- WeekendInvesting

- Posts

- Why a Little Market Pain is Good For You

Why a Little Market Pain is Good For You

Stay Calm, Invest On

Friday, 22 Aug 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

The week ended on a weak note as the top end of the market completely gave up. Nifty has almost surrendered all the gains it had made over the last four sessions, at least from Monday’s open.

Adding to this nervousness is the talk of new tariffs on the 27th of August. The additional tariffs that were earlier announced for India have not been rolled back, and the US administration has been hinting that they will be applied.

Over the last few days, we have also seen several meetings with the Russian government and more interaction with China. This is sending a strong message to the US, though a lot of it may just be posturing. It is still uncertain how much collaboration will really happen with China. But such a combative setup is not good for the market as it increases uncertainty.

Nifty gave up all gains of the last four sessions, and a big gap remains in the charts.

The junior Nifty was down 0.64%, while mid caps and small caps were down only 0.18% and 0.16% respectively.

The Nifty Bank index looked even weaker as it not only covered its gap but also went lower, unlike Nifty which still has some gap left.

Gold remained flat at ₹9931 per gram.

Other Market Triggers

No sector was spared except Autos and Pharma which looked muted. Big falls were seen in ICICIGI, Lodha, PNB, Hyundai, Naukri, MCX, Adani Ensol and Cement stocks, while Pharma showed small gains.

Vodafone Idea stood out as its net loss narrowed and there was news that government dues may be slashed.

On the other hand, Nazara halted its real money online games, with Poker Bazi being stopped, leading to a 25–30% fall in market cap.

What to watch next ?

The decision on online gaming has shaken the gaming ecosystem, including big names like Dream11 which had signed sponsorship contracts worth nearly ₹3000 crore. Opinions remain divided, with some welcoming the moral policing by the government and others calling it harsh.

The positivity that had built up from recent government announcements, like GST reforms, has taken a back seat. The rally that was just starting to gain momentum has been cut short.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

| Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

|

What To Read This Week ?

Market Trends: Positive Days Outweigh the Negative

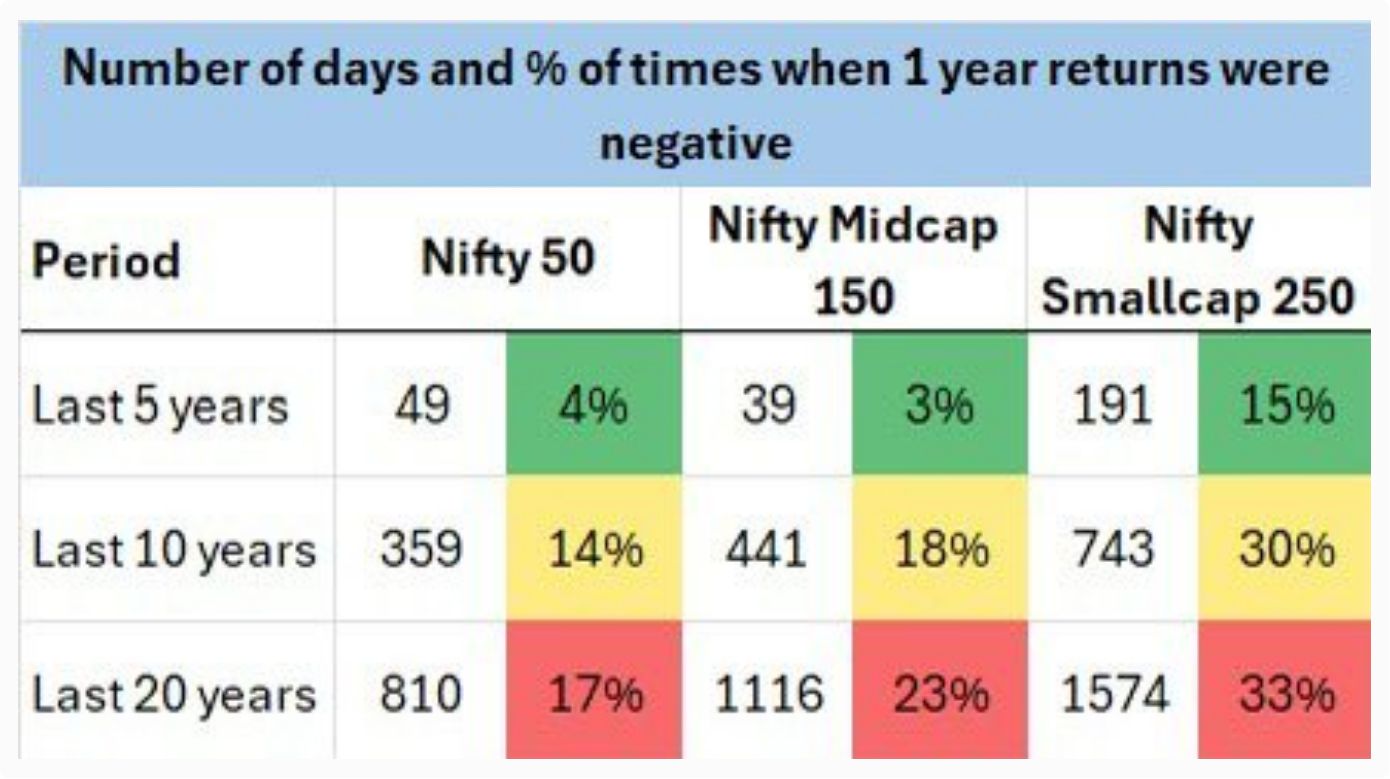

Ever feel stressed out by market dips? You're not alone. But what if the "bad" days were a lot fewer than you think? Let's break down some fascinating data from Niranjan Avasthi that puts market volatility into a powerful perspective.

Last 5 Years: The Exception, Not the Rule

Over the last five years, it's been an exceptionally good run for investors. The data shows that the major indices had negative one-year returns for only a very small percentage of the time.

Source : Niranjan Avasthi on X

This "bull run" has been so strong that it might make us forget what a typical market looks like. To truly understand the game, we need to zoom out.

The Longer View: 10 and 20 Years

When we expand our view to the last 10 and 20 years (in the above image) , we see a more realistic picture of the market's behavior. The periods of negative one-year returns become more frequent, but still remain a minority.

While the number of "negative days" increases as you lengthen the timeframe, the percentage of time spent in negative territory stabilizes.

The takeaway? Even over long periods, the market is positive far more often than it's negative.

The single most important insight from this data is simple: Market pain is a small price to pay for long-term growth.

The data suggests that most indices will be in negative territory for 17% to 33% of the time over the long run. This means that for the remaining 65% to 83% of the time, your returns will be positive.

While a one-third chance of a negative return over a year might sound stressful when you're living through it, seeing it as a long-term pattern makes it far less intimidating. It's a normal part of the process, not a sign of failure.

Meme Of The Day

Based on the long-term market data we looked at, which statement best describes your investing mindset? |

Follow for Daily Market Updates and Insights

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply