- WeekendInvesting

- Posts

- Will the Gold/Silver Rally Sustain ?

Will the Gold/Silver Rally Sustain ?

USD/INR Decisive Moves

Market Update - Friday, 12 Dec

Today was a better day for the market, perhaps one of the best this week. The market reacted positively to renewed rumors of a US-India deal, with some reports in the papers suggesting negotiations are underway.

Furthermore, the implications of the Federal Reserve's recent rate cut are gradually setting in, particularly the news that the Fed plans to increase the size of its balance sheet by $40 billion per month. In essence, quantitative easing (QE) is back, which explains why precious metals, especially gold and silver, are soaring. The equity markets also showed signs of stabilization today.

Analyzing the rupee gold chart, new highs have been crossed on the gold price, now standing at 13,280 per gram. The price of gold in INR is receiving two tailwinds: both the USD INR is rising (rupee weakening) and dollar gold prices are also increasing. This provides strong support for the INR gold price.

The Nifty has crossed the 26,000 mark. The 26,000 level has been crossed 17 times in the last 35 or 36 days, averaging a crossing every two or three days, though the market has yet to cement its position above it.

Nifty Junior also looks better, up 0.84%.

Mid caps showed an impressive pullback, rising 1.18%, which is perhaps one of the more encouraging charts among the three major indices. Small caps were up 0.83%.

Nifty Bank was up a more modest 0.3%, appearing benign and stable over the last few sessions.

As mentioned, gold is up 1.1%. Silver has been rocketing and is now at 1,97,000 rupees per kilo. With GST and making charges, even purchasing a coin or a bar places the price well above 2 lakh rupees.

Other Market Triggers

The heatmap was quite green, with Bharti Airtel, L&T, Maruti, Titan, TCS, Zomato, Nestle, NTPC, the Bajaj Twins, and Axis Bank all contributing to the gains in Nifty.

The Nifty Next 50 also saw very good gains in Adani Power, Hindustan Zinc (up 7% on the back of silver moves), Vedanta (up 2.75%), Ambuja Cement, and BPCL, which rose nicely. Naukri was up 2.5%.

All these stocks performed reasonably well in the Nifty Next 50 segment.

Hindustan Zinc took the pole position in the Mover of the Day segment, hitting a 52-week high and zooming 14% in just four days. This sharp movement is a result of the extraordinarily rapid increase in silver price.

U.S. Market Update

In the US Markets during the previous session, the Dow Jones index saw good gains of 1.3%, and the Russell index was up 1.2%, though the S&P and NASDAQ were completely flat.

Some of the moving stocks were Visa, up 6%, and MasterCard, up 4.5%. A look at the long-term charts of Visa and MasterCard reveals them to be nearly straight lines moving up for decades, consistently defying alternatives.

MetLife, Nike, and Linde were also major gainers. A reminder is included that some of these stocks could be part of a US stock strategy, but this is not a recommendation.

What to watch next ?

On the dollar chart, silver has not had a significant run since the 1980 top of around $50. Currently, silver is at $65. This means that from peak to peak, the commodity has essentially done nothing in dollar terms for 45 years, leading some to speculate it could eventually reach hundreds of dollars.

Whether this happens in two years or ten years is uncertain, but the current rally appears very strong.

It is often observed that when a very strong rally begins in any commodity, asset class, or sector, people hold back from participating, which effectively removes all resistance and creates a clear path for the asset to continue its ascent.

Important Announcement

We’re launching Winvest Capital, our SEBI-registered Category III AIF that brings our rule-based momentum frameworks into an institutional-grade structure. And we’d love for you to be part of this journey.

We’re hosting an exclusive webinar covering our investment philosophy, AIF suitability for HNI/UHNI investors (>₹1 Cr), multi-asset allocation, risk management, and more.

📅 Saturday, 13 December 2025

🕚 11:00 AM IST (60 mins)

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📰 USD/INR Decisive Moves: A 15-Year Data Study

📈 The Historical Trend: Decisive 20% Moves

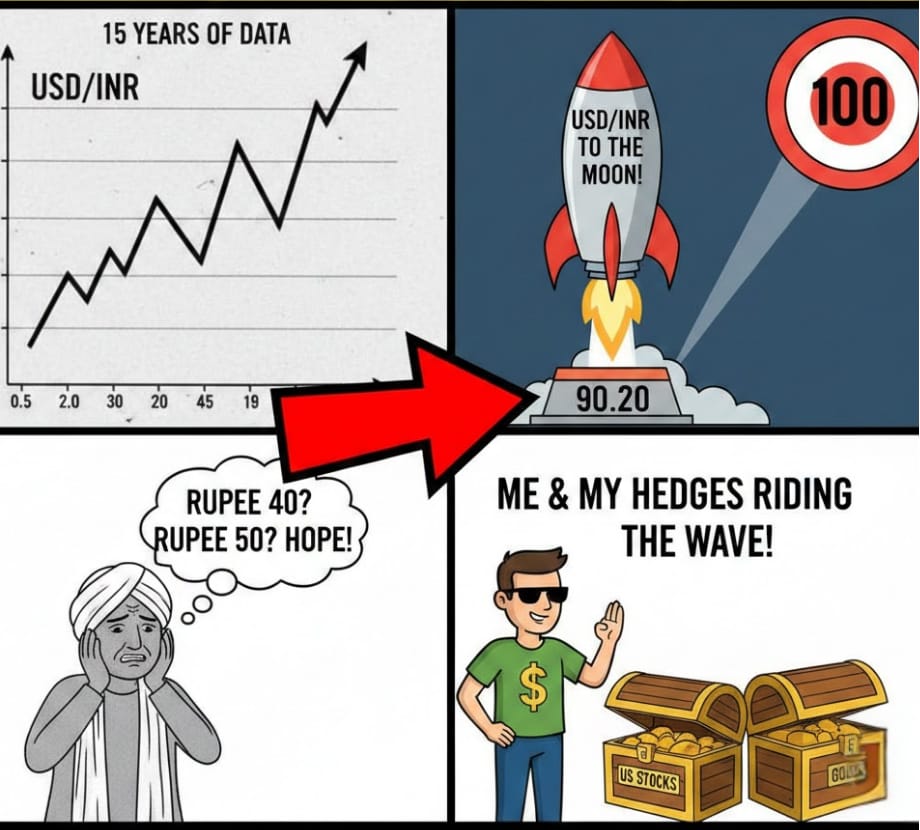

A study of the last 15 years of USD/INR data reveals a compelling pattern: whenever the Indian Rupee (INR) experiences a sharp decline against the US Dollar (USD), the move typically averages around 20%.

This substantial move is often decisive, meaning it represents a significant shift rather than minor volatility.

The timeline for this move can vary greatly:

A few weeks (in the fastest instances).

A few months.

One or two years (in the longer-term instances).

While some retracement (a temporary reversal) follows the major move, the overall trend is clear: the depreciation tends to reach close to the 20% mark.

📉 Current Context: Where is the Rupee Headed?

Looking at the current instance, the USD/INR has already appreciated by approximately 9% as of December 2nd, with the exchange rate hovering around 90.20.

If the current trend follows the pattern of the last seven or eight historical instances where the USD/INR surged by 19% to 20%, the next potential target is significant:

Potential Target: The rate could reach close to 100.

Next Stabilisation Zone: After this peak, while a retracement to, say, 95 is possible, the analysis suggests a very high probability that the next major point of stabilisation or pause will be found somewhere between 95 and 100.

The analysis indicates that it is unlikely the current move will halt and reverse significantly at its current level.

🎯 Key Learning: Embrace the Trend

The long-term data suggests that, contrary to some popular narratives about the Rupee appreciating to 40 or 50, the INR has consistently devalued against the USD over time.

Meme Of The Day

Which strategy best describes your current or planned action to hedge against potential Rupee devaluation? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply