- WeekendInvesting

- Posts

- Why This Bull Market Might Just Be Getting Started

Why This Bull Market Might Just Be Getting Started

A Look at Global Trends

Monday, 20 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The festive spirit has clearly lifted the mood in the markets. Over the past few sessions, we have seen a strong surge in stocks, driven by positive sentiment and optimism.

Every marketplace has been buzzing, showing that Indian consumerism remains strong and steady. Corporate earnings have also come in better than expected, adding to the upbeat tone.

One major piece of news that boosted sentiment was the direct investment in RBL Bank, which has sparked optimism for more such inflows into smaller private banks. Overall, the markets are in a bright, cheerful mood.

Gold and silver have cooled off slightly over the past two days, though the broader rally still looks intact. The Nifty has now been in the green for four consecutive days, showing solid strength this October — a month that usually tends to be volatile.

Today, Nifty gained 0.5%, while the Nifty Junior was flat, and midcaps rose 0.6%. Small caps were also slightly up, though still behind the larger indices.

The Bank Nifty closed above 58,000, up 0.55%.

Gold remained flat, up just 0.17%, but importantly, it hasn’t had two consecutive down days in a while.

Silver, too, has been steady around the ₹75,000 mark, holding on to most of its gains.

Other Market Triggers

Reliance led the rally with a 3.53% gain after strong results, followed by Bharti Airtel at 1.96%.

State Bank, Bajaj Finserv, Axis Bank, and TCS also performed well. However, ICICI Bank and HDFC Bank saw muted reactions post-results.

In the Nifty Next 50, Adani Power continued its strong run, while PSU banks like Bank of Baroda, PNB, and Canara Bank were on fire.

Cement and Commodity stocks saw some profit-taking, with names like Hindalco, Voltas, D’Mart, and Varun Beverages among the losers.

Among the big movers, Tejas Networks plunged 8.48% after weak quarterly results, continuing its downtrend from previous months.

On the other hand, South Indian Bank jumped 16% after strong earnings, rising from ₹28 to ₹38 in no time.

U.S. Market Update

In the US, markets also remained firm in the previous session. The S&P 500 and Dow Jones both advanced, while Nasdaq 100 gained and small caps slipped slightly by 0.6%. Despite political protests against Trump, the markets remained unaffected.

American Express surged 7%, Gilead gained 4.2%, Capital One rose 4%, and Tesla advanced 2.4%. The sentiment remains positive across global equities.

What to watch next ?

The hope that Indo-US tariffs will soon be resolved has added to the enthusiasm. Consumer spending has also been remarkable, with massive car and mobile sales during Dhanteras.

The Nifty is now very close to its all-time high, while the Bank Nifty has already hit a new record. Mid and small caps are still lagging but seem to be setting up for their next move.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

New Strategy Announcement

Introducing All Seasons — Growth When You Need It, Stability When It Matters Most

A dynamic strategy that blends Nifty 50 (growth) and Gold (stability) — adjusting fortnightly to market conditions so you can stay invested through every phase without emotional decisions.

Growth with Nifty 50 — India’s top 50 companies driving long-term wealth.

Stability with Gold — a proven hedge during crises.

ACTUAL PRICE : ₹4,999 / year

DISCOUNTED PRICE : ₹250 / month

LAUNCH OFFER : 40% OFF for life (including all renewals) — use code SEASON40

VALID TILL 21 Oct 2025 (Tuesday)

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

What To Read This Week ?

Why This S&P 500 Bull Market Might Just Be Getting Started

The Historical Case for Higher Ground

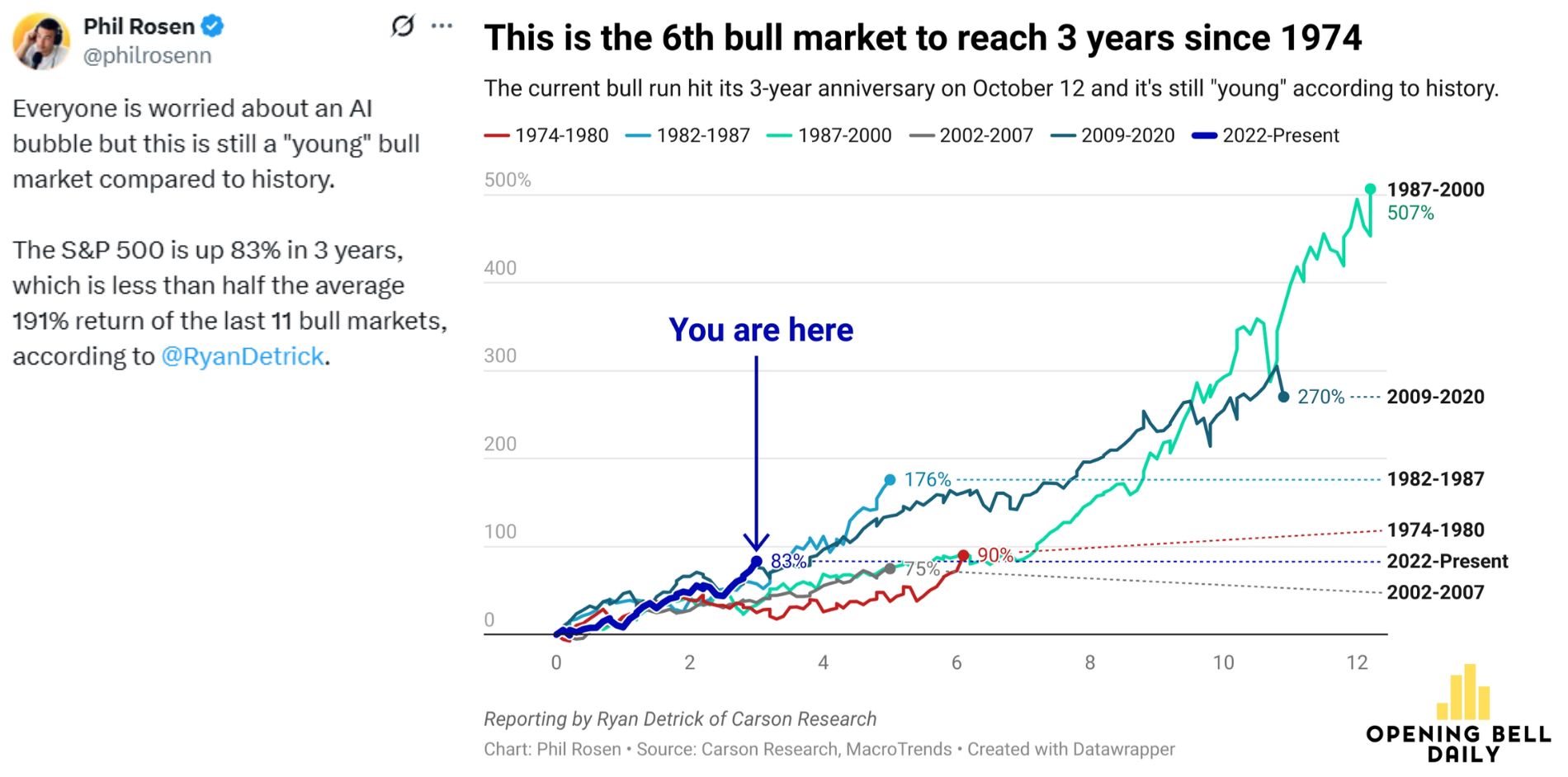

The primary concern among investors today centers on the longevity of the current rally, often bundled with the looming narrative of an "AI bubble". However, a historical perspective suggests that the current bull market in the S&P 500 is still relatively young and has considerable room to run.

The current run, spanning from 2022 to the present, is sitting at approximately 83% in total gains. When compared to previous bull cycles over the last 45-50 years, this figure appears quite modest.

Source : Phil Rosen on X

The thesis, therefore, is that a move of 83% is not "out of the usual" but rather a typical, continuing phase in a broader cycle that could reasonably extend to 150%, 200%, or even higher, aligning with historical precedent.

Index Resilience: Shrugging Off Global Headwinds

Despite a relentless stream of negative news—ranging from tariff escalations to supply chain disruptions and geopolitical turmoil—global equity indices are displaying remarkable strength. The market's behavior is often the clearest indicator of underlying sentiment, and currently, that message is one of non-weakness.

Across major indices, including the India market and the S&P 500, prices remain within a few percentage points of their all-time highs. This sustained resilience, where significant downside pressure fails to push the index substantially lower, is a powerful signal. It tells us that capital is actively defending these levels.

The "Small Trigger" Theory

When a market inherently resists selling pressure, the balance shifts dramatically in favor of the upside. The market is effectively suggesting it "doesn't want to go down."

This is the foundation of the "Small Trigger" theory:

Downside Pressure Absorbed: The market has absorbed significant negative catalysts without collapsing.

Upside Potential: It now requires only a very small positive trigger to push prices to new all-time highs (e.g., on the Nifty or S&P 500).

This underlying structural strength suggests that, based purely on technical observation and historical context, investors are currently in a reasonably safe position and the pessimistic narrative surrounding a market crash or an imminent AI bubble burst may be premature.

Meme Of The Day

Do you agree with the historical analysis that the current S&P 500 bull market (up ~83% since 2022) is still young? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply