- WeekendInvesting

- Posts

- Why Your "Break-Even" Strategy is Costing You a Fortune

Why Your "Break-Even" Strategy is Costing You a Fortune

The 18-Year Wait

Market Update - Tuesday, 27 Jan

The market opened following a long weekend with expectations of a robust upward move. Two primary factors fueled this optimism: indications from the Trump administration regarding the potential removal of additional tariffs on India, and the formalization of the Free Trade Agreement (FTA) between India and the European Union. The EU deal is a landmark achievement, and the government deserves congratulations for reaching this milestone.

Despite these positive developments, the market's response was surprisingly muted and somewhat disappointing. One might have expected these news items to signal a market bottom and spark a pre-budget rally. However, the limited quantum of today's move suggests underlying weakness.

As the day progressed, silver saw extraordinary volatility, jumping from Friday’s close of roughly $89 to $117 before experiencing a 15% intraday drop. Interestingly, this massive correction is hardly visible on the long-term charts, suggesting that the upward trend in precious metals remains intact.

Investors are encouraged to follow price signals rather than narratives; currently, silver would likely need to drop below $100 to signal a true corrective mode.

The Nifty gained a modest 0.51% today, remaining nearly 1,400 points below its recent peak.

The Nifty Junior and Mid-cap indices followed a similar flat trend, rising 0.66% and 0.53% respectively, while Small-caps rose marginally by 0.2%.

The standout performer was the Nifty Bank, which gained 1.25% and recovered nearly all of its previous day's losses. This strength is primarily driven by the PSU banking and small finance space, though private banks have yet to catch up.

In the commodities space, gold continues its ascent to 15,926, and silver is up approximately 45% in just one month. These are once-in-a-century moves that signal a potential realignment of global power and economic orders.

Other Market Triggers

In terms of individual stocks, Kotak Bank fell 3.3%, and Mahindra & Mahindra dropped 4% on concerns that the EU deal would bring cheaper competition.

Such fears appear misplaced, as the duty changes involve completely built units, making it an "apples to oranges" comparison.

Conversely, JSW Steel, UltraTech Cement, and TVS Motors performed well. State Bank of India saw fantastic gains, and Adani stocks recovered after denying recent charges.

In the Nifty Next 50, Vedanta and various oil stocks showed strength, while DLF climbed 3.59% following positive management commentary.

On the downside, JSW Energy fell 8%, joined by losses in Hyundai and Naukri.

U.S. Market Updates

Looking at global cues, US markets saw mixed results on Monday; while the Dow and Nasdaq rose nearly 0.5%, Intel dropped 5.7%, and Nvidia and Tesla also traded lower. While some of these are part of the Weekend Investing US strategy, they are mentioned for context and not as recommendations.

What to watch next ?

Typically, markets build anticipation leading up to the budget, but the current stagnation suggests either significant investor caution or fears of unfavorable news.

On a technical note, the Nifty managed a small "saving grace" by closing slightly above its 200-day Moving Average (DMA) after having closed below it the previous session.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The 18-Year Wait: Why Your "Break-Even" Strategy is Costing You a Fortune

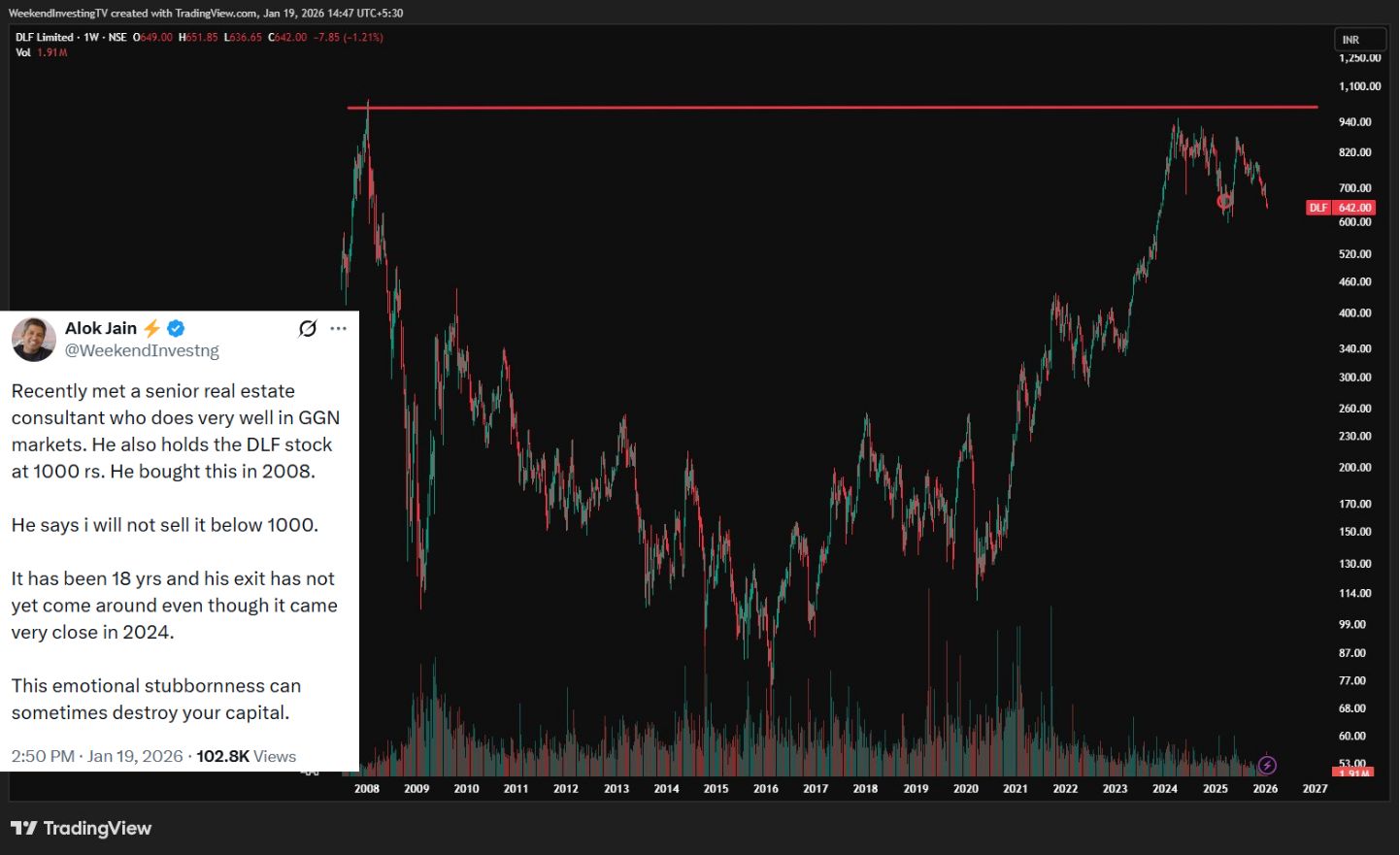

The Ghost of 2008

Imagine buying a stock in 2008, watching it plummet, and then waiting nearly two decades just to see your initial investment again. That is the reality for many investors in DLF Ltd. From its IPO glory days of ₹1,100, the stock crashed to double digits (₹60-80), teased a recovery at ₹950, and currently hovers around the ₹640 mark.

The Invisible Thief: Opportunity Cost

While our friend was waiting for DLF to return to ₹1,000, the rest of the market didn't hit the pause button. Let’s look at the "Opportunity Cost" he paid:

Nifty in 2008: ~6,000

Nifty Today: ~26,000

The Reality Check: An investment in the broader market would have grown 4x (400%).

By staying stubborn, he didn't just lose money on DLF; he lost the chance to quadruple his wealth elsewhere. Even if DLF hits ₹1,000 tomorrow, the purchasing power of that ₹1,000 has been eroded by 18 years of inflation. ₹1,000 in 2008 bought a lot more than it does in 2026.

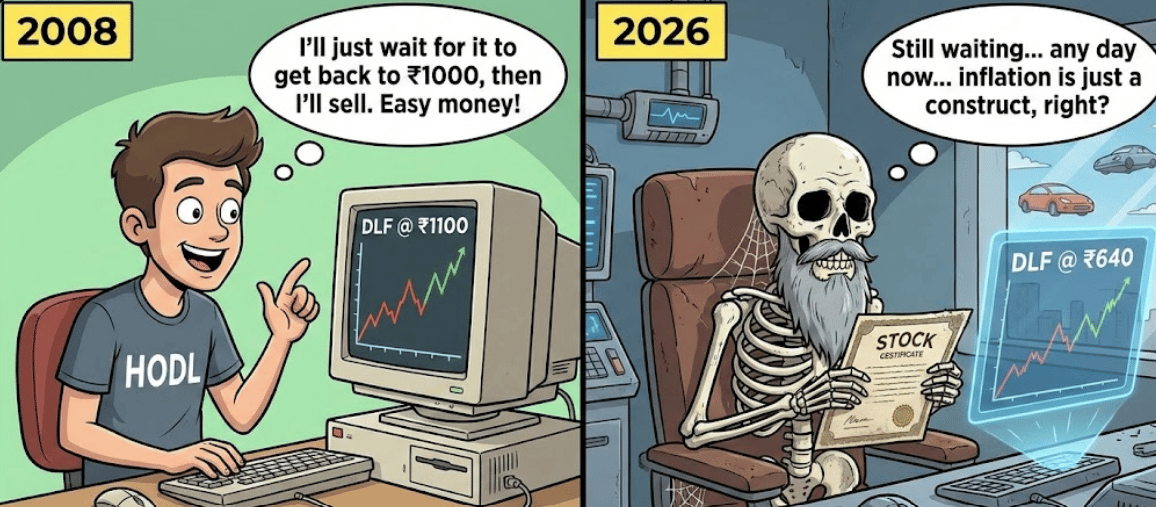

The Ego Tax in Investing

Market behavior is often more about psychology than math. Investors often fall into the trap of "Stubbornness" or "Ego-driven investing." We treat our entry price as a sacred boundary that the market must respect.

The Market doesn't care what you paid. It doesn't owe you a return to your "cost price." When you refuse to sell a stagnant or declining asset, you are essentially "locking" your capital in a prison of your own making.

Stop-Loss: Not Just a Number, But a Mindset

To avoid the 18-year trap, you need a pre-defined exit strategy. Whether it is 20%, 30%, or 40%—decide your "pain threshold" before you enter.

If a stock hits that point, exit, breathe, and take a fresh view. Ask yourself: "If I had cash today, would I buy this stock at its current price?" If the answer is no, why are you still holding it? Concentration in a single stock without a reality check isn't investing; it's a gamble against time.

Meme Of The Day

Question: Your stock is still 30% below your buy price after 10 years, but the Nifty has doubled. What do you do? 📉 |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply