- WeekendInvesting

- Posts

- Your "Bhav Bhagwan Che" Guide

Your "Bhav Bhagwan Che" Guide

A Case Study: The Paradeep Phosphates Surge

Tuesday, 12 Aug 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

The market started with hopes of extending yesterday’s bounce, but the optimism faded quickly. After attempting to move higher in the morning, it collapsed sharply, failing to continue the recovery.

This is disappointing for those hoping the bounce would turn into a steady uptrend, at least until the end of August when some major global events are scheduled.

Nifty attempted a move towards 24,700 but fell about 250 points from there.

Mid-caps and small-caps held relatively well, with only marginal declines, indicating that these segments may already be heavily beaten down.

Nifty Bank was weaker, dropping 0.84%, raising the risk of a breakdown.

Gold remained flat after being hit earlier by the news of the 15th August peace meet.

Other Market Triggers

Apex Frozen Foods jumped 12% after strong Q1 results.

MRF weakened on falling profits and narrowing margins.

What to watch next ?

Now, attention is back on crucial support levels that could break in the coming days.

One possible trigger is the 15th August meeting between President Putin and President Trump, which may bring a resolution to the ongoing war and could lift global markets.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From next week onwards (starting 15th of Aug 2025), we’ll be sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

| Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

|

What To Read This Week ?

The "Bhav Bhagwan Chhe" Principle Explained

In the world of investing, there's a timeless principle known as "Bhav Bhagwan Chhe" (BBC), which translates to "Price is God." This isn't about blind faith; it's about respecting what the market price is telling you.

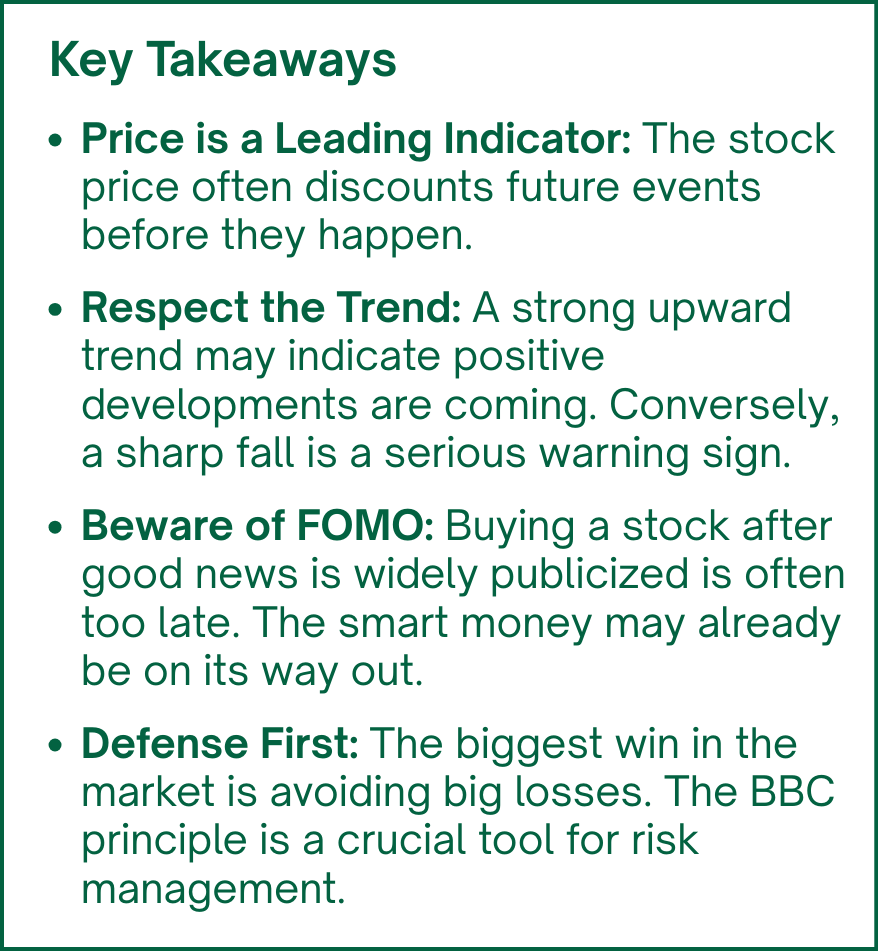

The core idea is that a stock's price often reflects all the known (and sometimes unknown) information about a company. Price movement, therefore, can be a powerful leading indicator, signaling major news before it ever hits the headlines.

A Case Study: The Paradeep Phosphates Surge

Let's look at a recent, stunning example: Paradeep Phosphates.

On July 28th, the company announced spectacular quarterly results:

Net Profit: Jumped to ₹256 crores from just ₹6.3 crores year-over-year.

Revenues: Increased to ₹37 billion from ₹23 billion.

This is the kind of news that gets investors excited. But here's the catch: the "smart money" was already in. In the two months leading up to this announcement, the stock price had already skyrocketed from ₹83 to ₹216—a gain of over 150%!

The price was screaming that something big was on the horizon, long before the news became public. Those who listened to the price (the "Bhav") were rewarded handsomely.

When the News is Out, the Game Changes

So, what happens after the fantastic results are all over the news? Often, not much. The stock might move sideways or even dip.

Why? Because the initial investors, who rode the wave up, may start selling their shares to the new wave of investors driven by FOMO (Fear Of Missing Out). The big move has already happened. This is a classic market pattern: the run-up happens on the rumor and anticipation, not necessarily on the news itself.

It Works Both Ways: Heeding the Warning Signs 📉

The BBC principle is also your best defense mechanism. Just as a rapidly rising price can signal good news, a sharply falling price should never be taken lightly. It can be a precursor to a major negative event—a bad quarter, a corporate governance issue, or industry-wide trouble that isn't public knowledge yet. Ignoring such signals can lead to substantial losses.

Meme Of The Day

When making an investment decision, what do you rely on the most? |

Follow for Daily Market Updates and Insights

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply