- WeekendInvesting

- Posts

- Rupee Falls to Record Low

Rupee Falls to Record Low

US Tech Giants > Entire Countries?

Friday, 21 Nov 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The last 24 to 48 hours have been marked by significant flux in global markets. One major factor is the tech meltdown following Nvidia's results.

The other is the issue of Japanese yields going through the roof. Japan's planned large stimulus is causing tremors globally because of the carry trade—where people borrow cheaply in Japanese yen and invest overseas for better yield. If the interest rates or yields within the Japanese economy start to rise, a large portion of this carry trade will need to reverse, causing pressure across asset classes.

In India, the India VIX is sharply up, and the rupee has crashed. Fortunately, the stock market has remained reasonably stable for the day, even though we are at the end of the week.

The Nifty saw a mild drop of 0.47%.

Nifty Junior was down 1.29%, Midcaps were down 1.14%, and Small caps fell by 1.24%.

The Bank Nifty is also down 0.81% but is still within its uptrend mode.

The India VIX is dramatically up by 12% today. This, along with the movement in USD/INR, demonstrates the Bhaav Bhagwan Che (BBC) principle, which states that price moves ahead of the news.

Gold is tentative, up 0.22%, while Silver is sharply down 2.21%, showing mixed signals between the two precious metals.

The Bitcoin and the entire crypto world are truly unraveling, with Bitcoin down 5.17% today, having lost approximately 34% in less than six weeks.

Other Market Triggers

The Nifty Heat Map was overwhelmingly red, with only a few stocks like Indigo, Asian Paints, Maruti, Mahindra & Mahindra, and ITC showing minimal gains. Significant losses were seen in IT, banking and finance, steel, metal, infrastructure, and defense stocks.

The Nifty Next 50 was a completely red picture, with virtually no green visible, and stocks that were previously holding up well, such as Hindustan Zinc, HAL, and Vedanta, also took a beating.

The Mover of the Day was Karnataka Bank, which moved up almost 8%. Its strong performance, combined with the fact that it hadn't hit new highs while the overall bank index had, made this a notable positive move.

U.S. Market Update

The US market in the previous session was completely smashed: S&P 500 down 1.5%, NASDAQ down 2%, Russell down 1.7%, and the Dow Jones down 0.8%. This was complete mayhem in the US markets.

Stocks collapsing included AMD, Oracle, Palantir, Intel, and Netflix. The disclaimer notes that some of these stocks might be part of the Weekend Investing U.S. stock strategy and are not recommendations to buy or sell.

What to watch next ?

We may see a down-leg if the Nifty drops below 25,750, but until then, the hope for the continuation of the uptrend remains.

Since about 10-13% of Canadians and Americans own Bitcoin, the dramatic drop in the value of this asset impacts their sense of wealth, or "feel-good factor." This could percolate into a second-order outcome where consumer spending is impacted, particularly in North America.

The focus should remain on the Japanese yield: if it continues to go up dramatically, all asset classes globally will likely be impacted as people cut positions and withdraw funds borrowed in yen.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📧 Global Market Insights: US Tech Giants vs. International Country Weights

The Disproportionate Power of the "Magnificent Seven"

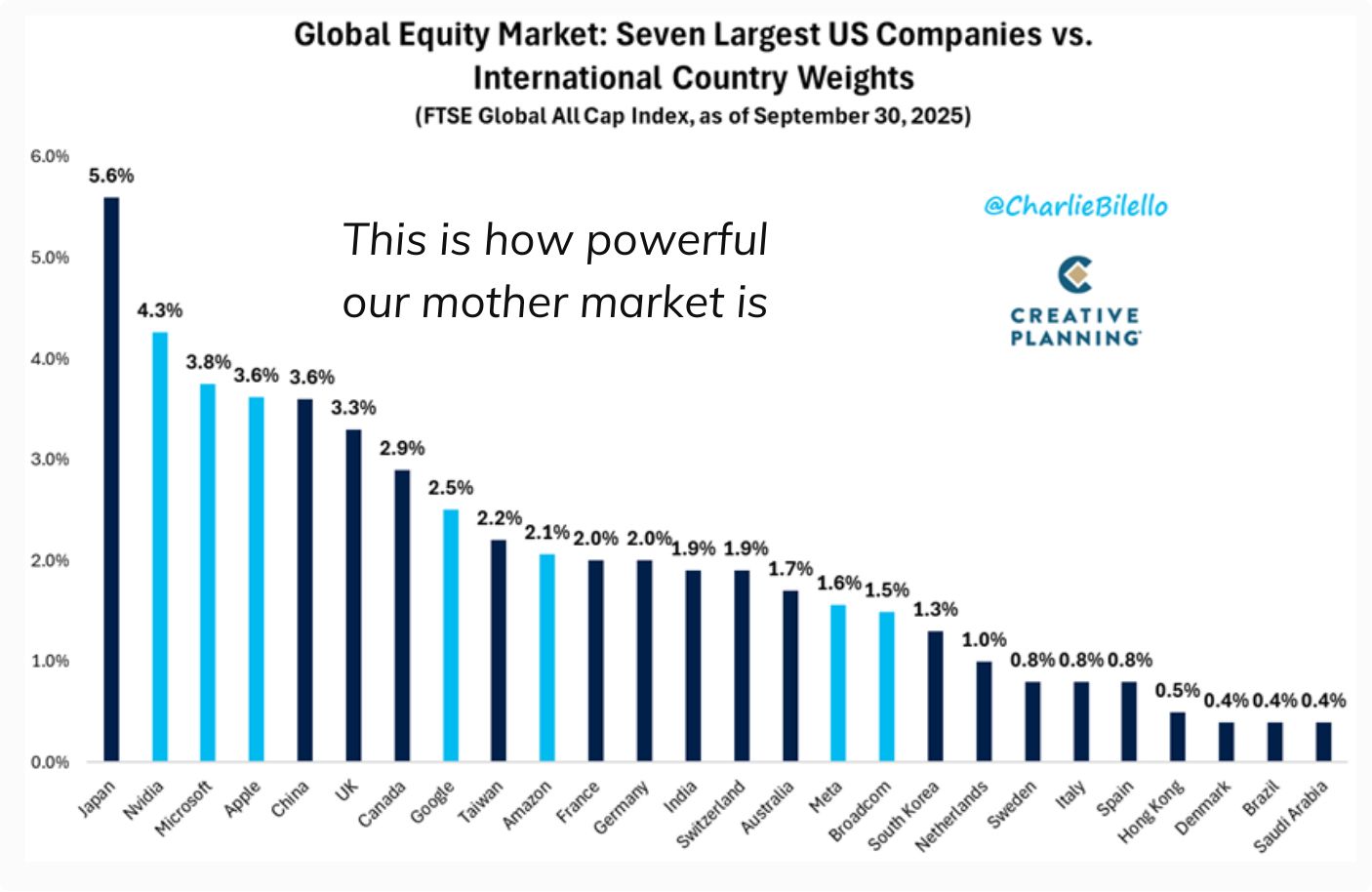

The discussion highlights a striking disparity in the FTSE Global All Cap Index, where the market weight of just seven of the largest US technology companies rivals, and in some cases, surpasses the combined weight of entire countries.

Source : Peter Mallouk on X

The "Magnificent Seven" US companies analyzed are: Nvidia, Microsoft, Apple, Google, Meta, Broadcom, and Amazon.

Nvidia holds a significant weight of 4.3%.

Microsoft is weighted at 3.8%.

Apple is weighted at 3.6%.

This concentration suggests an increasing reliance and focus of global indices on a select group of high-performing US tech stocks.

🌎 Country Weights in the Global Index

In comparison, the weightage allocated to several major international economies in the same index presents a stark contrast to the US tech giants.

India's Relative Position: A Closer Look

India's current index weight of 1.9% is a key focus of the discussion, demonstrating its relatively low positioning in the global equity landscape compared to its peers and the US mega-caps.

India vs. US Single Stocks: India's total market capitalization weight (1.9%) is less than half of Nvidia's (4.3%) and roughly half of Microsoft's (3.8%) and Apple's (3.6%). This means a single US stock has an allocation double that of the entire Indian market in this index.

India vs. Other Nations: While India is ahead of countries like Hong Kong and Brazil, it significantly trails major economies such as Japan (5.6%), China, the UK, and Canada.

The speaker attributes India's lower weight to its "not so great" performance over the past year or so, as index weights are often based on market capitalization and past performance.

📈 Future Outlook and Market Performance

The speaker expresses hope for an improvement in India's relative position, emphasizing that better market performance is crucial for an increased allocation in these global indices.

The goal is to see India's weight move from 1.9% to 2% to 3% in the near future.

A shift in relative weights towards India is expected if its performance improves.

Meme Of The Day

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply