- WeekendInvesting

- Posts

- Smallcaps Crash : Has Fear Overpowered ?

Smallcaps Crash : Has Fear Overpowered ?

Is Gold Overvalued ?

Market Update - Monday, 08 Dec

Monday started as a bloody day and a bloody week, and the entire market was looking very, very weak. Of course, while it sounded like a joke a few days back that every time Putin visits India, the Indian market falls, once again we have seen the same thing playing out.

The average fall from the 52-week high now for small-cap stocks is 27%. So, the average small-cap stock is down 27%. Out of 250 stocks in the small-cap index, we have 201 stocks that have fallen more than 15%, some as high as 65% to 67%.

So, there is a sense of fear in the market, especially in the micro-cap and the small-cap space.

Nifty completely erased what we gained in the last two sessions, down 0.86%.

In the Nifty Junior, you can see a very sharp cut where a complete rounding top pattern has been made. And the sharp sell-off that we had in September, we are again at the bottom of the same point, at minus 2.05% here.

Mid-caps also lost significant space. For the last two and a half months, we were having a slightly upward trend, you can say, and now that has been smashed down at minus 1.7%.

Some support may come through at this level, but the way markets were thrashed today, there can be some more downsides also, and small caps are showing you that downside, where the previous low was not only broken but convincingly much below that, at 2.27% for the small-cap space.

Bank Nifty also lost the last day's gain, so we are back where we were on Thursday, at 0.9% down.

Gold is flat at 12,918 per gram with a 0.46% minor gain, and silver is actually again nearing its all-time high close on the daily basis at 0.71%. Almost 1,80,000 per kg is the price there.

Other Market Triggers

Nothing was spared today, whether it was banking, autos, or FMCG.

The significant losses were foreseen in JSW Steel, Bharat Electronics, IndiGo (of course, 8.2%), Bajaj Finance, and State Bank of India also not getting spared.

Nifty Next 50 was even more red, where 2% to 4% is sort of the norm for most stocks. HAL lost 3.5%, and Vedanta 2.5%.

The mover of the day is Kaynes Technology. Kaynes Tech is down 26% in just three days. The stock was nearly 8,000 rupees not so far back, and we are at 3,800. So, it tells you the importance of having some exit plan at some point because you really can't say when it can come and hit your stock.

U.S. Market Update

In the previous session of the US markets, S&P 500, Dow Jones, and Nasdaq all gaining slightly. Russell, however, was down 0.3%. You have Adobe up 5.3% after a long time. This stock has been falling since 700 plus, so it's a good move here. Salesforce was up 5%.

Booking Holdings, Charter Communications, and Broadcom all did well in the previous session. So, the US market is yet to be hit by any weakness, and the emerging market, especially India, is getting hit by a lot of weakness.

So, it's very counterintuitive sometimes when you think about where the growth is coming and where the markets are moving. Disclaimer, of course, that some of these stocks may be part of the Weekend Investing US stock strategy. These are not recommendations at all.

What to watch next ?

So, this is looking like some sort of a big liquidation that has happened. Normally, when such a bigger move comes, it is not a single day move. It is usually lumped with a few days of such moves and then, of course, some consolidation.

So, it will be surprising if we just have today's down move and the rest of the days of the week become a non-continuation of this. We may get some breather after this move, but the force of this move sort of suggests that there is more to come.

Important Announcement

We’re launching Winvest Capital, our SEBI-registered Category III AIF that brings our rule-based momentum frameworks into an institutional-grade structure. And we’d love for you to be part of this journey.

We’re hosting an exclusive webinar covering our investment philosophy, AIF suitability for HNI/UHNI investors (>₹1 Cr), multi-asset allocation, risk management, and more.

📅 Saturday, 13 December 2025

🕚 11:00 AM IST (60 mins)

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

💡 The Gold vs. Equity Debate: Is Gold Overvalued?

We're sharing some truly interesting data today. The accompanying chart (representing the last two years) shows the Nifty Index (white line) versus Gold Prices (golden line).

In the last two years, Gold has surged by 124%.

The Nifty Index, in comparison, has grown by only around 29%.

Seeing this dramatic difference, many might conclude that Gold is significantly overvalued and due for a major correction. The immediate narrative will be to book profits and exit gold positions. However, a deeper, "big picture" analysis suggests a different story.

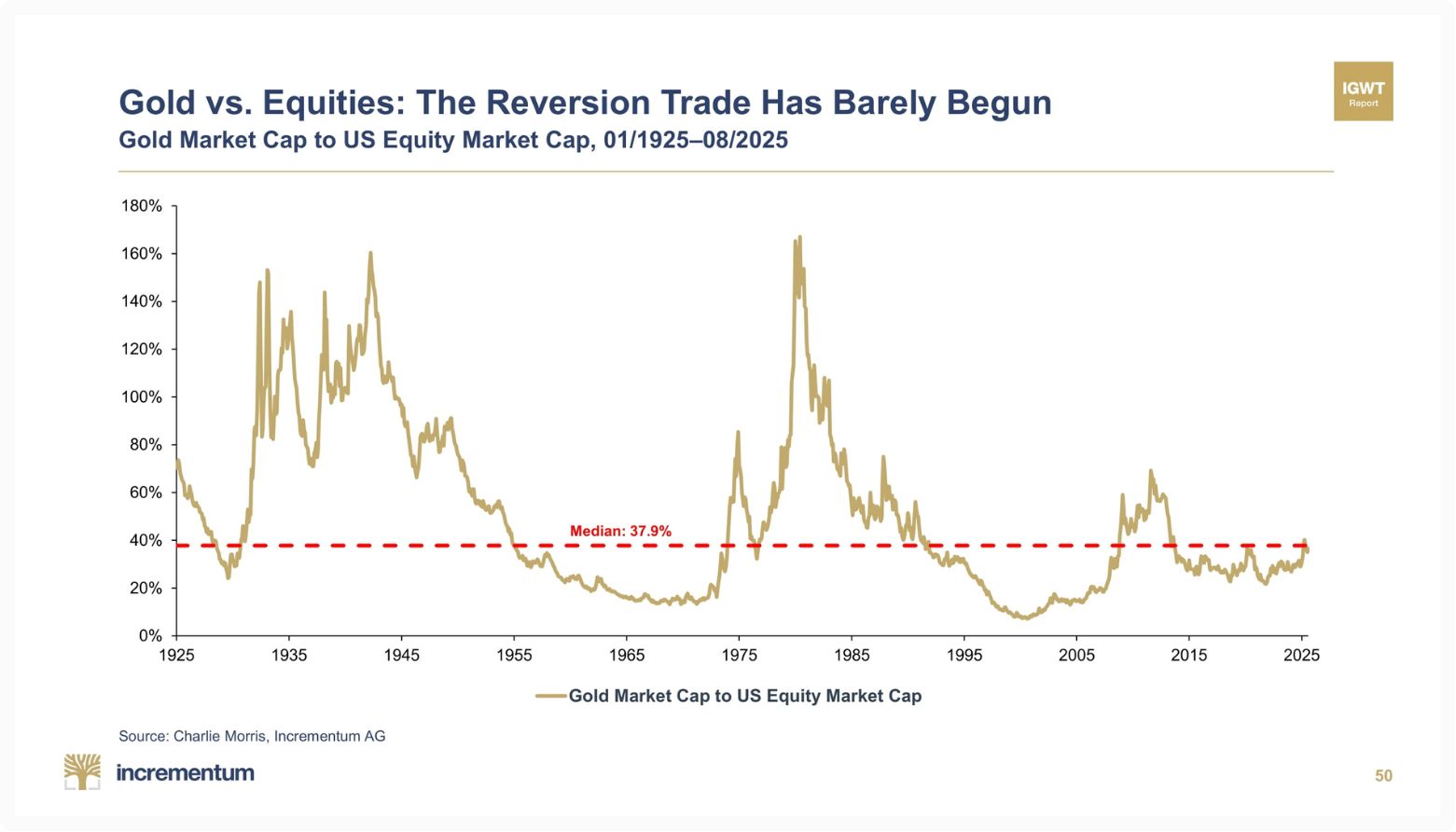

📈 A Historical Perspective: The Gold to Equity Ratio

Source : IGWT

When we look at the long-term trends, specifically the Gold to Equities Ratio, we find that there have been several decades marked by an explosive rise in this ratio:

1930s

1970s

2000 to 2011

Currently, the long-term average ratio (approximately 38% when comparing Gold to the US market, as referenced in the original data) is quite moderate. Even against the Nifty, the Gold to Equity Ratio is still relatively low.

This suggests that the current rally in Gold, while impressive, may not yet signal the peak of a major long-term upcycle.

🚀 Is the "Mania Phase" Yet to Come?

The question remains: Can the current Gold rally evolve into a phase similar to the massive increases seen in previous cycles?

It is plausible that we have not yet entered the true "Mania Phase," where commodity discussions dominate every conversation. If equity markets remain range-bound or moderate, there is a significant possibility that Gold and other precious metals could still surge by an additional 20%, 30%, or even 40% from current levels.

Key Drivers for Continued Gold Rally:

The anticipation of a change in global monetary policy, potentially led by new Federal Reserve chairmen who may favor a more accommodative (easy) policy and interest rate cuts, strongly supports this view. Easier money typically:

Reduces the opportunity cost of holding Gold (a non-yielding asset).

Increases the appeal of risk assets (which includes commodities like Gold in an inflationary environment).

Meme Of The Day

Which of the following investment actions best reflects your view for the next 1-2 years? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply