- WeekendInvesting

- Posts

- The 7 Year Long SIP Secret

The 7 Year Long SIP Secret

Why Patience Pays Off

Friday, 24 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The markets were quite dull today. The earlier optimism around the US–India treaty has faded again after Piyush Goyal mentioned that things will move step by step and take time. The rest of Asia also looked weak and quiet. It felt like investors simply didn’t have the energy to push any segment higher today.

Looking at the charts, it seems like yesterday was a “sell on news” kind of day. The excitement about the US trade deal probably peaked then. Now, no one is even talking about it anymore, even though nothing concrete has happened.

Nifty was down 0.37%, Nifty Junior was flat at 0.11%, midcaps dipped 0.22%, and small caps were down 0.15%.

The Nifty Bank index fell by 0.65%, which is a meaningful move over the last two sessions. Given how much it had run up earlier, a bit of consolidation seems fair and healthy at this point.

Gold prices have also come off their highs. From around ₹131,000 per 10 grams, gold has now dropped close to ₹121,000. This is actually good news—it gives buyers another chance to enter at more sensible prices.

Silver, too, has cooled from ₹164,000 to ₹143,000. Coming back to long-term averages is healthy for any bull run.

Other Market Triggers

Hindustan Unilever dropped 3.2%, which is significant.

State Bank of India was down almost 1%, Kotak Bank fell 2%, Axis Bank and HDFC Bank were down about 1.3% each.

In the Nifty Next 50, Chola Finance and Vedanta saw some gains, but many others like LIC, Ambuja Cement, Varun Beverages, Motherson, CG Power, PNB, Hyundai, Dmart, and LTIM slipped.

The mover of the day was Shipping Corporation, which shot up 10%. This is another example of the “BBC – Bhao Bhagwan Che” principle at work. There’s probably some news brewing—perhaps a privatization or stake sale—and the market seems to have caught the scent.

U.S. Market Update

In the US, markets continued to recover. The S&P 500 rose 0.5%, Dow Jones 0.25%, Nasdaq nearly 1%, and the Russell index also bounced back.

Over the past month, the S&P is up 1.5%, Nasdaq and Russell around 2%. Over the past year, Nasdaq has gained 25% and the S&P 16%, which is quite impressive.

Stocks like Honeywell, Intuitive, Intel, Conoco, and GE Aerospace are doing well in the US markets, with Honeywell showing a strong breakout.

What to watch next ?

There was a small gap in the market three days back which has now been filled, and the index has cooled off. Maybe next week, we’ll see another attempt to go higher. The market doesn’t look weak, just pausing for breath.

The long-term trend for Gold still seems bullish. JP Morgan has put out a target of $8,000 for 2028, and other big names like Goldman Sachs and Morgan Stanley also have higher price targets. Of course, these reports could be wrong, but the main logic is simple: as long as fiscal deficits and money printing continue, gold will likely keep rising.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Festive Offer Announcement

Gold has quietly outshone everything else — up 72% while Nifty has remained flat

This Diwali, let Gold + Momentum protect and grow your wealth together. 🌟

Festive Offer: 35% OFF till 26th Oct (Sunday)

Code: FESTIVE35

Explore our Gold-backed strategies:

🌿 Mi EverGreen – 75% equity + 25% gold, monthly balanced stability.

🟡 Mi Allcap GOLD – Large, mid, small caps + gold, full-market momentum.

🔄 All Seasons – Dynamic Nifty + Gold blend, adjusts every fortnight.

🎥 Watch Special Video: [Watch Here]

💛 Wishing you a shining & prosperous Diwali!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📰 The Long-Term SIP Secret: Why Patience Pays Off

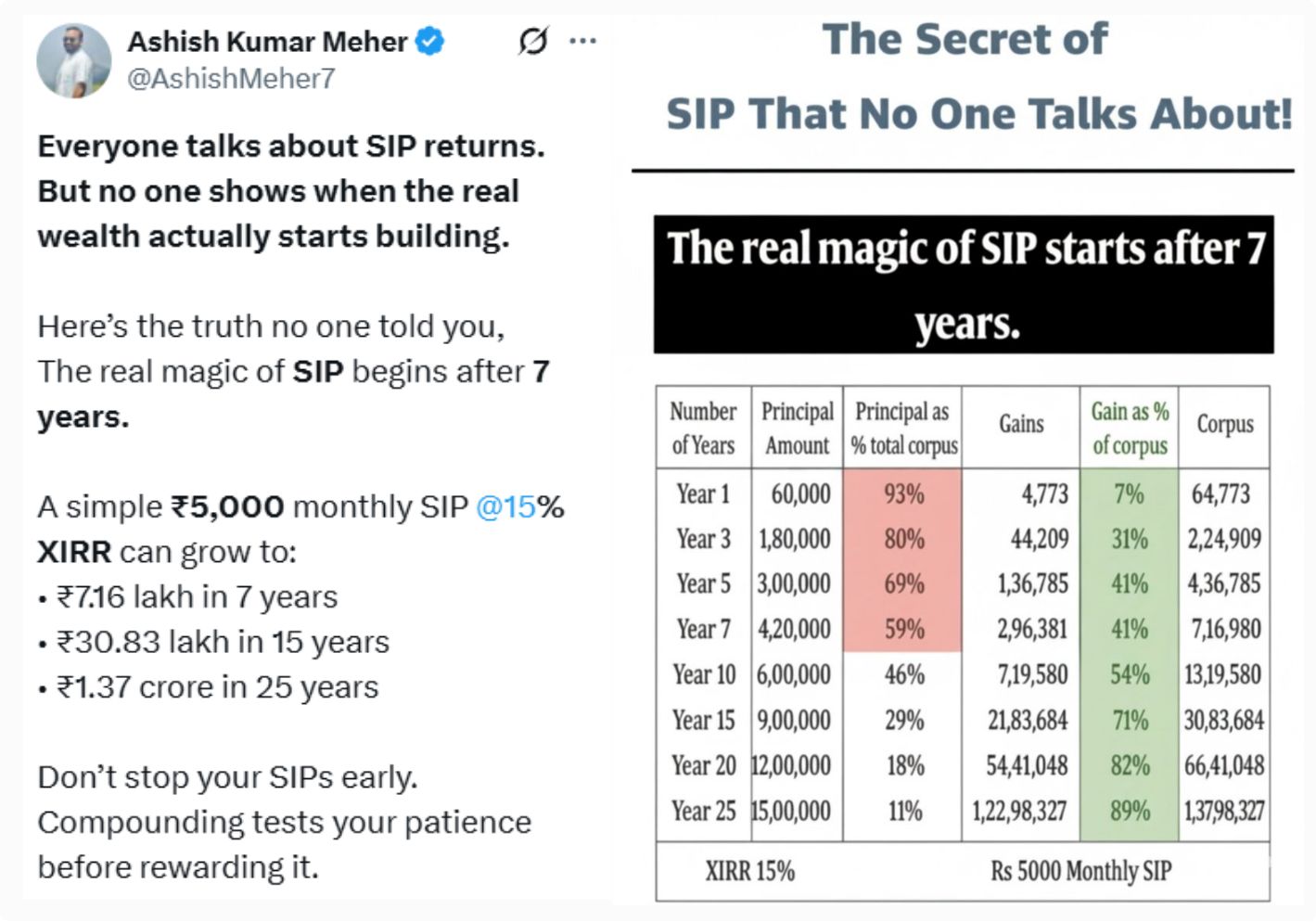

Today, we dive into a topic that, while discussed often, bears repeating: the often-unseen magic of Systematic Investment Plans (SIPs), inspired by excellent data shared by Mr. Ashish Meher. The core message is clear: equities are a long-term game, and stopping your SIPs prematurely is the biggest barrier to wealth creation.

🎯 The Delayed Gratification of Compounding

The data highlights a crucial point that many new investors miss: the "real magic" of an SIP often starts to become evident only after approximately seven years.

Source : Ashish Kumar Meher on X

📊 The Principal vs. Gain Breakup

The key insight is in the changing composition of your investment corpus over time. In the initial years, your principal investment dominates the total corpus.

Year 1: Gain is only about 7% of the corpus; 93% is your principal.

Up to Year 7: The principal remains a significant, if not majority, part of the total corpus. For example, after 7 years, you've invested ₹4.2 Lakhs (Principal), and your corpus is ₹7.16 Lakhs. While the gain is substantial, the principal is still over 58% of the total.

However, post-seven years, the situation dramatically shifts due to the power of compounding:

Longer Term (10, 15, 20, 25 years): The percentage of the corpus represented by the principal dramatically shrinks (from over 60% down to about 11% in 25 years).

Exponential Gains: The gain as a percentage of the corpus becomes humongous, typically 80% or more over a longer period of time. This is because the gains from earlier years start earning returns themselves—the true definition of compounding.

🛑 The Investor Mindset Trap

The data on investor behavior is sobering: the average fund investor stays invested for only about one and a half years.

This statistic is the reason why most people will not make significant money or compound wealth over longer periods. Many investors get frustrated when they don't see "humongous gains" in the start, especially after periods like the last four to five years where new investors were spoiled by high early returns, followed by periods of market stagnation.

The Critical Message:

Don't Stop: Do not stop your SIPs just because you don't see spectacular returns in the first one, two, or three years.

Set the Right Expectation: Equity investment is not designed to give you massive gains immediately. If it happens, consider it luck.

Maintain Perspective: Enter the equity market with a very long-term plan (10+ years). Having the right, patient mindset is essential to navigating the inevitable volatility of the equity journey.

Meme Of The Day

In a long-term SIP (e.g., 25 years), what part of your total corpus is generally the largest contributor to the final value? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply