- WeekendInvesting

- Posts

- Why did the Market Fall Today ?

Why did the Market Fall Today ?

Why Market Predictions Fail

Market Update - Thursday, 8 Jan

U.S. tariffs have returned to the forefront of the market narrative. A new bill is being presented in the U.S. Parliament, reportedly with approval from Trump, which proposes tariffs on India. This move stems from the belief that Russian oil is still being consumed in India, a practice the U.S. wishes to discourage.

The market experienced a significant downturn following this news, compounded by general weakness in the global marketplace. Metals, which had enjoyed a long rally, gave up gains in a spectacular fashion. The broader market lacked positivity in almost every sector.

Domestic markets were hit hard, with the Nifty falling 1.01%.

The Junior Nifty (Nifty Next 50) plummeted 2%, wiping out nearly six days of gains in a single session and turning the short-term trend negative.

Mid-caps and small-caps followed suit, dropping 1.88% and 1.94% respectively, with momentum trends signaling a negative outlook.

Even Nifty Bank saw a 0.51% decline.

Across the board, asset classes including gold, Bitcoin, and silver moved lower, though gold and silver maintain positive long-term trends despite the daily dip.

Other Market Triggers

The heat map was almost entirely red, with rare exceptions like ICICI Bank, SBI Life, and Eicher Motors managing small gains.

Major stocks like Reliance, TCS, Infosys, and Adani Enterprises all saw declines.

In the Nifty Next 50, oil and energy stocks were slammed, with Hindustan Zinc dropping 6% alongside heavy losses in Jindal Steel and PSU banks.

In a rare positive move, Balaji Amines surged 14% following the grant of a mega project. Aside from that, sectoral trends were bleak.

US Market Updates

In the U.S., the Dow Jones fell 0.9%, partly due to news that President Trump might sign a bill preventing defense companies from engaging in stock buybacks.

While some of these stocks may be part of company strategies, these mentions are not formal recommendations.

Interestingly, mega-cap tech stocks like Google, Microsoft, and Nvidia saw gains, showing that the news primarily impacted smaller companies.

What to watch next ?

There is currently significant discussion regarding dividend yields, especially as some stocks have seen their capital value bleed away. It is important to remember that dividend yield is often a "rear-view mirror" metric.

It reflects past profits and provides no guarantee for the future. Rapidly falling stock prices are often a precursor to operational difficulties; if the capital value drops significantly, dividends are likely to be reduced in the coming years.

Relying solely on dividends can be risky, as seen in the early 2000s when high-yield oil stocks remained stagnant for years while inflation was high. The primary focus should generally remain on capital appreciation.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

For more details about Category 3 AIFs, fill in the interest form below

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

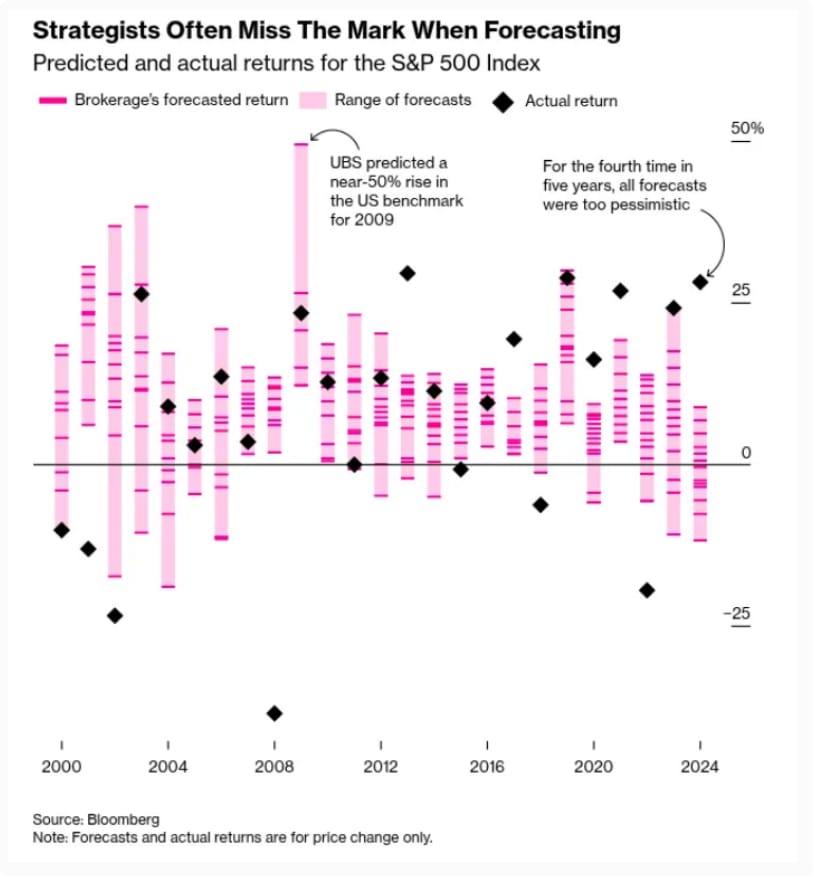

📉 The Crystal Ball Delusion: Why Market Predictions Fail

Every December, a familiar ritual begins. Financial "strategists" and "experts" flood our screens with bold forecasts for the coming year. They tell us exactly how much the S&P 500 will grow, which sectors will shine, and where the index will land by December 31st.

But if we look at the last 25 years of data from the US markets (and the trend is remarkably similar in India), a startling pattern emerges: The experts are almost never right.

Source : Bloomberg

The "Perma-Bull" Bias

One of the most bizarre findings in historical data is that in over 25 years of S&P 500 forecasts, the average expert prediction has never been for a down year.

Analysts are incentivized to be optimistic. Even when the economy is on the brink of a recession, the consensus usually points toward "modest growth." This creates a dangerous "Perma-Bull" environment where investors are never warned about potential crashes.

Prediction vs. Reality: A Reality Check

When we compare what the strategists said versus what actually happened, the gap is often a canyon.

The "Broken Clock" Trap

You might argue, "But I saw one expert who got 2023 exactly right!" Remember the old saying: Even a broken clock is right twice a day. When you have thousands of people throwing darts at a board, a few are bound to hit the bullseye. The problem is that no one can do it consistently. Following a "lucky" guesser into the next year is a recipe for losing your hard-earned capital.

Source : Bloomberg

A Better Strategy for the New Year

If predictions are a waste of time, how should you invest? The answer lies in process over prediction. Instead of tuning into TV experts, focus on these three pillars:

Stick to a Strategy: Follow a rule-based system (like SIPs or Trend Following) that doesn't rely on "feelings" about the market.

Asset Allocation: Don't put all your eggs in one basket. Diversify across equity, debt, and gold so that your survival doesn't depend on a single asset class.

Ignore the Noise: The most successful investors are often the ones who watch the least amount of financial news.

Meme Of The Day

How much do market "expert" predictions influence your investment decisions for the new year? |

|

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply