- WeekendInvesting

- Posts

- Why Your Portfolio Needs More Than Equities

Why Your Portfolio Needs More Than Equities

The Smart Way to Invest (Beyond Stocks)

Wednesday, 6 Aug 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

The markets continued to remain weak today, clearly struggling under the pressure of fresh global tensions. Former U.S. President Donald Trump has again made headlines with more aggressive statements.

In the last 24 hours, he claimed that Indian drone components were found in Russian drones used in the Ukraine war, and now, there’s talk of tariffs up to 250% on Indian pharma and other products.

The Nifty index is inching closer to a key support zone around the 24,400 mark. The closing today was very close to the day’s low, suggesting no real strength during the session.

Nifty Next 50 also closed near previous support levels, down 0.87%.

Midcaps were down 0.9% and Smallcaps dropped 1.2%, just below their last swing low.

Bank Nifty was the only one that remained flat, closing up just 0.09%.

Even gold, which recently crossed ₹10,100 per gram, failed to break out above resistance and closed lower at ₹10,048, down 0.73% for the day.

Other Market Triggers

Britannia, despite posting a rise in Q1 profit, fell 4% as the numbers were below market expectations.

Canara Bank, on the other hand, gained 1.22% after transferring unclaimed deposits to a specified fund, which may have triggered some investor interest.

What to watch next ?

While India’s exports to the U.S. may only form around 2% of the total, the fear is more about what else could happen.

In this kind of vulnerable global situation, any major country can use various pressure tactics—be it visa restrictions or limiting business access.

Small and mid-cap stocks are dangerously close to their recent support levels. If these supports break, it could lead to a deeper correction and a longer period of consolidation before any recovery.

In Nifty 50, It feels like we’re waiting for one final trigger—either a positive surprise that holds the market up or another blow that finally breaks support and pulls everything lower.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Top Trending Strategies

Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

| MI_NNF10Strongest top 10 stocks from the Nifty Next50 Index | Rotates into trending Sectors | Monthly Rebalanced Mi_NNF10 is a dynamic strategy which aims to outperform the underlying benchmark Nifty Next 50. These are the 50 large caps which have potential to enter Nifty at some point. This product is suitable for use in all stages of the market cycles as its design is to remain invested in the strongest 10 stocks in the pack regardless of market conditions.

|

What To Read This Week ?

Beyond Equities: The Power of Asset Allocation

Today, let's talk about a core tenet of long-term investing that many seem to have forgotten: asset allocation. While the markets have been fantastic over the last decade, history shows us that periods of market upheaval are not only possible but inevitable. Just as we buy insurance for our cars or health, asset allocation is the insurance for your portfolio.

The Comfort of a Well-Diversified Portfolio

The primary purpose of asset allocation is to provide your portfolio with a buffer against volatility. Even if equities remain stagnant for five or ten years—which has happened in the past—other asset classes can step in to provide buoyancy and keep your overall portfolio healthy. This makes your investment journey smoother and less stressful.

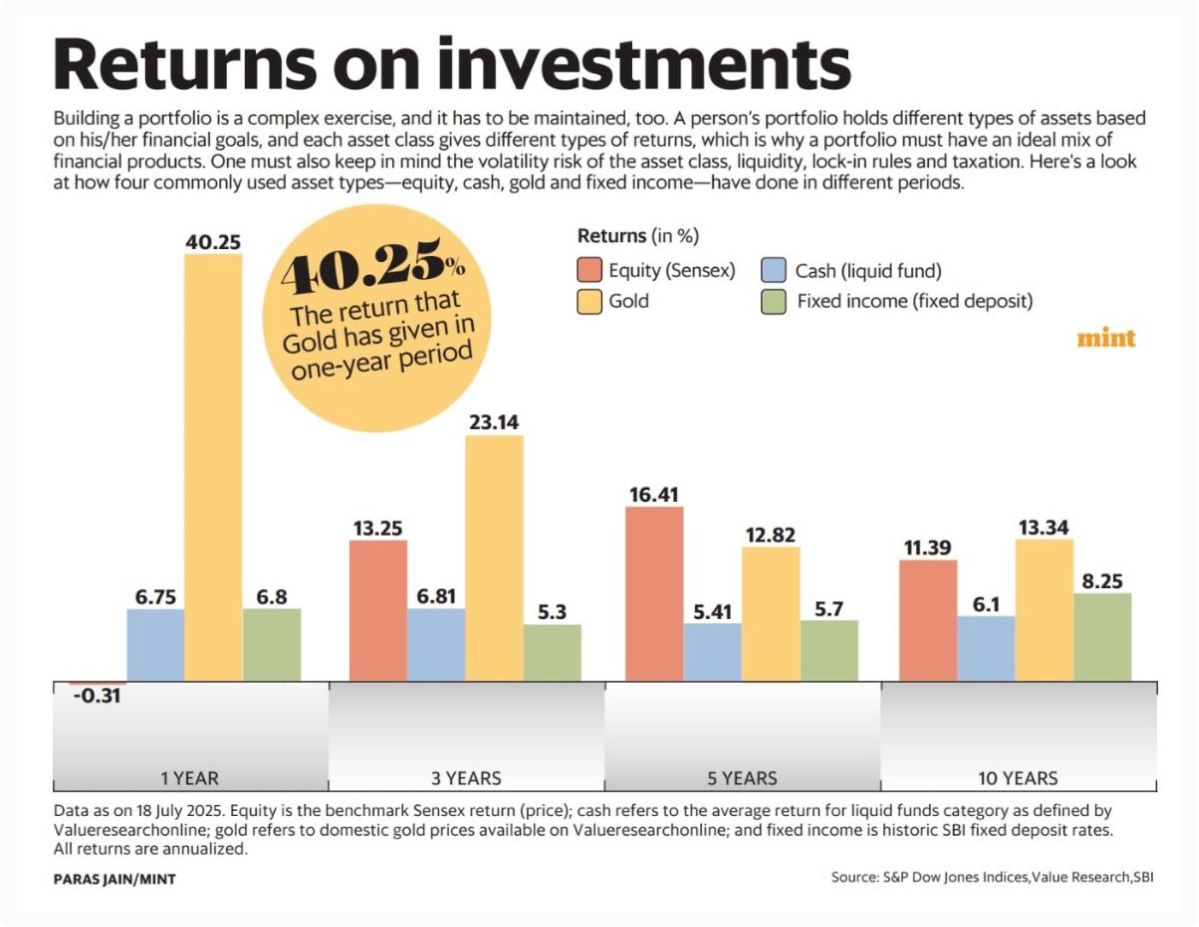

Source : Paras Jain (Mint)

The Above infographic from Nuvama highlights this perfectly by showcasing the performance of four asset classes: equity, gold, cash (liquid funds), and fixed income.

In the last year, gold returned 40%, while equity was down 0.31%.

Over three years, gold's cumulative return was 23% per year, outperforming equity's 13%.

Over five and ten years, the returns of gold and equity were more balanced, showing how different assets perform at different times.

The real lesson isn't just about which asset performs best in a given year. The key is what happens when equity takes a hit for an extended period. During those times, your non-equity assets are what will keep your portfolio from sinking.

Have you considered diversifying beyond equities? It might be time to think about creating allocations toward non-equity assets for a more balanced and secure future.

Meme Of The Day

Follow for Daily Market Updates and Insights

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply