- WeekendInvesting

- Posts

- Why the Top 25 Companies Are Crushing the Rest

Why the Top 25 Companies Are Crushing the Rest

The Great Market Divide

Market Update - Thursday, 04 Dec

The market continues to exhibit a dullness and is in a completely disinterested state. No sector or part of the market is showing a willingness to move up. The rupee, being at or around 90, has completely dominated the market narrative.

There are very few encouraging cues in the market. While emerging markets are generally receiving flows, India is suddenly slumping badly across all parameters. Foreign direct investment (FDI), Foreign Institutional Investor (FII) flow, and even overseas NRI flows coming into the country have not kept pace with the usual percentage gain.

There is a lull in inflows, but outflows continue because India has to buy crude oil, and Indians consistently buy gold, resulting in a persistent trade deficit.

The Nifty moved up by a marginal 0.18%, but the overall market sentiment remained very dull across the board.

Nifty Junior showed a small gain of 0.23% after a big beating in the previous session.

Mid-caps were slightly negative at 0.04%, and small caps continued their fall at 0.24%. The small cap space is currently in a very critical zone. The 16,500 level has historically served as a support, and if it breaks, confidence in the small cap space will likely diminish for some time.

Nifty Bank was also completely flat, down 0.1%. The market is clearly searching for something to latch onto—a cue to hold on to—but none is currently available.

Gold is slipping 0.26% to 12,877, and silver is dropping 1.81% to 176,000.

The USD/INR is retracing slightly from 90.43 to 89.94.

Other Market Triggers

IT stocks continued to run up on the expectation of a falling rupee. Some banking and finance stocks perked up, and energy stocks like ONGC, Coal India, and Power Grid did well.

Reliance was down 0.21%, but it is looking not so bad and is initiating the IPO process for Reliance Jio, which should provide a good boost in the coming times. Mahindra & Mahindra, Bajaj Auto, ITC, Sun Pharma, Bharti Airtel, and JSW Steel were among the stocks moving.

Indigo was down nearly 3% due to the fiasco at Indian airports, likely stemming from a monopolistic situation where most flights are operated by Indigo and Air India (now private with the Tatas). On most sectors, there is a monopoly or duopoly, causing issues in the airline space.

The Nifty Next 50 heat map had some gainers, including LTIM, Naukri, HAL, ABB, Motherson, Siemens, Britannia, and Torrent Pharma.

However, power stocks like Adani Power, Enrin, and JSW Energy, along with IOC, BPCL, and Bajaj Holdings, lost ground, resulting in a mixed bag for the Nifty Next 50.

In the Mover of the Day segment, Hind Copper performed well, gaining 7.83%. This is because copper prices are rising, and the move that began in precious metals is gradually percolating down into other metal regions. Hindustan Copper is benefiting from rising copper and silver prices.

U.S. Market Update

In the previous US market session, the Russell 2000 performed very well, up 1.8% to 1.9%. The Dow Jones was up 0.86%, and the S&P 500 and NASDAQ also saw minor gains.

The US market is showing great strength. Bristol Myers Squibb, UnitedHealth, Accenture, Texas Instruments, and Tesla were the big gainers. Some of these stocks could be part of the Weekend Investing US stock strategy, but this is a disclaimer and not a recommendation.

US markets have done reasonably well this year, while Indian markets have basically gone flat.

What to watch next ?

There are significant rumors suggesting the US-India tariff deal is now on the back burner, particularly because President Putin is visiting India, and some major deals are likely to be signed with him. This is expected to further antagonize the U.S. team.

Historical studies have shown that whenever the USD/INR starts to move, it moves by an average of about 18%. This time, we have already moved about 8%.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

The Great Market Divide: Why the Top 25 Companies Are Crushing the Rest

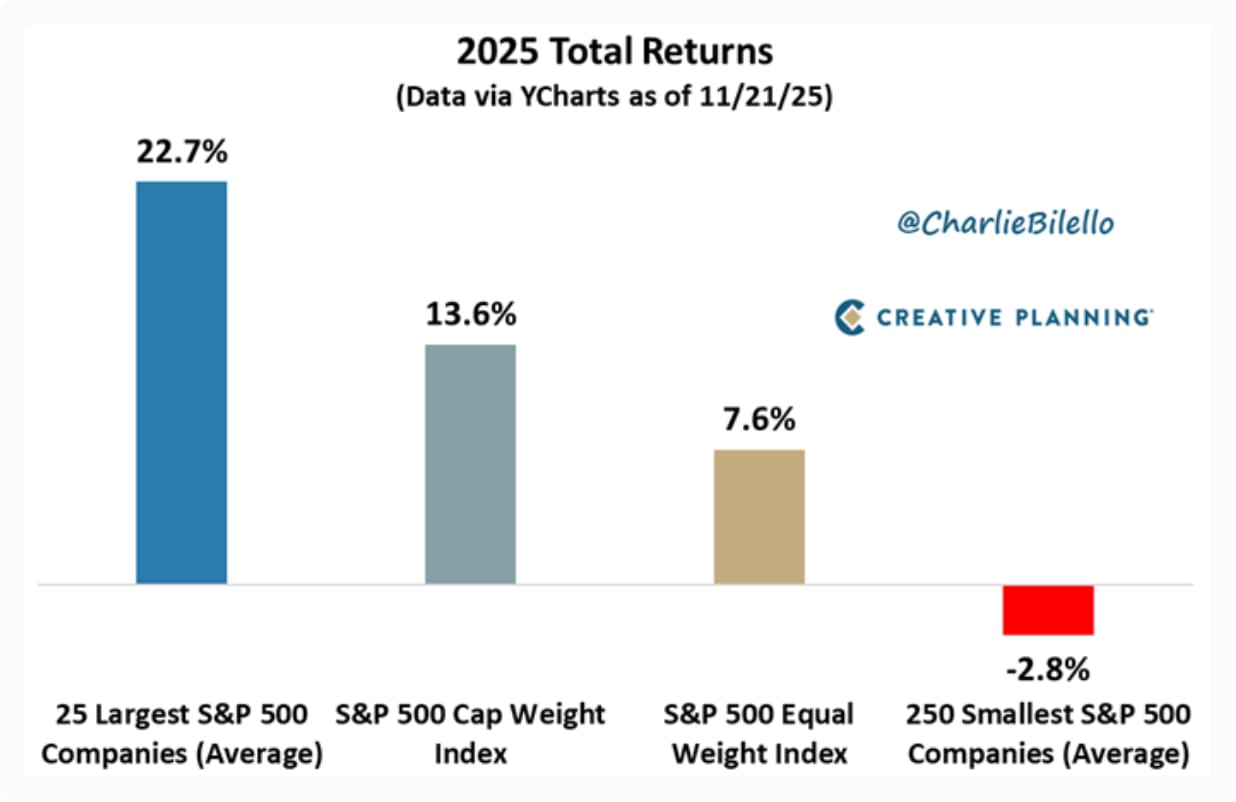

We have some compelling data to share with you today, sourced from the account of Charlie Bilello of Creative Planning. The chart we are analyzing illustrates the total returns of the US markets for 2025, highlighting a significant divergence in performance based on company size and index weighting. This pattern appears to be playing out in both the US and Indian markets.

Source : Creative Planning

📊 The 2025 US Market Performance Snapshot

The data reveals a stark contrast between the largest market players and the rest of the pack in 2025:

The Top 25 Largest Companies: These market giants generated an impressive 22% average return.

S&P 500 Overall Index (Market Cap Weighted): The broad index delivered a return of 13.6%. Its weighting naturally gives higher influence to the largest companies, pulling the overall return up significantly.

S&P 500 Equal Weight Index: When all constituents are given equal weighting, the return drops dramatically to 7.6%.

The Smallest 250 S&P 500 Companies (Lowest Market Cap): This segment actually saw a negative return of -2.8%.

🌍 A Global Phenomenon: Divergence in Top Performers

The most crucial observation is the massive gap and deviation between the returns of the largest companies and the smallest S&P 500 companies.

The Market Cap Weighted S&P 500 index performs significantly better than the Equal Weight index primarily because the overwhelming returns from the Mega-Cap companies carry the entire index.

This pattern is being repeated in India as well. While the top 50 companies (Nifty) and the top 250 companies overall are performing quite well, the subsequent 250 companies (which are effectively small-cap stocks) are lagging, with many far from their all-time highs.

A major divergence has been created between the top-performing companies and the rest of the market, even within the top 500 stocks. This phenomenon is clearly playing out in both the US and India.

💡 Potential Reasons: Fund Flows and Investor Behavior

Why is this divergence happening? The likely explanation points towards the direction of capital flows:

Institutional Fund Flow: It appears that a majority of the institutional money is being directed toward the top companies (Large-Cap/Mega-Cap). These firms are often seen as safer bets, especially in uncertain economic climates.

Retail Investor Flow: Conversely, retail money tends to chase higher potential returns in smaller companies (Small-Cap/Mid-Cap). When these smaller companies underperform, the divergence widens.

This pattern of fund allocation is contributing significantly to the current market disparity.

Meme Of The Day

Given the stark divergence where the Top 25 largest US companies returned 22% while the smallest 250 S&P 500 companies returned -2.8% (a pattern also seen in India), how do you plan to adjust your investment strategy? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply