- WeekendInvesting

- Posts

- Why Gold Outshone Equity Since 2000

Why Gold Outshone Equity Since 2000

Oil peaking above its 200 DMA

Market Update - Wednesday, 28 Jan

There is finally some current in the market as it takes off after digesting the news of the EU deal, with only two sessions remaining before the budget. Perhaps the biggest news is the rapid fall of the dollar index, which is now near 96 levels. Although the Indian rupee is not yet strengthening against the dollar, a falling dollar index suggests that flows toward emerging markets may increase, hopefully stopping outflows from the Indian market.

Taking a more cynical view of the situation, the EU deal must be ratified by the parliaments of all European countries. The extent of potential problems is huge, as every ratification point carries the risk of the deal being derailed.

One of the underlying back-burner stories is oil, which has been very steady near 62 dollars and is starting to peak above its 200-day moving average. Some experts believe that with fiat currency losing value and every asset class and commodity rising, oil will eventually join the party, making triple-digit oil possible in the near future.

Regarding market direction, the Nifty has avoided staying below the 200 DMA and is now above it, though it has not yet closed convincingly above a two-day high. Confidence in this rally remains tentative, but the Nifty was up 0.66% for the day.

Nifty Junior showed a nice move today above the 200 DMA with a closing above the two-day high, looking much better than the Nifty.

Mid-caps were up 1.6%, small-caps rose 1.92%, and Bank Nifty gained 0.66%.

Gold rose another 2.3% to 16513 per gram. As people become immune to the idea that gold only goes up, any future drop could cause significant trouble.

Silver corrected viciously two days ago but is now back near 354,000.

Other Market Triggers

Notable gainers included Bharat Electronics up 9%, ONGC up 8%, and Coal India up 5%, while Asian Paints, Maruti, and Infosys saw some selling.

In the Nifty Next 50, the heatmap was very green. CG Power had an amazing run up 9.6%, Solar Industries was up 9%, and HAL gained 6%.

STL Tech stood out as the mover of the day, jumping 20% on the back of good results.

U.S. Market Updates

In the US markets, the Dow Jones was down while the NASDAQ and S&P were up, with stocks like General Motors gaining almost 9%. While some of these are part of the Weekend Investing US strategy, they are mentioned for context and not as recommendations.

What to watch next ?

While oil companies like ONGC ran up sharply today, the sector is far from a bull rally; it is simply emerging from a position below the 200-day moving average.

This trend line is important to watch, as a breakout could signal a very meaningful move.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The Golden Decade(s): Why Gold Outshone Equity Since 2000

The 25-Year Reality Check

As we cross the 25-year mark of the 21st century (2000–2025), a deep dive into data from DSP Mutual Fund reveals a surprising trend. While investors often flock to the stock market for high returns, the real winner in many portfolios has been quietly sitting in the vault. In both Emerging and Developed markets, Gold hasn't just been a "safe haven"—it has been a top-tier performer.

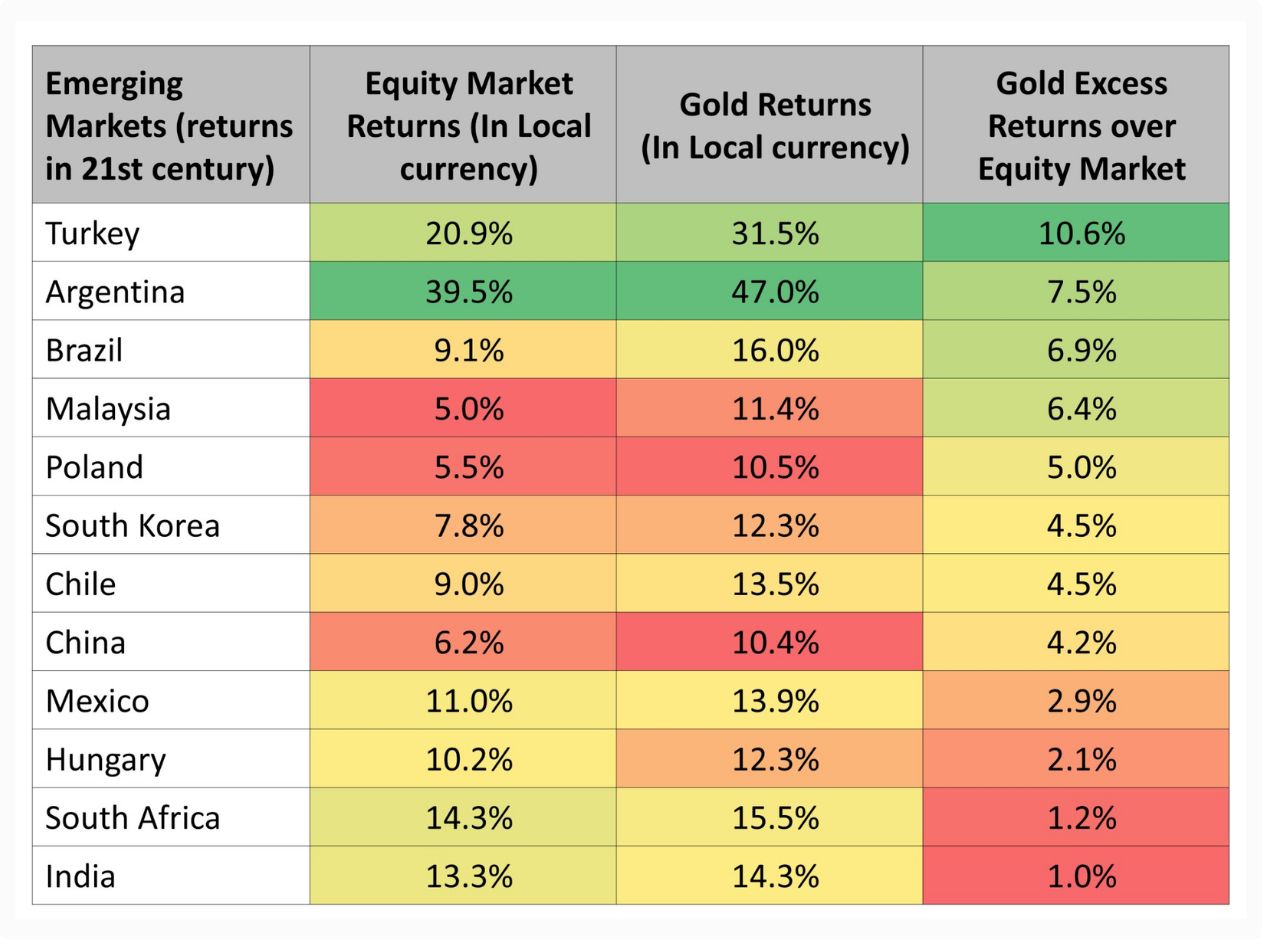

Emerging Markets: The Local Currency Factor

When we look at Emerging Markets (EM), the performance of Gold in local currencies has been staggering. Due to currency depreciation and economic volatility, Gold acted as both a shield and a sword for investors.

Source : DSP MF

In India, while equity returns of 13.3% are respectable, Gold actually edged ahead with a 14.3% CAGR. In hyper-inflationary environments like Turkey and Argentina, the gap was even wider.

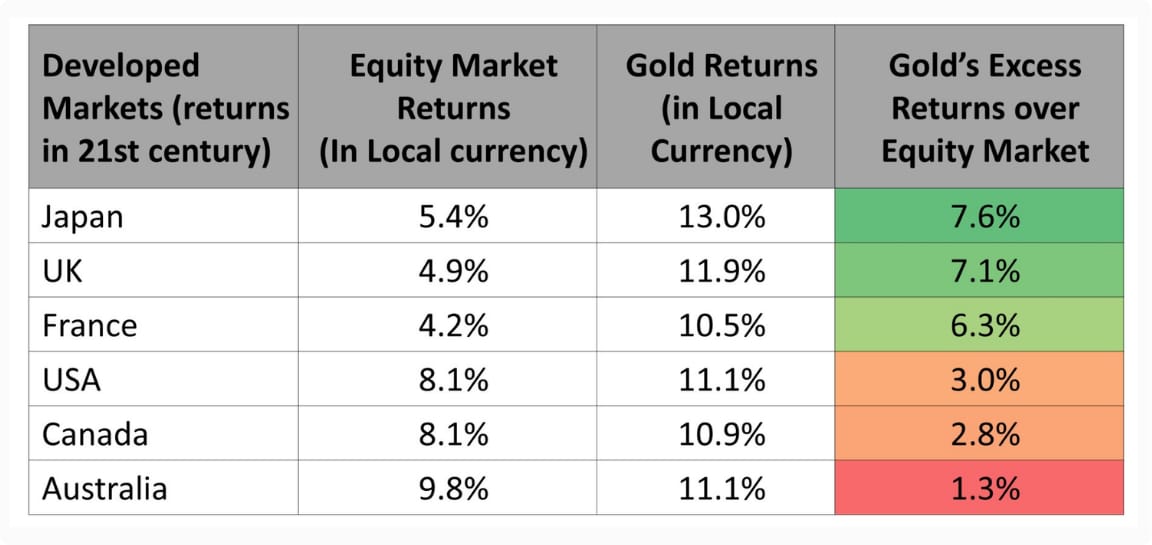

Even Developed Markets Aren't Exempt

It isn't just a "developing nation" story. High-performing, stable economies like Japan, the UK, and France saw a similar trend. In many of these regions, equity returns hovered around 4%, while Gold delivered nearly 10%.

Source : DSP MF

An excess return of 6-7% in a developed economy is a massive win.

It proves that Gold isn't just for "crisis" times; it's a long-term wealth compounder.

The Ultimate Portfolio Insurance

The takeaway is clear: Gold is the ultimate hedge. Whether you live in a booming economy or a struggling one, Gold provides a "cushion" that equity often cannot during periods of currency fluctuation or geopolitical stress. The data suggests that for the next 10 to 25 years, investors should reconsider their "Gold-to-Equity" ratio.

Meme Of The Day

Does the recent 25-year data (showing Gold outperforming Equity) change your portfolio strategy? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply