- WeekendInvesting

- Posts

- Why Markets are stuck in "Wait-and-Watch" mode?

Why Markets are stuck in "Wait-and-Watch" mode?

Good, Bad & Ugly Weekly Review

Hello, Investor !

Markets Overview

There have been significant geopolitical shifts unfolding globally, and these developments are increasingly influencing market behavior. We are seeing signals from multiple regions — Canada, China, and even Germany — where the German Chancellor has openly stated that Russia should be considered part of Europe and that friendly relations should be restored. The broader underlying theme here is that countries are actively trying to diversify and de-risk their dependence on the United States. Each nation appears to be working on a Plan B in case US trade access becomes constrained or weaponized, as has been witnessed earlier with countries like Venezuela and Iran.

Conversations around Cuba are also emerging, while Taiwan remains relatively insulated for now due to its trade alignment and investment commitments with the US. These shifting alliances and strategic recalibrations are dominating the global equity narrative, with new developments emerging almost daily and creating localized disruptions across markets.

For India, this evolving global backdrop has translated into a wait-and-watch phase. There is no decisive trend emerging yet, and markets seem to be in a holding pattern, reacting selectively rather than moving decisively. Each fresh geopolitical headline introduces uncertainty in one pocket of the market or another, making sustained directional conviction difficult.

Adding to this cautious tone, recent earnings from large heavyweight companies such as Infosys, TCS, Reliance, and HDFC Bank have been underwhelming. While these results have not triggered a sharp breakdown, they also haven’t provided the kind of positive surprise that would propel markets decisively higher. As a result, the market likely needs more time to consolidate, even though headline indices continue to hover close to their all-time highs.

Latest Daily Byte

It has been a volatile end to the week, shaped by a heavy flow of geopolitical and macroeconomic narratives. The global landscape is changing rapidly, with news that the US is requesting Taiwan to establish semiconductor factories domestically while simultaneously prohibiting certain Nvidia and AMD chips from being exported to China. In response, China has stated it will not allow those chips under any circumstances.

Further shifts are seen as the Canadian Prime Minister discusses a new world order in Beijing, and the German Chancellor expresses a desire for friendship with Russia, acknowledging its place as a European nation. While Iran previously dominated the headlines, oil prices have since cooled, and that situation appears to have moved to the back burner for now.

Amidst this global mayhem, the Indian rupee has started to slide again. Despite recent intervention by the RBI, significant changes are occurring while the markets remain somewhat stagnant.

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

You May Also Like

Compounding Explained Simply: Why Wealth Grows Fast Only in the Later Years | Why Multi Asset Investing Gives Better Returns Over the Long Term |

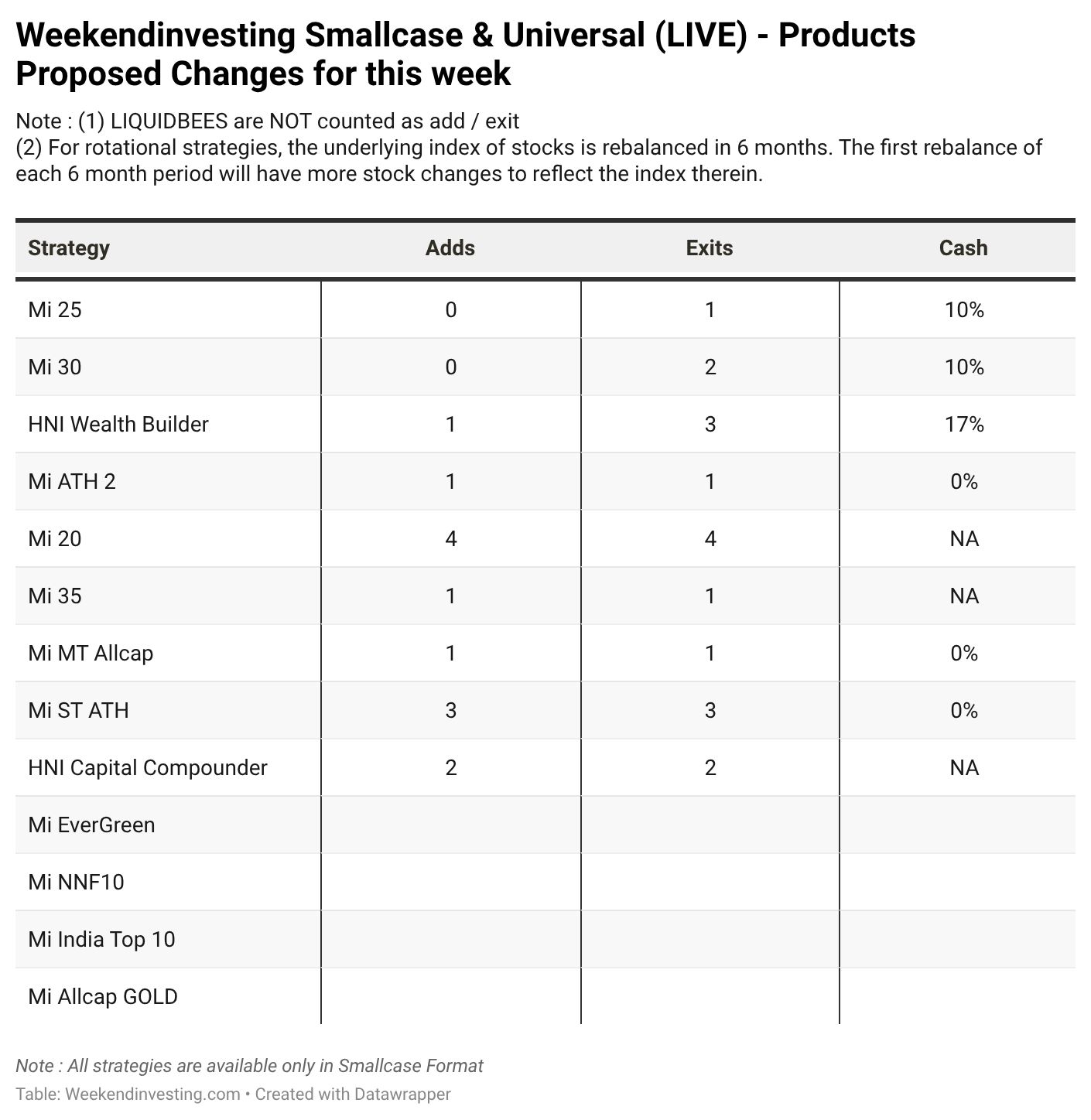

Rebalance Update for the week

Please write to [email protected] if you have any questions.

Reply