- WeekendInvesting

- Posts

- What 25 Years of Nifty 500 Data Teaches Us

What 25 Years of Nifty 500 Data Teaches Us

The "Safety Net" of Time

Market Update - Tuesday, 20 Jan

The market environment on Tuesday, January 20, 2026, was characterized by extreme volatility, with almost all market sectors experiencing a virtual crash while precious metals surged. This instability is largely driven by a volatile geopolitical landscape.

In Europe, alliances are being questioned, particularly regarding Greenland, following public displays from the U.S. suggesting a larger "Akhand USA" map that includes Canada and Greenland. Such events have contributed to a global climate of fear, making market stability difficult to achieve.

The gold futures market witnessed extraordinary price swings this morning. Prices jumped from 154,000 to nearly 160,000 before collapsing back to 154,000. Such drastic movements, including a single candle representing several tons of gold, suggest that large players are either accumulating positions or that short sellers are being squeezed.

This volatility extended into the ETF market as well; Gold BeES fluctuated wildly between 120 and 127 within very short timeframes, indicating that extremely large orders are being processed.

The equity markets faced a difficult session, with the Nifty dropping 1.38% and breaking out of its recent range to settle around 25,200.

The broader market fared even worse. Nifty Junior collapsed by 2.3%, wiping out all gains made in December.

Mid-caps fell by 2.49%, and small-caps hit a new 52-week low with a decline of 2.68%.

Even the Nifty Bank, which had shown resilience recently, fell by 0.81%.

Other Market Triggers

Major stocks like Reliance, Bajaj Finance, TCS, and Mahindra & Mahindra saw significant losses, while ITC continued its downward trend.

Only HDFC Bank, ICICI Bank, and SBI managed to remain relatively flat.

In the Nifty Next 50, Hindustan Zinc was a rare outlier, while most other stocks were heavily sold off.

What to watch next ?

Despite the current market turmoil, there is some constructive news regarding the broader economy. The IMF has revised India’s GDP growth estimate upward by 0.7% to 7.3% for 2025.

This revision reflects a better-than-expected performance in the third quarter. While a positive economic outlook does not immediately stop a market sell-off, it provides a fundamental floor that should eventually support a recovery once the market finds its footing.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📈 Timing vs. Time: What 25 Years of Nifty 500 Data Teaches Us

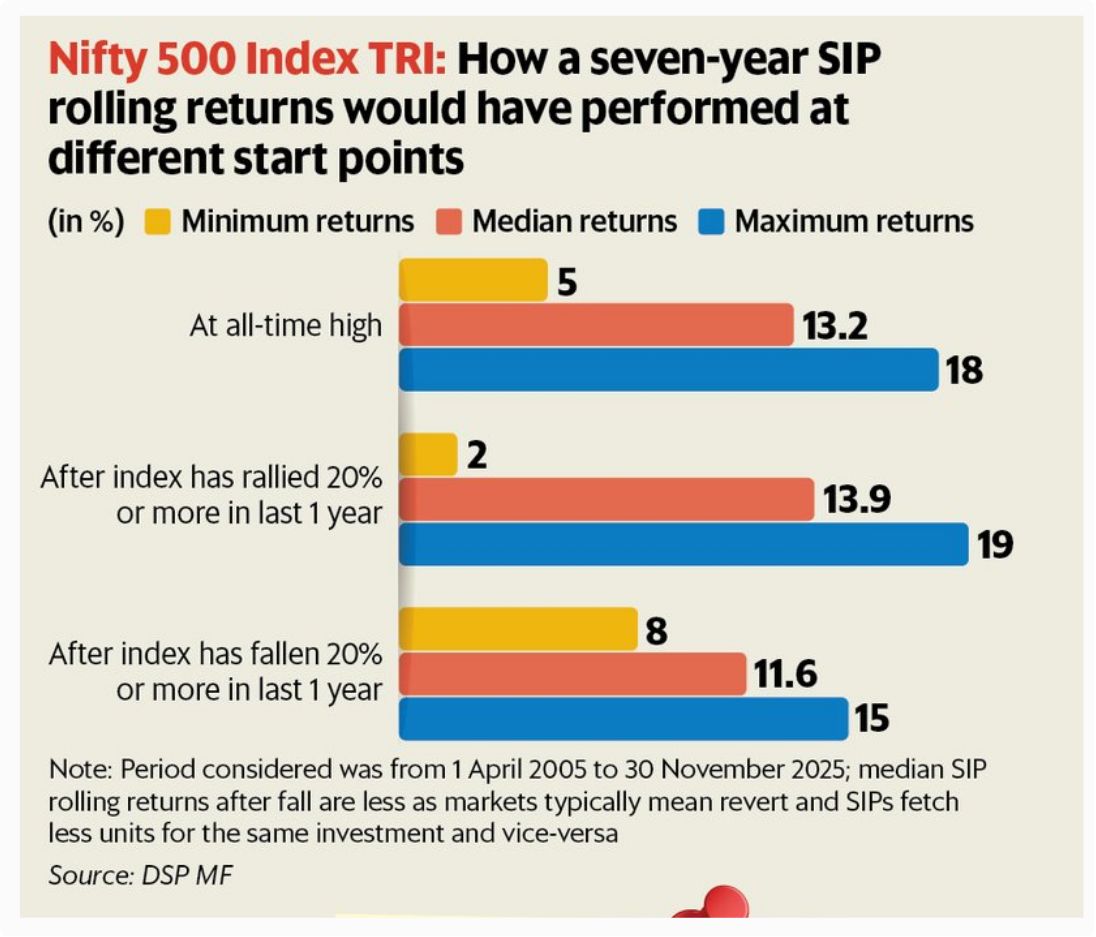

A recent study published in Mint has analyzed the Nifty 500 index's total returns from 1999 to 2025. The data focuses on 7-year rolling SIP returns, and the results challenge the common obsession with "finding the perfect time" to enter the market. Whether you start at a market peak or after a crash, the data suggests that discipline consistently beats luck.

The "Starting Point" Paradox

Many investors freeze when the market hits an All-Time High (ATH), fearing a correction. However, the data shows that even if you started a 7-year SIP at the very peak, your median return remained a healthy 13.2%. Interestingly, starting after a 20% rally actually yielded the highest median return, though it came with a lower "floor" (minimum return) compared to starting after a market crash.

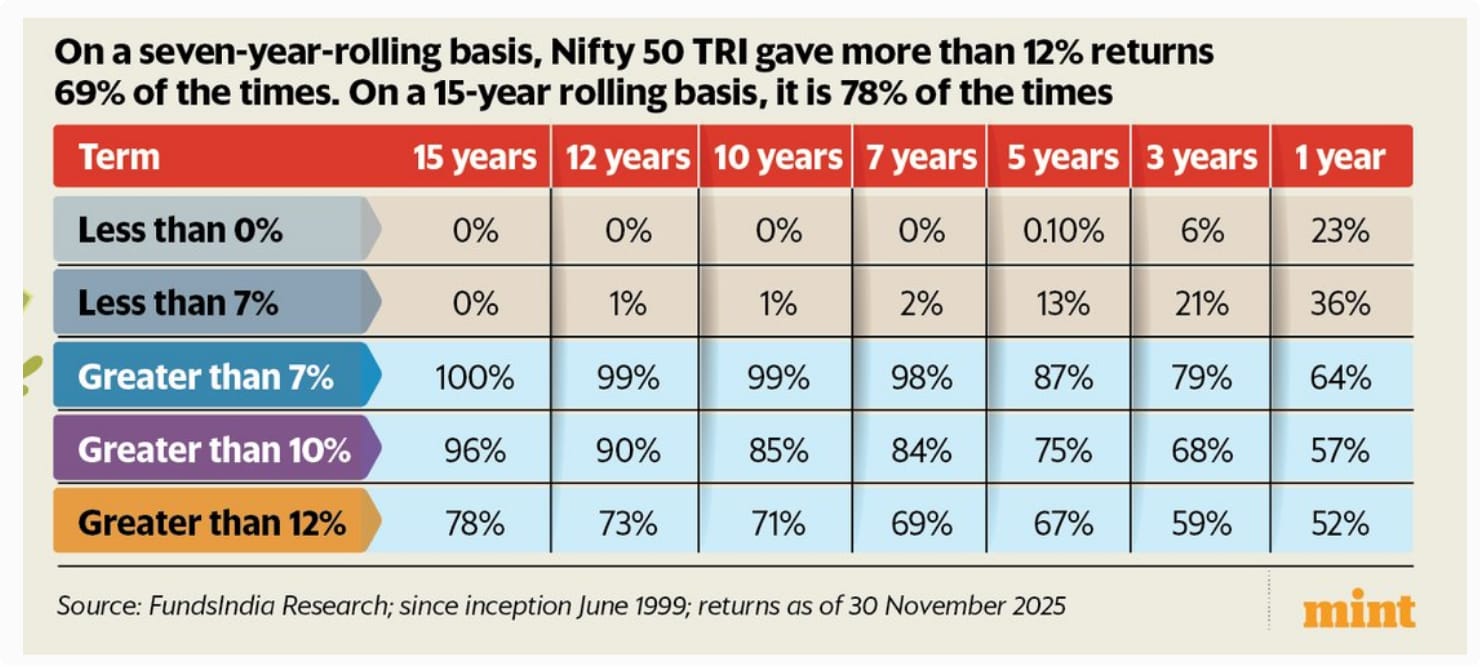

The Magic of the 15-Year Horizon

The study highlights a clear correlation: as your investment duration increases, the probability of sub-par returns practically vanishes.

If you stay invested for 10 years, there is a 99% probability of earning more than 7% returns. Extend that to 15 years, and the probability of earning at least 7% hits a perfect 100%.

Even more impressive is the "wealth creation" zone. For a 15-year journey, there is a 78% chance that your returns will exceed 12%, regardless of when you started.

Discipline Over Prediction

While historical data from the last 25 years doesn't guarantee the same results for the next 25, it establishes a powerful precedent.

The takeaway is clear: the risk of being "out of the market" is often higher than the risk of "bad timing." If you maintain a disciplined SIP, the market's volatility eventually smooths out into consistent growth.

Meme Of The Day

The Nifty 500 data shows a 100% success rate for 15-year SIPs. What is your current investment horizon? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply