capital into the system, inevitably causing a rise in asset prices, including the market capitalization of stocks.

This trend is part of a larger, systemic "race" between nations. The goal is to make their currencies cheaper through debt, thereby boosting their exports and making them more competitive internationally. The immediate costs of this debt accumulation are often ignored, leading to a precarious situation where future obligations are mounting. While raising long-term money (20 or 30-year debt) can "kick the can down the road," the fundamental rule remains: there is no free lunch.

The Unsustainable Path: Crisis or Restructuring

The current economic structure, driven by ever-increasing debt, is explicitly deemed unsustainable. The money borrowed today must eventually be repaid, and this realization points to two possible outcomes in the coming decades:

Debt Default/Restructuring: Countries may be forced to default on their obligations or attempt to restructure the debt. Restructuring, however, requires the agreement of lenders, which is a major hurdle.

Financial Market Crisis: The system’s structural issues could result in a severe, sudden crash in financial markets, recalibrating valuations violently.

The flight to perceived safety assets is already evident, with gold running up very hard. This fuels speculation about a potential monetary restructuring, possibly involving a partial gold-backed currency system, though the precise details of any future reform remain unknown.

🔑 Key Learning

The all-time high Market Cap to GDP ratio (Buffett Indicator) in India and other nations is a clear signal that asset valuations are being driven by systemic debt expansion rather than proportionate real economic growth (GDP), suggesting the current trajectory is fundamentally unsustainable and poses a significant risk of future financial or monetary crisis.

Meme Of The Day

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply