- WeekendInvesting

- Posts

- What's Your Post-Pandemic Wealth Report ?

What's Your Post-Pandemic Wealth Report ?

Why Thinking Long-Term Wins

Market Update - Wednesday, 7 Jan

The market continues to trade within a dull range, unable to break significantly past the 26,000 level. With the Union Budget less than three weeks away, there is ongoing discussion regarding whether it will be presented on Sunday, February 1st, or Monday, February 2nd. A final confirmation on the date is expected soon, which will likely trigger a wave of narratives concerning budget expectations.

A recent analysis of gold prices over the last 26 years suggests an interesting thesis for the metal's future trajectory. By looking at a dollar-denominated gold chart—which removes rupee fluctuations from the equation—one can observe historical patterns. Between 2000 and 2011, gold experienced its first major move of the century, rising approximately 660% over a span of 624 weeks. This was followed by a resting period of 228 weeks before the price resumed its upward path.

Technical analysis often reveals such symmetrical patterns, similar to a flagpole formation where a second "pole" of similar height and duration follows a period of consolidation.

The Nifty remained flat with a marginal dip of 0.14%, even though momentum trends across the short, mid, and long term remain positive.

Broader indices showed a similar pattern: the Nifty Junior rose 0.13%, mid-caps gained 0.43%, and small-caps moved up 0.15%, with all trends recently turning positive.

Bank Nifty saw a slight decline of 0.21% today, yet its overall indicators still point toward an upward trajectory.

In the commodities space, gold dipped 0.98% to 13,883 and silver fell 2.56%, but both maintain positive momentum trends.

Other Market Triggers

Heat maps showed large-cap stocks like Maruti, Hindustan Unilever, and ITC facing another day of losses, alongside Asian Paints, Bharti Airtel, and State Bank of India.

Conversely, certain names in the IT, private banking, auto, and pharma sectors gained ground.

In the Nifty Next 50, commodity stocks like Hindustan Zinc and Jindal Steel saw losses after recent rallies, while Varun Beverages, DMart, LTIMindtree, and Dr. Reddy's performed well.

The standout performer of the day was Tata Elxsi, which surged 9.5% following an upgrade by JP Morgan.

US Market Updates

International markets also showed strength, with US indices rising between 0.6% and 1.4%.

Texas Instruments gained 8% while companies like Accenture and FedEx also saw upticks.

On the NASDAQ 100, Amazon and Microsoft moved higher, while Nvidia, Apple, and Google experienced slight declines.

Notably, Palantir rose 3.2% and Micron surged 10% in a single session. It is important to note that these observations are for informational purposes and do not constitute investment recommendations.

What to watch next ?

A specific look at the silver market reveals a potential short squeeze setup. Data from an ultra-short 2x inverse silver ETF in the US shows that retail traders are piling into short positions with record volume, often a sign that a market top is not yet in.

While physical supplies are tightening in countries like Singapore, mass euphoria has not yet hit long-side gold and silver ETFs, which remain below their 2011 tonnage peaks.

This suggests that the silver market may have more room to climb.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

For more details about Category 3 AIFs, fill in the interest form below

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The Post-Pandemic Wealth Report: Why Thinking Long-Term Wins

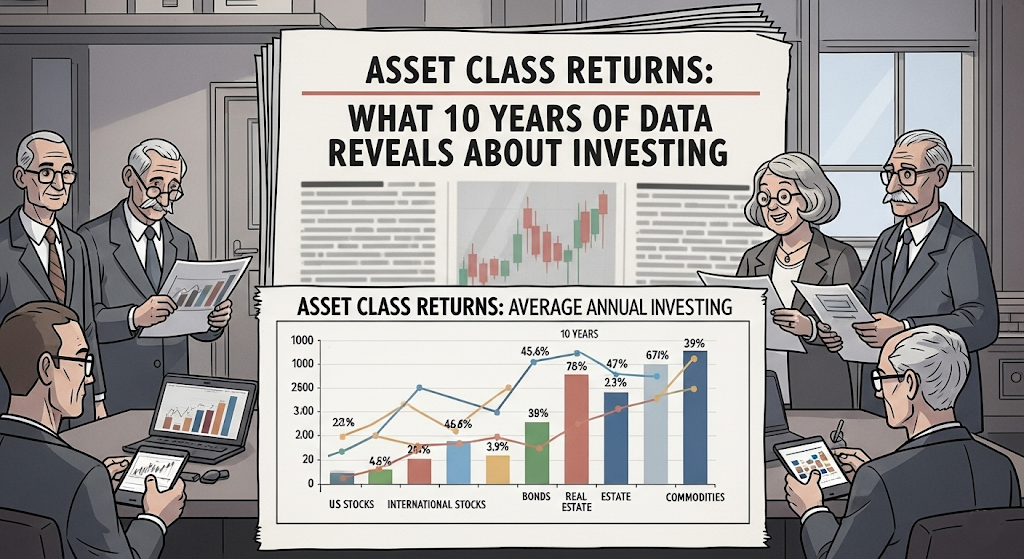

It has been six years since the "Covid Strike" of January 2020. Looking back, the market's journey has been nothing short of extraordinary. While short-term noise often clouds our judgment, a birds-eye view reveals a story of massive wealth creation and the undeniable power of patience.

The Numbers: A Six-Year Performance Review

Since the pre-Covid levels of January 2020, the Indian markets have delivered stellar returns. Even with the recent 15-month consolidation phase, the Compound Annual Growth Rate (CAGR) remains significantly higher than historical averages.

Historically, the average return for Mid and Small-caps hovers around 14–15%. Currently, we are still sitting well above those levels. This suggests that even if the market remains sideways for a while, it is simply a natural correction toward the mean after a period of "extraordinary" performance.

Equity is Not a Sprint, It’s a Marathon

The biggest mistake an investor can make is measuring equity performance over months rather than years. Short-term gains are often the result of luck or market timing, which is impossible to sustain.

True equity investing requires a 5 to 7-year horizon. If you don’t have that time frame, measuring the success of your portfolio becomes incredibly difficult. Instead of reacting to a "flat" year, evaluate your decisions based on the long-term cycle. A period of consolidation is not a failure of the market; it is a healthy part of a long-term wealth cycle.

The Balancing Act: The Role of Gold and Silver

A crucial observation from the recent cycle is the inverse relationship between Equities and Precious Metals. When equity markets were soaring, Gold and Silver remained relatively flat at the bottom. However, as soon as the equity markets began to cool down or face volatility, Gold and Silver started their upward move.

This is the essence of Asset Allocation. By holding both equity and commodities, you create a "balancing act" in your portfolio:

When Equities dip: Gold and Silver often act as a cushion.

The Result: Your portfolio experiences less volatility and more consistent growth.

Meme Of The Day

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply