- WeekendInvesting

- Posts

- Why Small-Cap Falls Are Not a Big Reason to Worry

Why Small-Cap Falls Are Not a Big Reason to Worry

Riding the Cyclical Wave

Market Update - Tuesday, 09 Dec

Following the significant drop in micro caps and small caps yesterday, today's open for the broader market was also quite rough, with markets plunging lower in the morning.

However, there was a noticeable recovery after the first hour, particularly in small, mid, and micro caps, which ultimately ended the day in the green. Unfortunately, large caps didn't keep pace and actually saw a small decline.

Markets managed a comeback, closing about 100 points higher than their bottom today. It seems the two-day fall was simply too much for the market, leading to some relief rally.

The Nifty Junior was up half a percent, climbing nearly 1,300 points from its low of 66,403, which was a good recovery, but its weak structure persists.

Mid caps also rose by 0.37%, showing an identical pattern. It's possible we're forming a candle similar to what we saw in early November before a small upward move. Thursday's event will be crucial in determining this.

Small caps also pulled back nicely, moving from 15,860 to 16,200, though the overall downtrend remains intact.

The Nifty Bank was relatively flat, closing at minus 0.03%.

Gold has been absolutely flat for the last six sessions, forming a very flat, flag-like structure.

Silver inched up 0.3%, trading very near ₹179,000 per kilogram.

Other Market Triggers

Finding green on the Nifty heat map was difficult, with Shriram Finance, Titan, Adani Enterprise, Bharat Electronics, Adani Ports, and Eternal showing gains. The Nifty Next 50 heat map was much greener.

This highlights a distinct difference in movement between the Nifty 50 and Nifty Next 50, even though both consist of large-cap names.

Very few reds were visible in Nifty Next 50 space, , including Siemens, ICICI GI, Divi’s Lab, BPCL, JSW Energy, and Zydus Life.

Good recoveries were seen in Adani Power, Adani Green, Bank of Baroda, Canara Bank, PNB, and CG Power.

In the Mover of the Day segment, Kaynes Tech saw a significant move, recovering 13% today after having dropped roughly 30% in the last few sessions. This looks much like a dead cat bounce following such a massive fall, as the stock recently tumbled from nearly ₹8,000 down to ₹3,600.

U.S. Market Update

In the US markets during the previous session, indices were down mildly: S&P 500 at 0.3%, Dow Jones at 0.45%, Nasdaq at 0.1%, and Russell almost flat.

Stocks like Nike, Procter Gamble, Netflix, Tesla, and NextEra Energy lost between 3% and 3.5%. Some of these may be part of the Weekend Investing stock strategy in the US (note: these are not recommendations; please refer to the disclaimer).

What to watch next ?

The focus now shifts to Wednesday night, Indian Standard Time, when the US Federal Reserve will announce its decision on interest rates. This announcement could have major consequences for fund flows into emerging markets like India.

If the Fed announces a rate cut and indicates that more cuts are coming, we might see some stability return to the Indian market. However, this is merely a hope right now, as the current market structure remains reasonably weak.

Important Announcement

We’re launching Winvest Capital, our SEBI-registered Category III AIF that brings our rule-based momentum frameworks into an institutional-grade structure. And we’d love for you to be part of this journey.

We’re hosting an exclusive webinar covering our investment philosophy, AIF suitability for HNI/UHNI investors (>₹1 Cr), multi-asset allocation, risk management, and more.

📅 Saturday, 13 December 2025

🕚 11:00 AM IST (60 mins)

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

Riding the Cyclical Wave

Feeling the Small/Micro Cap Pinch? You Are Not Alone

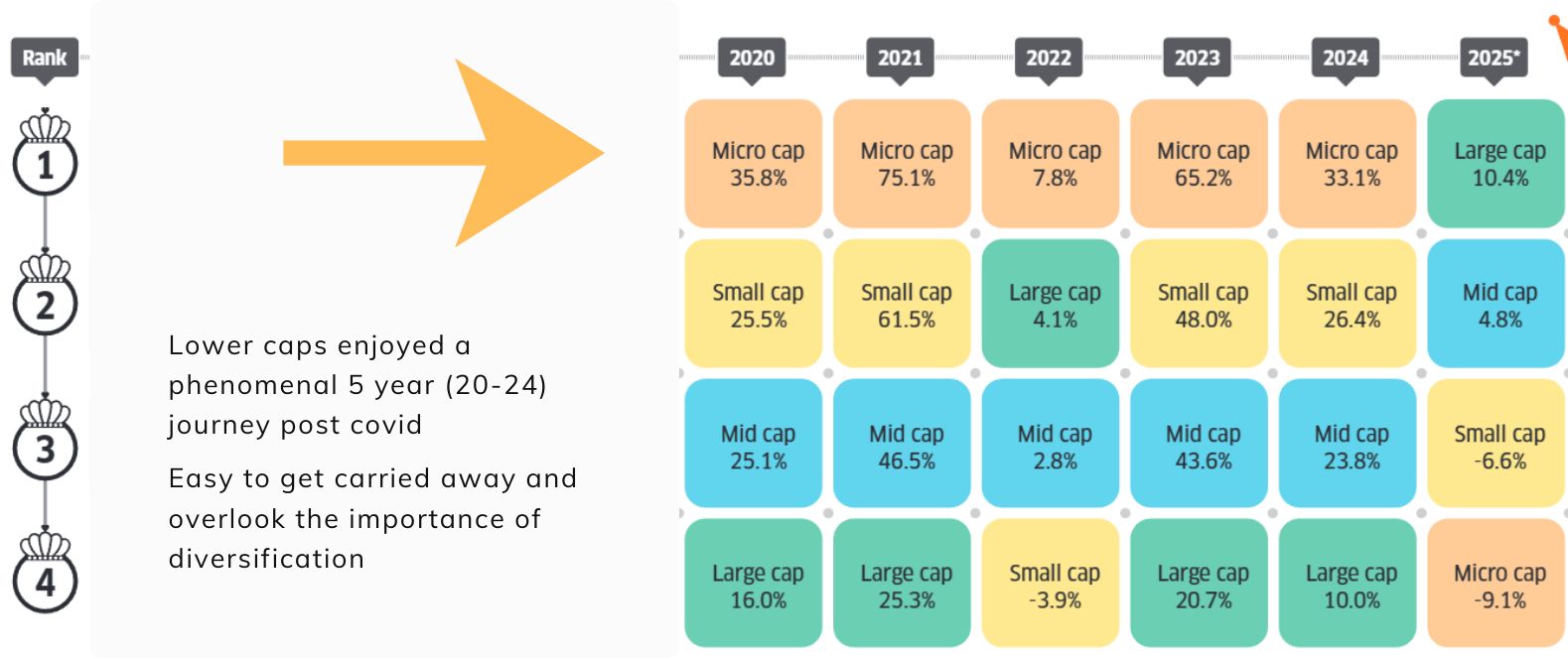

Many investors are currently expressing frustration with Small Cap and Micro Cap performance, with reports of portfolios dropping by 40% to 50%.

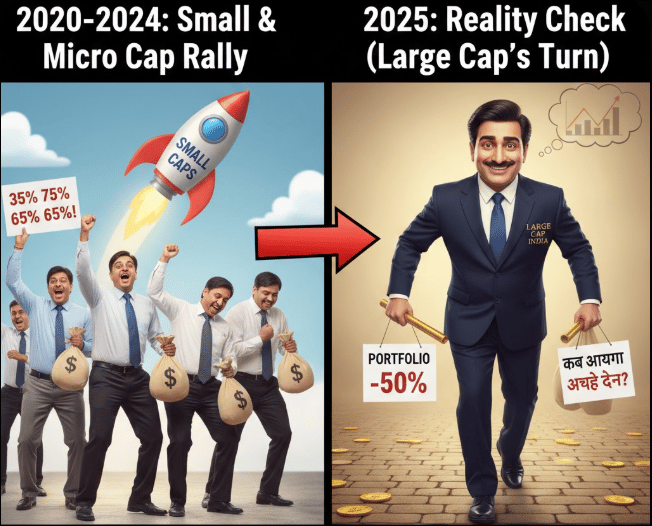

The Root Cause: Recency Bias: This widespread concern can be traced back to recency bias. The last five years (2020, 2021, 2022, 2023, 2024) saw exceptional returns from Micro and Small Caps:

Source : ET Wealth

The lingering memory of this stellar performance led to the expectation that 2025 would follow the same trend. Mid Caps performed well too, while Large Caps, initially weak, have recently shown improvement.

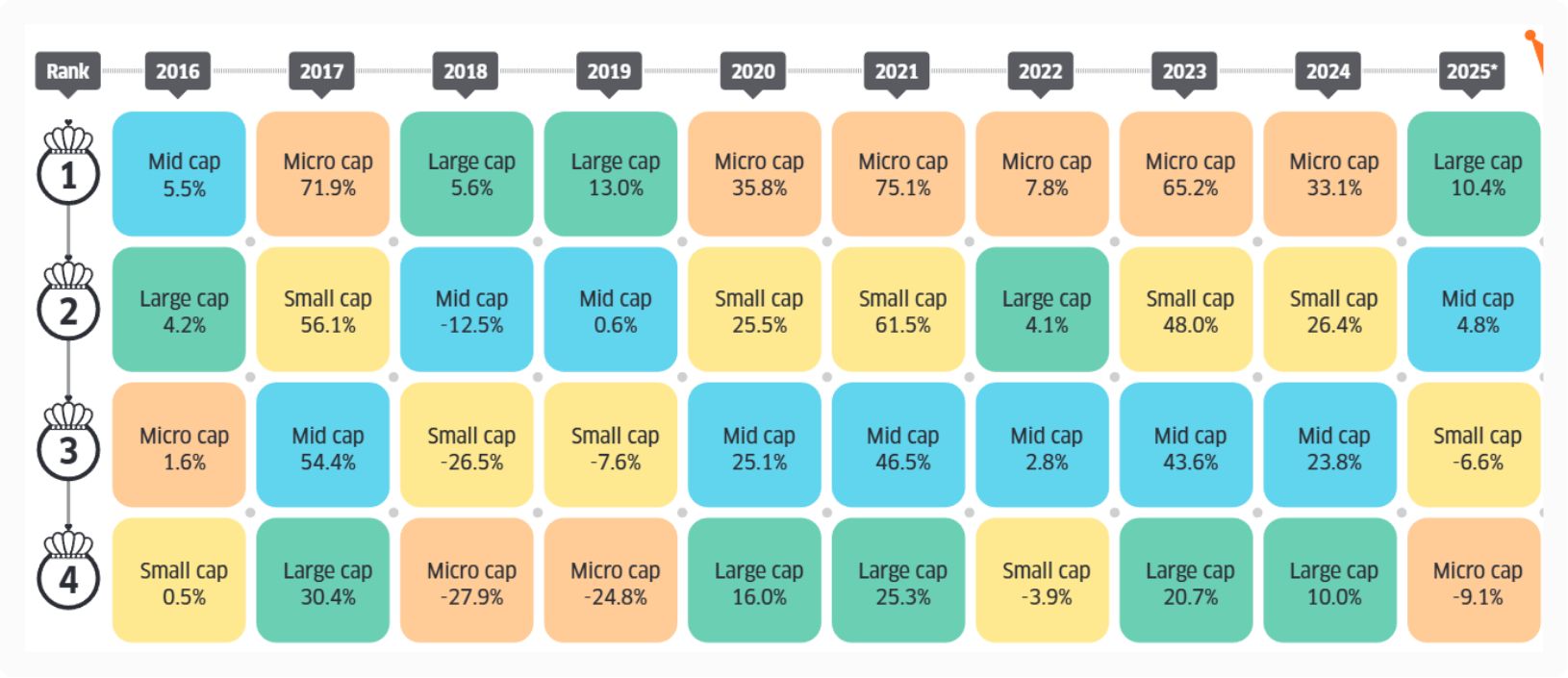

Understanding the Market as a 'Relay Race'

The larger picture reveals that the market is a cyclical relay race, where outperformance is passed like a baton:

Source : ET Wealth

“A passing on the baton, which happens in a relay race, will continue to happen. Sometimes Large Caps are up, sometimes Mid Caps, sometimes Micro Caps, and sometimes Small Caps are down.”

Current State: Small Caps are currently in a downturn this year.

Historical Precedent: This is a natural, cyclical phenomenon. Similar downturns occurred in 2018 and 2019, which were then followed by two fantastic years. There is no reason for deep disappointment; the cycle will eventually turn. Small Caps might be down for another year or two, but they will rebound.

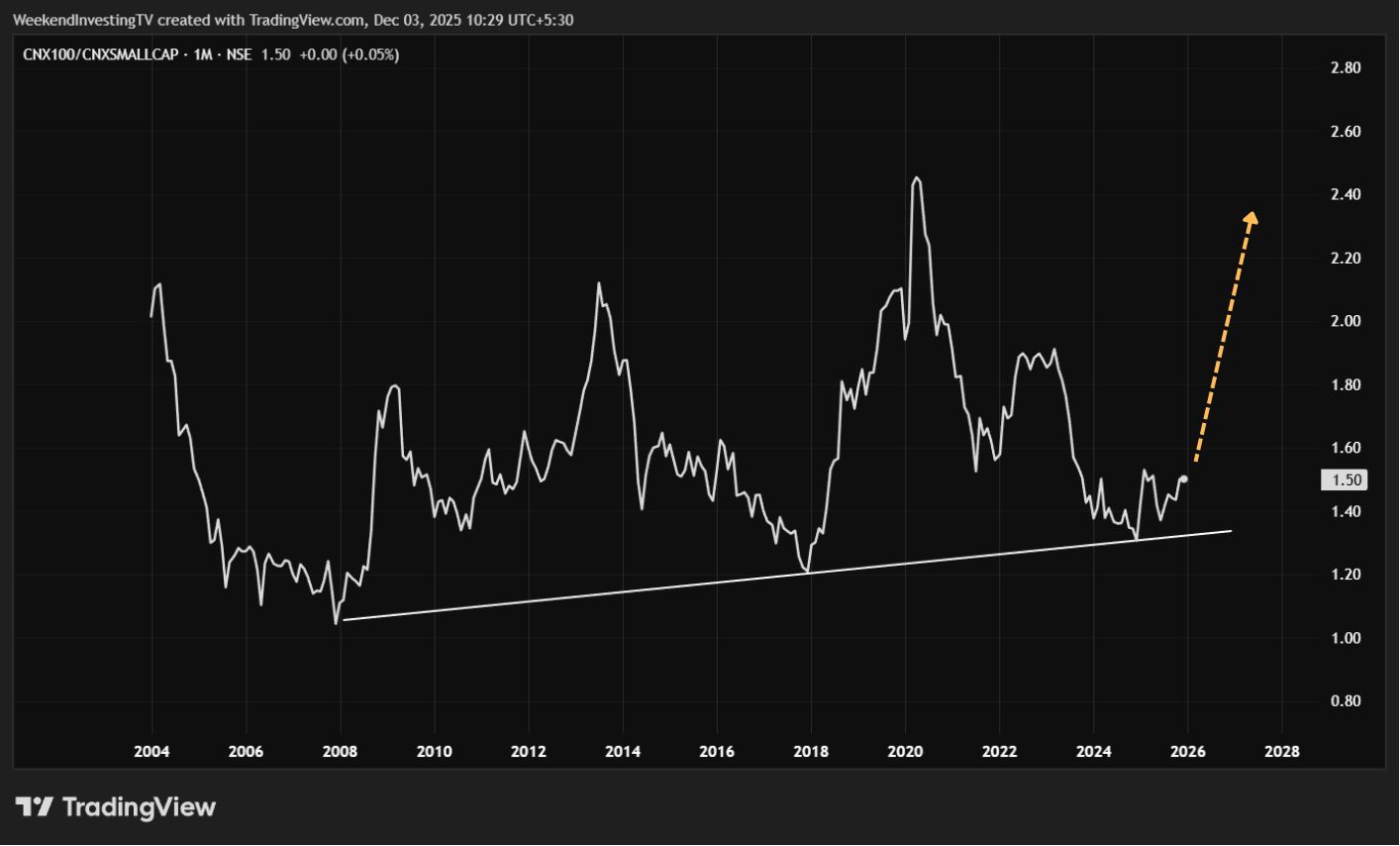

The Large Cap to Small Cap Ratio Chart: What It Tells Us

Observing the Large Cap to Small Cap Ratio chart provides crucial context. This ratio typically fluctuates between approximately 1.2 and 2.0 over a twenty-year period.

The Shift in Favour:

2020 - 2025 (Ratio Falling): Small Caps were in favour relative to Large Caps. (Note: This doesn't mean Large Caps were falling, but Small Caps were growing much faster).

Currently (Ratio Rising): We are now seeing a shift in favour of Large Caps.

Future Outlook: Over the next one or two years, Large Caps might grow faster than Small Caps. This could mean Large Caps surge, or both segments grow, but Large Caps slightly outpace Small Caps.

Key Learning: Embrace Strategic Allocation over Guesswork

The core learning is to treat investing not as a game of chance (तुक्केवाजी - guesswork) but as a strategized, standardized approach. This strategic mindset is your best defense against cyclical downturns.

Meme Of The Day

What is your primary investment strategy for the next 12-18 months? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply