- WeekendInvesting

- Posts

- Stocks Flat, Metals Exploding - Warning or Signal?

Stocks Flat, Metals Exploding - Warning or Signal?

Good, Bad & Ugly Weekly Review

Hello, Investor !

Markets Overview

We are now entering the last week of the year, and in many ways, this has been a rather underwhelming year for equity markets. Expectations were high coming into the year, but equities have largely failed to deliver exciting returns. That said, this is not unusual. Markets move in cycles, and it often takes a full market cycle for average long-term returns to materialise. In that context, there is no real damage done. In fact, what we have witnessed is a long phase of consolidation, stretching almost a year and a half since August–September of last year. Such prolonged consolidation phases often act as the base for the next meaningful leg up, even if that takes more time than investors would like.

While equities have struggled to excite, this year has unmistakably belonged to precious metals. Gold, silver, platinum, and even copper have delivered strong and in some cases explosive moves. This surge in hard assets is also a reflection of how over-financialized the global system has become over the last five decades, where financial instruments were prioritized while real assets were ignored. That imbalance is now correcting. A key reason behind this shift is the growing belief that interest rates are unlikely to rise meaningfully, especially with a new Federal Reserve chairman expected and a political mandate that clearly favors lower rates.

This creates a deeply conflicted macro backdrop. Bond markets want interest rates to rise because demand for U.S. Treasuries from foreign governments has weakened significantly. If fewer countries are buying these bonds, yields logically need to move higher. On the other hand, political forces want rates to come down to support growth and manage debt burdens. This tug-of-war is being resolved, at least temporarily, by injecting liquidity into the system. That is precisely what precious metals are signaling. When silver jumps nearly 10% in a single session, it is not just momentum — it is a sign of stress beneath the surface of the financial system, raising questions about stability and trust.

Latest Daily Byte

As the calendar year draws to a close, what initially appeared to be a Santa Claus rally seems to be running out of steam. This is a bitter pill to swallow because the markets saw three consecutive green candles on the 18th, 19th, and 22nd, which have now been followed by three consecutive red candles.

The Nifty lost about 0.38% today, and while this is not overly pessimistic, the reality is that the market is still waiting for fresh triggers. There are currently not enough tailwinds to drive strong positive momentum for the Indian markets.

This period is also the end of the calendar year, which is usually met with muted volumes that do not augur well for the markets. Perhaps the next important event or trigger will be the earnings season which is set to kickstart very soon. All eyes are on whether any positive momentum will be created from that counter.

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

You May Also Like

How US Households Shift Between Real Estate and Stocks Over Time | Why Long-Term Returns Look Slower Than India’s Growth |

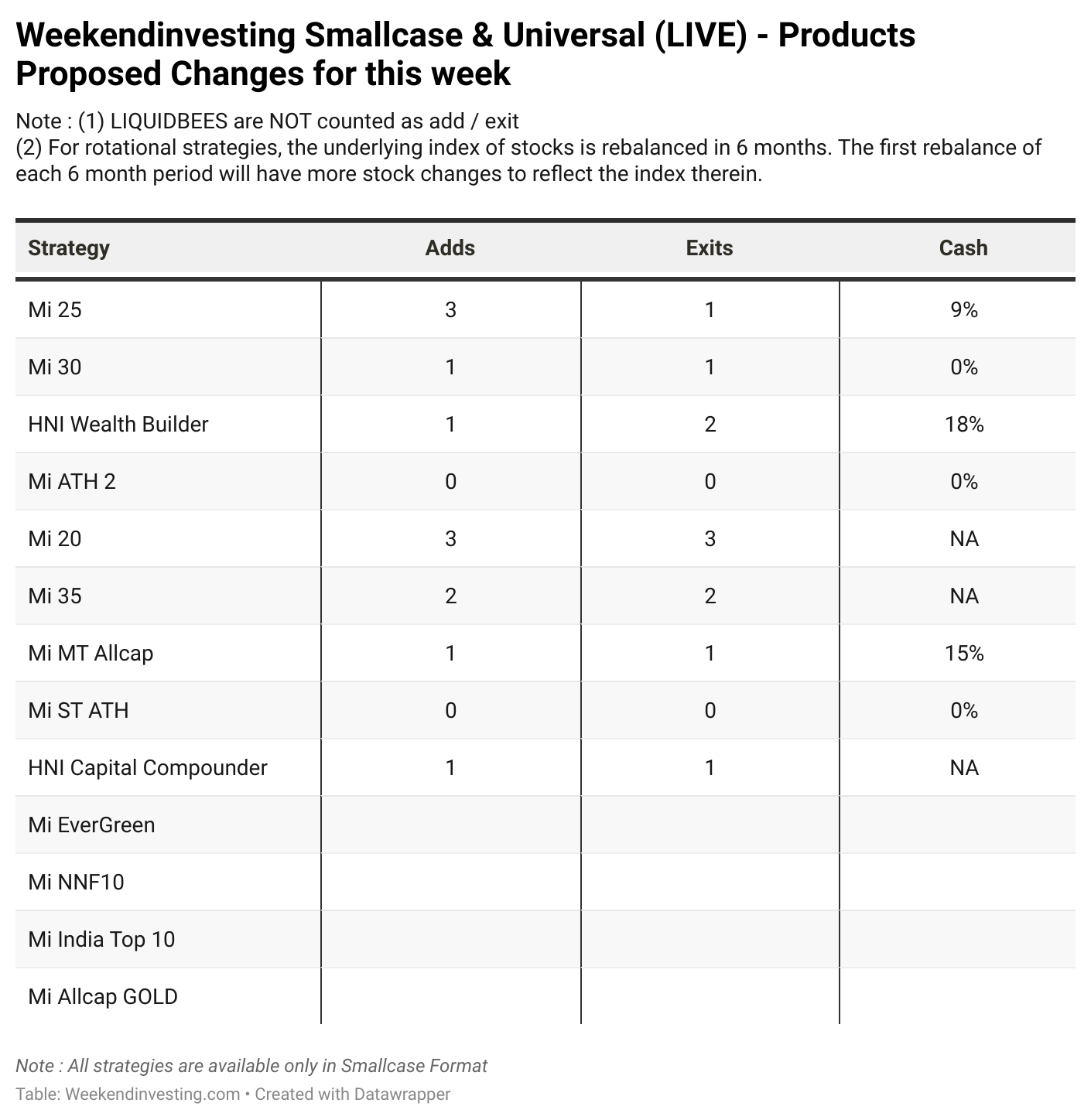

Rebalance Update for the week

Please write to [email protected] if you have any questions.

Reply