- WeekendInvesting

- Posts

- Why Every Market Dip Is Your Next Big Chance

Why Every Market Dip Is Your Next Big Chance

Survive the Bear, Ride the Bull

Thursday, 21 Aug 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

The trading day started on a strong note, but the markets gave up some gains by the end. Even then, the overall trend showed that underlying strength still remains.

The spotlight of the day was clearly on capital market related stocks such as BSE and Angel Broking. There was news that SEBI may soon come out with a consultation paper on longer duration contracts for options and futures. This created a fear that weekly options might be discontinued, which kept pressure on such stocks.

Adding to this, just yesterday we saw the government move very quickly against online betting. The new bill was cleared in both the Lok Sabha and Rajya Sabha. This is significant because some big companies, like Dream11, have built massive businesses around online gaming. Dream11 alone has annual revenues of nearly ₹67,000 crores and is a sponsor of the national cricket team. But now, suddenly, the future of such businesses looks uncertain.

Looking at the indices, after four days of continuous gains, the Nifty seemed to be taking a pause today. It closed with a small gain of 0.13%.

Nifty Junior lost 0.28%, midcaps slipped 0.42%, while small caps stayed flat at 0.08%.

Surprisingly, Bank Nifty, which looked weak yesterday, ended positive with a 0.1% gain.

Gold prices moved up to ₹99,35 per gram, while the rupee lost about 25 paise against the dollar.

Other Market Triggers

In sectoral moves, pharma stocks were buzzing with Cipla, Dr. Reddy’s, Sun Pharma, and Lupin doing well. Reliance, ICICI Bank, and Bajaj twins were also among the gainers.

On the losing side were Coal India, Power Grid, Adani Ports, some FMCG names, and auto stocks, though losses were not very large.

In the Nifty Next 50 index, TVS Motors and Swiggy were notable gainers, while Dabur fell 3.6% and Britannia slipped 1.8%.

The biggest stock mover of the day was BSE, which fell sharply by 7.5%. This came after rumors that weekly contracts might be removed.

What to watch next ?

If online betting is banned and weekly options are taken away, the big question is where will speculators go? Many traders want to participate every day, even though it may not be the best practice.

One possible outcome is that cash market volumes might rise again, especially intraday. If only the Finance Ministry would consider reducing the STT rates, the cash market could become vibrant again.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

| Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

|

What To Read This Week ?

Why Every Bear Market Creates the Next Big Bull Run

This edition dives into the historical cycles of bear and bull markets, offering a perspective that encourages long-term thinking over short-term panic. We'll explore data points that highlight a fundamental truth of investing: resilience is key.

A Historical Look at Market Cycles

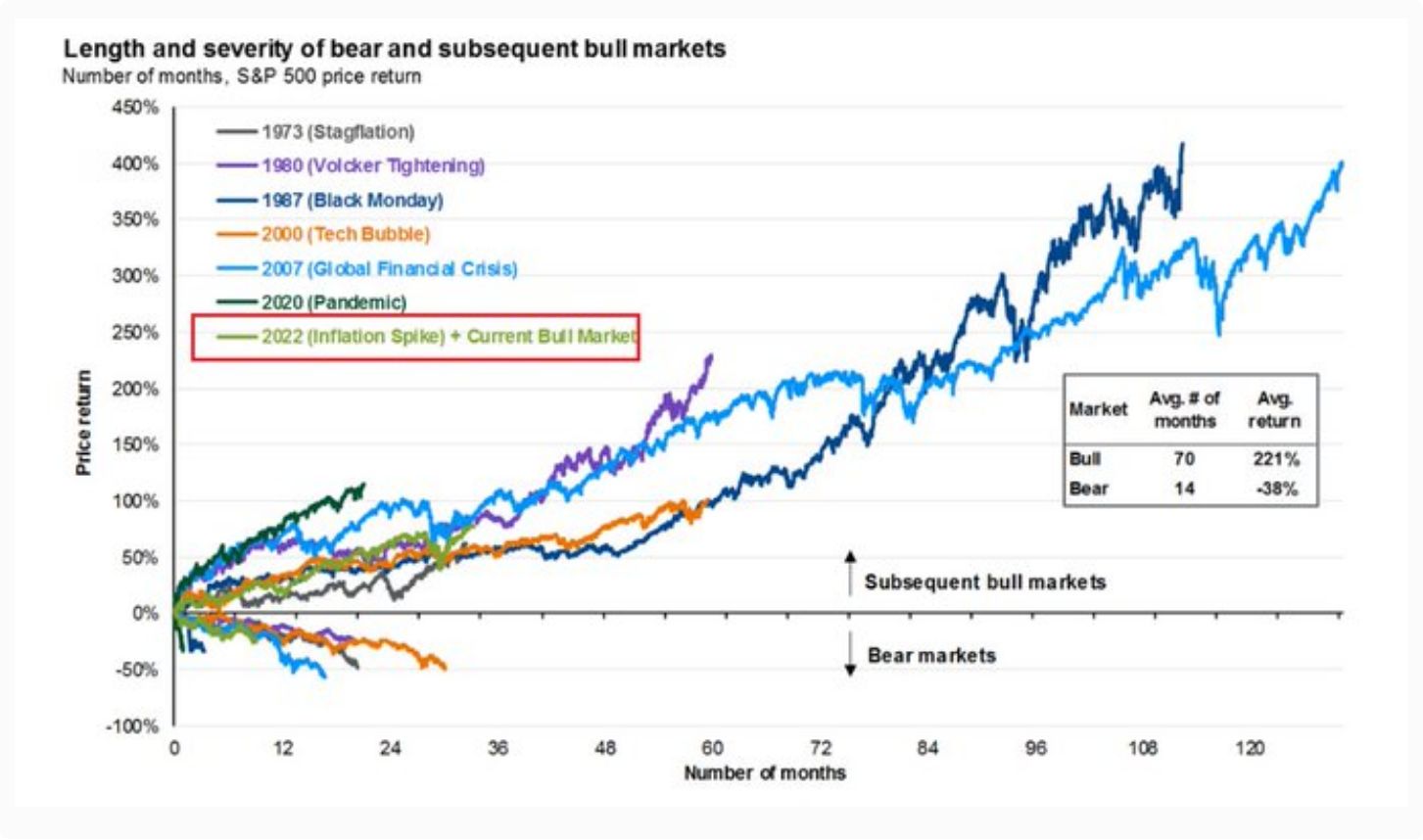

The provided chart, based on S&P 500 data from the U.S., offers a compelling visual of the market's cyclical nature.

Source : Mike Zaccardi on X

It tracks the duration and severity of various bear markets (below the zero line) and the subsequent length and gains of bull markets (above the zero line). Notable bear markets from 1973, 2000 (the "tech bubble"), and 2007 (the "global financial crisis") are shown to have seen declines of nearly 50%. The chart contrasts these with the powerful rallies that followed, such as a 100% gain after the tech bubble and a remarkable 400% gain after the 2007 crisis.

The Power of Patience

A crucial takeaway from this analysis is the disparity in both duration and magnitude between bear and bull markets. Historically, the average bear market has lasted about 14 months, with an average loss of 38%. In stark contrast, the average bull market has extended for roughly 70 months, delivering gains that are, on average, approximately five times the losses seen in the preceding downturn.

This suggests that the time and gains spent in a bull market far outweigh the pain of a bear market, making long-term participation critical for investors.

Rethinking Your Perspective on Market Dips

The natural human tendency is to feel disappointed when a portfolio is down, perhaps by 10%, 20%, or even more from its peak. However, this chart encourages a shift in perspective. Instead of focusing on temporary losses, one should look at a bear market or a period of consolidation as the foundation for the next major rally. The longer and deeper this consolidation is, the higher the bull market is likely to be when you come out of it.

Meme Of The Day

When the Indian market consolidates, which of the following best describes your investment strategy? |

|

Follow for Daily Market Updates and Insights

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply