- WeekendInvesting

- Posts

- US Nominal GDP Hits a Post-WWII High

US Nominal GDP Hits a Post-WWII High

The Shocking Post-Pandemic Surge

Friday, 03 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The week has come to an end, and the last two sessions have shown a strong pullback. Before this, the market had gone through nine continuous red candles heading down.

The GDP numbers and the RBI’s statement that credit offtake may finally start to rise gave new hope. Many brokerage houses also upgraded their ratings on banking and consumption stocks, which helped revive interest in these sectors.

Markets opened weak today but picked up in the last few hours and closed above yesterday’s high, which is a good signal. Nifty closed 0.23% higher.

Nifty Junior was up 0.39%, Mid Caps gained 0.85%, and Small Caps were up 0.86%.

Banks also rose 0.44% after a massive move in the previous session. Overall, the week closed well, and there is positive hope for the coming week.

Gold stayed very strong at 11,688, almost touching a new all-time high, closing with a 0.32% gain for the day.

Other Market Triggers

Many big names contributed to this rise including private banks like Kotak Bank and Axis Bank.

Power Grid, Bharat Electronics, L&T, Bharti Airtel, Hindalco, and Tata Steel also saw strong moves, with Tata Steel rising 3.4%.

Adani Power, Divi’s Lab, Hindustan Zinc, Solar Industries, and some PSU banks also showed mixed performance.

The mover of the day was V-Mart Retail, which jumped nearly 16% after posting a strong business update for the second quarter.

U.S. Market Update

In the US markets, the last session was flat. S&P 500 and Dow Jones barely moved, while Nasdaq gained 0.39% and the Russell 2000 small-cap index was up 0.66%.

Intel continued its sharp rally, moving from 24 to 37 in a short span, supported by US government stake. Advanced Micro Devices jumped 3.49%, while PayPal, Starbucks, and Adobe rose between 2% and 4%.

What to watch next ?

GST collections showed a rise of 9.1%. Some may say it is not a big number, but given the global challenges and tariff conflicts, this growth is actually encouraging.

October is expected to be even stronger.

Metals performed strongly today with copper, aluminum, and zinc doing very well in the commodity space. This makes it look like commodity-led inflation could be a possible outcome of current global policies.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Nifty returned an impressive 13% CAGR in 35 yrs – But why do most investors always lose?

👉 Watch this special video by Alok that dives deeper into this issue

💡Register for the webinar to know more about a brand new strategy that aims to solve this recurring problem.

📅 Date: Saturday, 4th October

🕚 Time: 11:00 AM

👉 Exclusive Offer only for Webinar Attendees

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The Unstoppable Engine: US Nominal GDP Hits a Post-WWII High 🚀

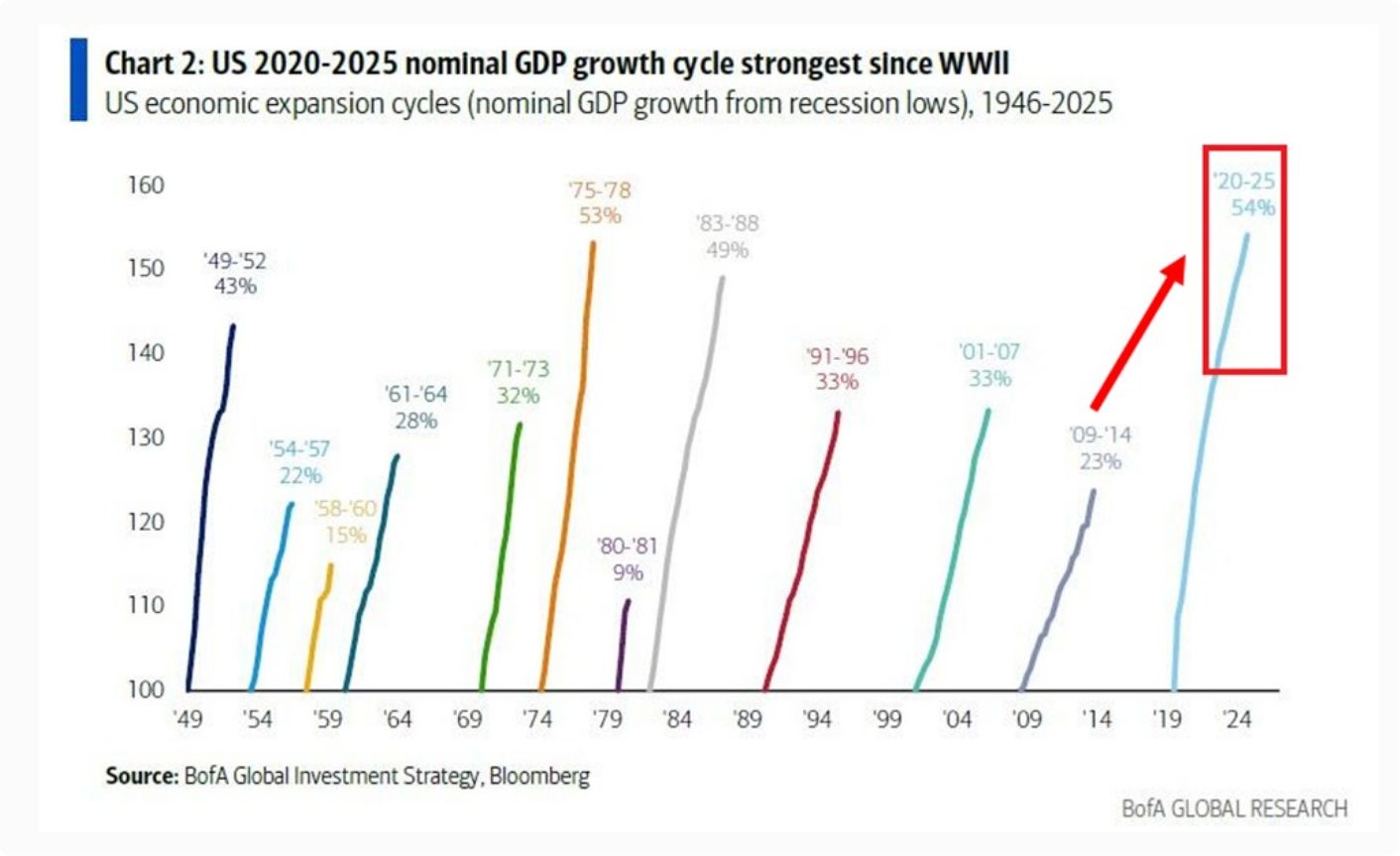

The Shocking Post-Pandemic Surge: 54% Nominal GDP Growth

A recent data point has genuinely surprised observers and market analysts. It reveals that the United States has clocked a staggering 54% nominal GDP growth for the five-year period between 2020 and 2025.

Source : The Kobeissi Letter on X

This is not only a significant figure but, remarkably, it stands as the highest five-year nominal GDP growth period since World War II. This powerful surge demonstrates that despite persistent "recessionary calls" and widespread skepticism, the U.S. economy is currently operating with unexpected vigor on a nominal basis.

Putting the Growth in Context: More Than Double the Recovery

To truly grasp the magnitude of this acceleration, it must be compared to previous recovery periods. Consider the five-year span following the 2008 Lehman crisis, from 2009 to 2014. That period, which was considered a strong recovery phase, achieved a total nominal GDP growth of just 23%.

The recent 54% growth is more than double the growth rate witnessed in the 2009–2014 era. This illustration highlights a massive difference in economic momentum, suggesting that the current growth cycle—whether fueled by innovation, inflation, or a combination—is historically potent.

Implications: Refuting the 'Dead Economy' Narrative

The robust nature of this underlying nominal growth offers a compelling explanation for the persistent outperformance of U.S. markets compared to their global peers. It directly challenges the narrative often circulated that the U.S. is a "dead economy" facing stagnation.

The data suggests the opposite: innovation and growth are being driven at an accelerated pace within the U.S. economic framework. This strong nominal foundation provides the necessary buoyancy for asset valuations and corporate earnings, confirming that the U.S. economy’s underlying strength remains surprisingly and historically robust.

Meme Of The Day

What is the single biggest factor driving this unprecedented US nominal growth? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply