- WeekendInvesting

- Posts

- Why Being "Perfect" is Overrated

Why Being "Perfect" is Overrated

The Market Timing Myth

Market Update - Wednesday, 21 Jan

The global financial landscape continues to face significant turmoil with no immediate signs of relief. U.S. markets experienced a dramatic fall yesterday, while yields in both the U.S. and Japan are on the rise.

The current market data reveals a striking abnormality in gold pricing. While gold prices typically track calculated global benchmarks, the MCX futures and gold ETFs in India have suddenly shot up, creating a gap of 5% to 10% over the last two days.

Turning to the domestic equity markets, the Nifty remains highly volatile, ending the day on a flattish note with a minor dip of 0.3%. Despite a "dead cat bounce" during the day, the market remains oversold, having dropped from 26,400 to 25,100 in just a few days.

The Nifty Junior formed a Doji candle, where the opening and closing prices were the same, offering a small glimmer of hope for a bounce tomorrow.

Mid-caps fell 1.01% without showing any signs of a positive reversal, and Small-caps declined by 0.7%.

The Nifty Bank also dropped 1.02%, leaving only the long-term trend in positive territory as market sentiment appears thoroughly crushed.

In the commodities space, gold is technically up another 2.77% at 15,191, but prices on the MCX and Gold BeES are trading much further ahead.

Silver is also inching higher, up 1.33% at 297,361.

Other Market Triggers

Individual stock performance was mixed. Major players like ICICI Bank, HDFC Bank, Coal India, BEL, and Nestle lost ground.

On the positive side, Reliance, Zomato, UltraTech Cement, and JSW Steel saw gains.

Other gainers included Mother Son, Siemens, Adani Enterprises, Naukri, and DLF.

However, the "mover of the day" was Kalyan Jewellers, which collapsed 12.1%, marking its eighth consecutive day of losses.

Jewelers are reporting a significant drop in footfalls and business as rising prices deter consumers.

U.S. Market Updates

The weakness extends to the U.S. markets, where the NASDAQ, Dow Jones, and Russell 2000 all fell by 2% in the previous session.

Significant losses were seen in 3M, Oracle, Broadcom, Accenture, and IBM, with drops ranging from 4% to 6%.

The NASDAQ 100 heat map was predominantly red, with heavyweights like Nvidia, Apple, Google, Microsoft, Amazon, Tesla, and Meta all moving down significantly.

What to watch next ?

There is a growing fear regarding the potential sell-off of U.S. Treasuries by European institutions.

In an unexpected turn of events, gold and silver are making moves that few anticipated, with gold ETFs rising almost 7% today. This surge accompanies a deeper story that warrants close attention.

In the cryptocurrency space, Bitcoin has broken down from its flag formation, dropping from 128,000 to approximately 80,000. Unless previous highs are reclaimed, the technical chart suggests a potential further slide toward the 40,000 level.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

🕒 The Market Timing Myth: Why Being "Perfect" is Overrated

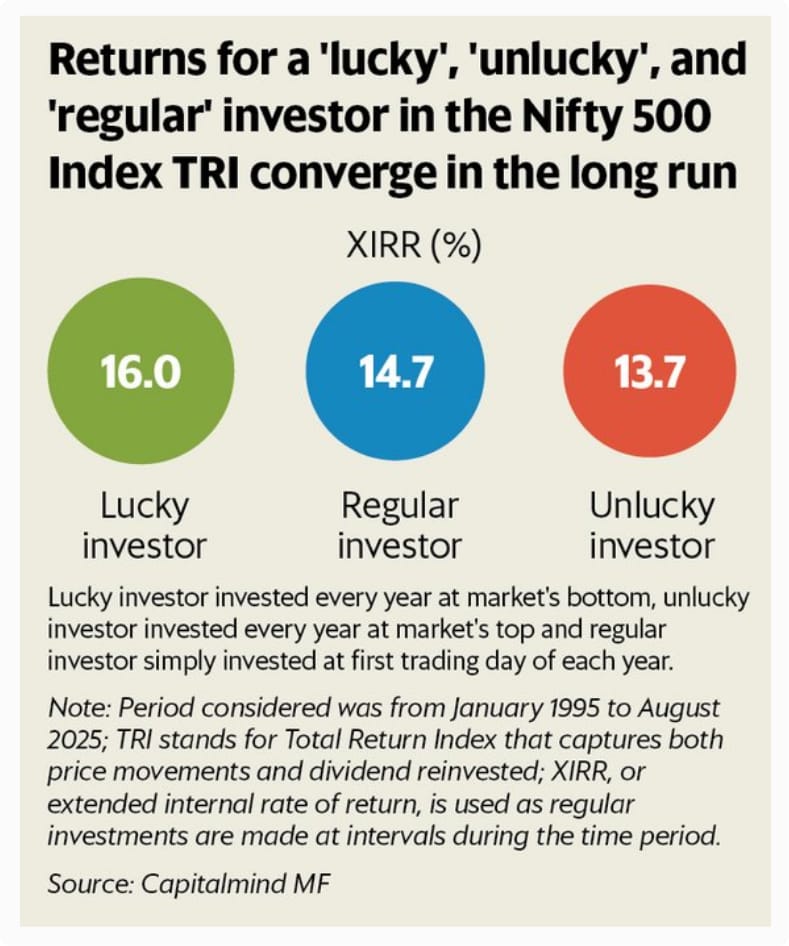

A fascinating study recently compared three types of investors over a 30-year period in the Nifty. The goal? To see how much "market timing" actually impacts your final wealth. The results are a massive relief for anyone who stresses over "buying at the right time."

The Three Types of Investors

To understand the impact of timing, the study looked at three hypothetical scenarios for annual investments:

The "Lucky" Pro: This investor has a crystal ball. Every single year, they manage to invest at the absolute lowest point (bottom) of the market.

The "Unlucky" Rookie: This investor has the worst luck imaginable. Every year, they invest at the absolute highest point (peak) of the market.

The "Regular" Disciplined Investor: This person doesn't look at charts. They simply invest on January 1st every year, regardless of the price.

The Surprising XIRR Breakdown

You might expect the "Lucky" investor to be miles ahead, but the 30-year data tells a different story:

Source : Mint & Capitalmind MF

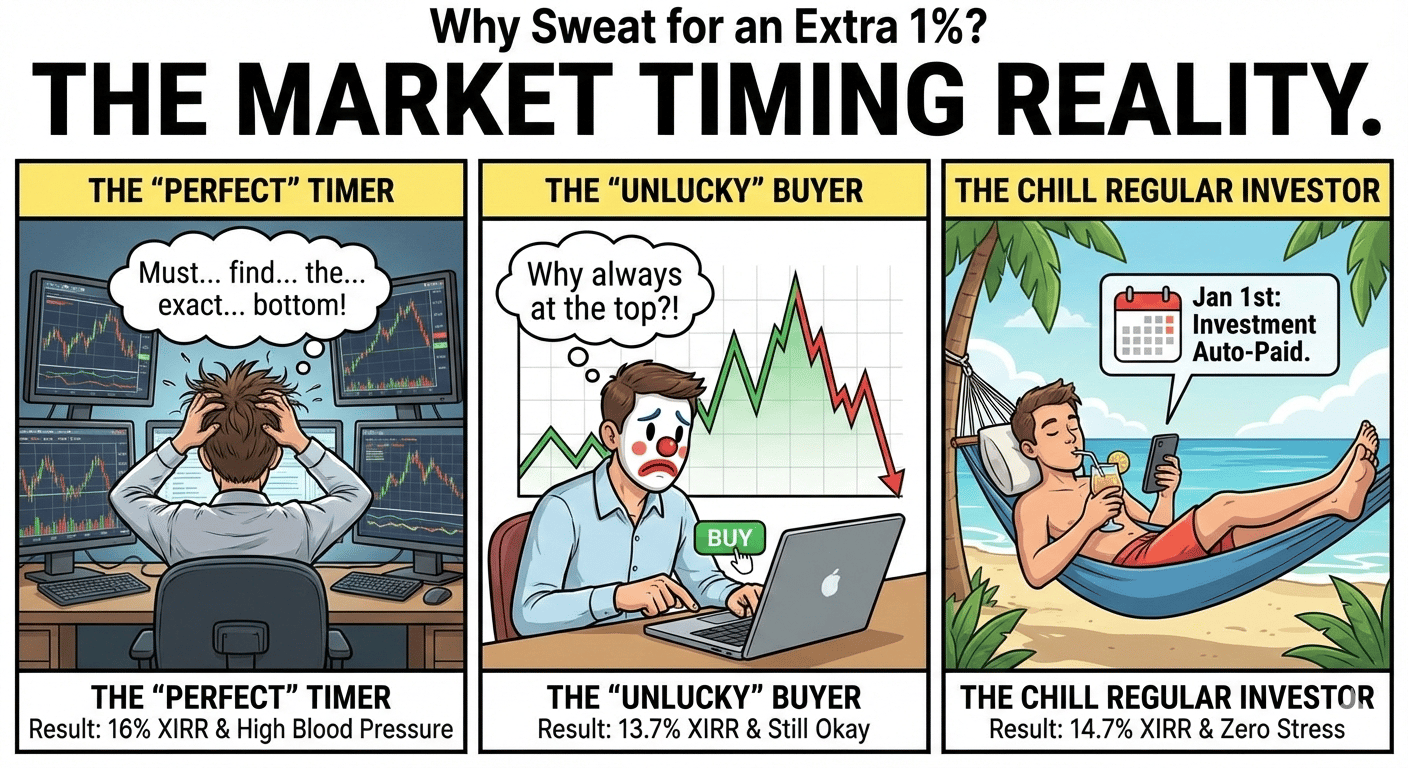

Why the "Perfect Catch" Isn't Worth the Stress

The difference between being a "Market God" (Lucky) and a "Regular Investor" is only 1.3%. While 1.3% matters over 30 years, the effort, stress, and technical knowledge required to perfectly hit the bottom every single year are nearly impossible to sustain.

Even the "Unlucky" investor, who bought at the worst possible time every year, still walked away with a respectable 13.7% return. This proves that the market's long-term upward trajectory acts as a safety net for everyone, regardless of their entry point.

Discipline Beats Greed and Fear

The real takeaway here is that "Time in the market" is vastly superior to "Timing the market."

No Greed: You don't need to wait for the "All-Time Low."

No Fear: You don't need to be terrified of the "All-Time High."

By simply being a Regular Investor, you capture the meat of the returns (14.7%) without the mental tax of monitoring the market 24/7. Long-term compounding is fueled by consistency, not by a single lucky trade.

Meme Of The Day

If "Perfect Timing" only gives you 1.3% more than "Regular Investing," what’s your strategy? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply